You’ve probably heard the news by now. Reports coming in that Nigeria’s central bank governor has plans to run for office. Yes, you read that right.

At different points in the past, Stears has written about the governor’s “Superman” efforts at fixing the Nigerian economy. So, it’s not entirely shocking to learn he has ambitions to run the country one day. What is shocking however, is that he wants to run for office while maintaining his role as a CBN governor.

It's shocking because the CBN is meant to be an independent organisation, and the governor's political ambition is bound to conflict with the bank's monetary policy goals.

Key takeaways

-

Although the CBN has rolled out many projects to improve Nigeria's economic performance, its efforts have failed to reduce inflation. They have also led to even more inflation.

- Specifically, in its efforts to maintain a suitable foreign exchange reserve, the

But his political ambition aside, the current CBN governor is the first since 1999 to hold the office for more than five years. That is, he's the first CBN governor to be appointed into office after his first tenure—his initial term ran from 2014 to 2019, and then he was reappointed in 2019 to run another period of five years. Therefore, after eight years in office, it's worth taking a step back to assess his performance in the role.

Although the CBN governor has rolled out many projects in several sectors—from agriculture to healthcare and power—these projects and the goals they aim to achieve for the bank are not the primary goal of the bank.

Therefore we'll take a more quantitative route by focusing on the performance of the CBN, during the governor's tenure, in achieving its primary objective of controlling and administering monetary and financial policies in Nigeria.

This assessment will therefore focus on his performance on the core mandate of the CBN as set out in the CBN Act 2007 and known by many as the key objectives of Central banks.

Going by these objectives, there are five functions of the CBN: price and financial stability, acting as the government's bank, maintaining the external reserves, promoting a sound financial system in the country and issuing the legal tender.

For this article, we'll focus on the three we believe are most important: price stability, external reserve management and financial stability of the economy.

Let’s begin.

The prices keep going up

The first and most important role of any central bank is price stability, and that is, ensuring the value of the Naira is largely predictable and stable. The CBN is meant to ensure that the same basket of goods and services I can afford with ₦10,000 today does not reduce tomorrow unexpectedly or by far. So, even though the price is increasing, the increase should be steady such that people are able to predict it, and attempt to make provision for it in their income.

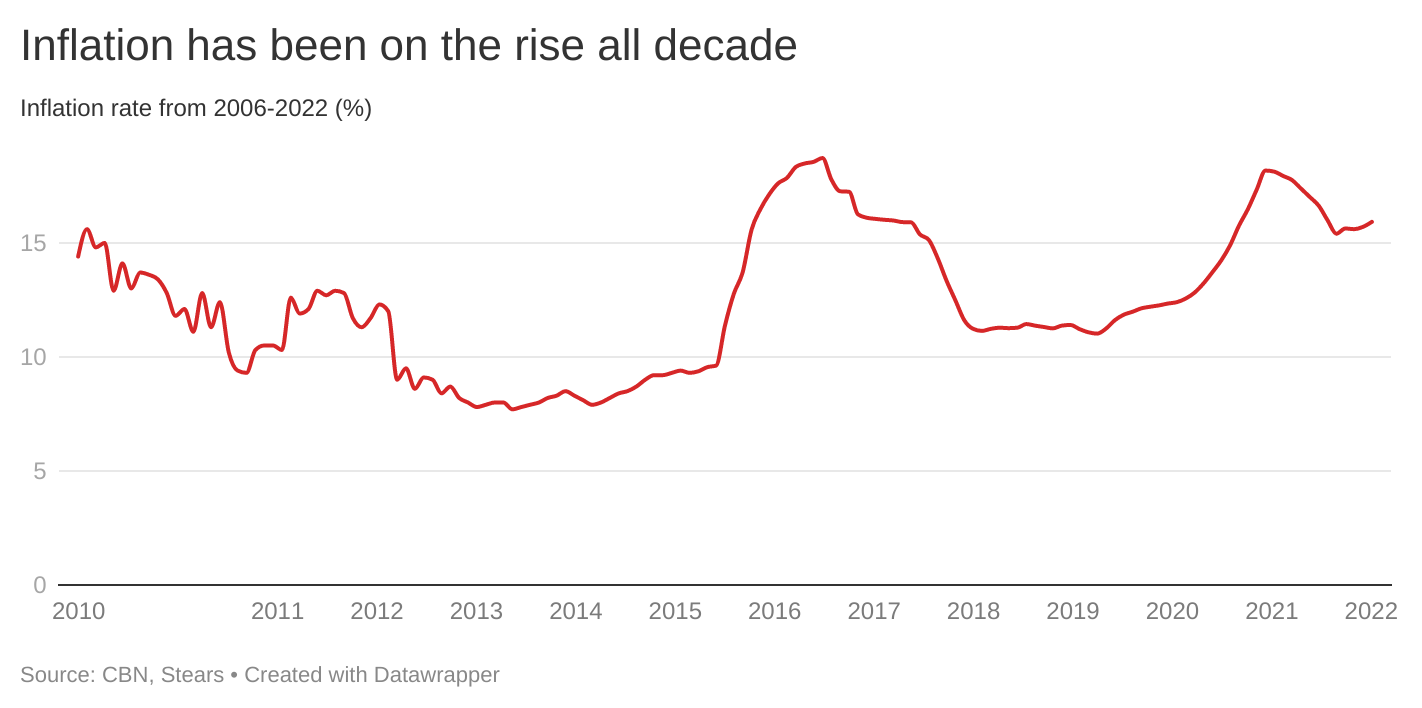

So far, Governor Emefiele has not tamed inflation in Nigeria. Our Head of Intelligence, Michael, put it quite vividly when he said the value of the naira halves every six years because our inflation rate has consistently been about 12%. So, the ₦1 million you earned in 2013 is worth only ₦500,000 today.

Average inflation since his tenure in 2014 is 13%, with peak inflation being almost 19% during volatile periods, which is a long way from the 6-9% target the CBN set for itself. And a long way from the 9% average inflation in 2013, the year preceding the CBN’s governor’s tenure.

Why has inflation been so high over the years? Prices are high and continue to rise because of the high cost of doing business in Nigeria. From the high cost of transportation, to import restrictions and security challenges; Nigeria is not an easy place to do business. Most of these require fiscal solutions; afterall, the CBN is not responsible for building roads or hiring more policemen to protect Nigerians.

However, the CBN’s exchange rate policies have exacerbated the exchange rate situation such that it has affected inflation.

In this article, we spoke about how the CBN’s monetary policy mechanism is not exactly straightforward because our financial sector is not sophisticated enough to induce changes in households and businesses behaviour when interest rate changes. So, the CBN has resorted to manipulating the exchange rate instead.

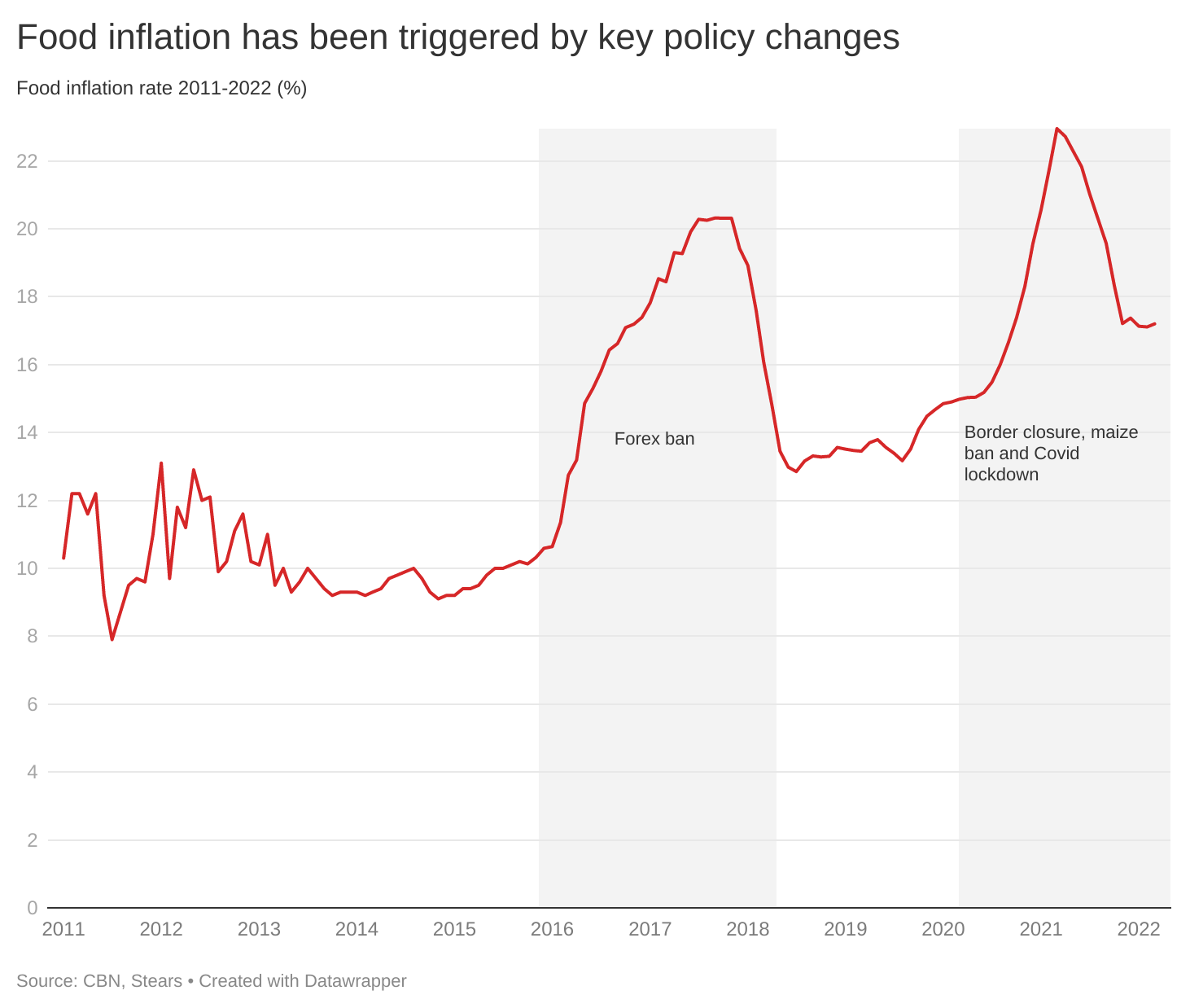

Many of the CBN’s exchange rate policies, especially relating to food—which is the main cause of inflation—have been to restrict access. For instance, since 2015, the CBN banned importers from accessing forex to import more than nine food items. This led to sellers relying on the black market for foreign exchange or domestic producers (which cost much more).

While this has led to increased local production, it worsened the lives of Nigerians by increasing the cost of food. The restriction doesn’t stop there. In 2020, manufacturers complained of lack of access to foreign exchange for the importation of materials needed to produce their goods. To keep business going, some of them would have also had to rely on the black market, leading to rising prices as well.

Also, like we highlighted in this article, another cause of inflation is inflation expectations. If people expect the prices of their raw materials to increase tomorrow, they increase the prices of their goods today to make provision for that increase. People's expectation of continuous inflation is mainly driven by the government protectionist policies like the border closure declaration by the federal government and the CBN's exchange rate manipulation.

For example, food inflation—the primary source of inflation in Nigeria, was relatively stable, at around 10%, from 2011 to 2015. This changed in 2016 after the CBN implemented the forex ban on importing some food staples like rice, tomatoes, meat and oils. Policies like this have actively caused prices to increase significantly, leading to more inflation.

Therefore, the CBN has not only been complicit in stoking inflation but has been actively involved in causing prices to rise significantly. And that has been primarily because of its inability to anchor inflation expectations (Nigerians continue to expect inflation, which begets inflation) and maintain an adequate level of forex reserves that will allow it to defend the value of the Naira to its dollar peg.

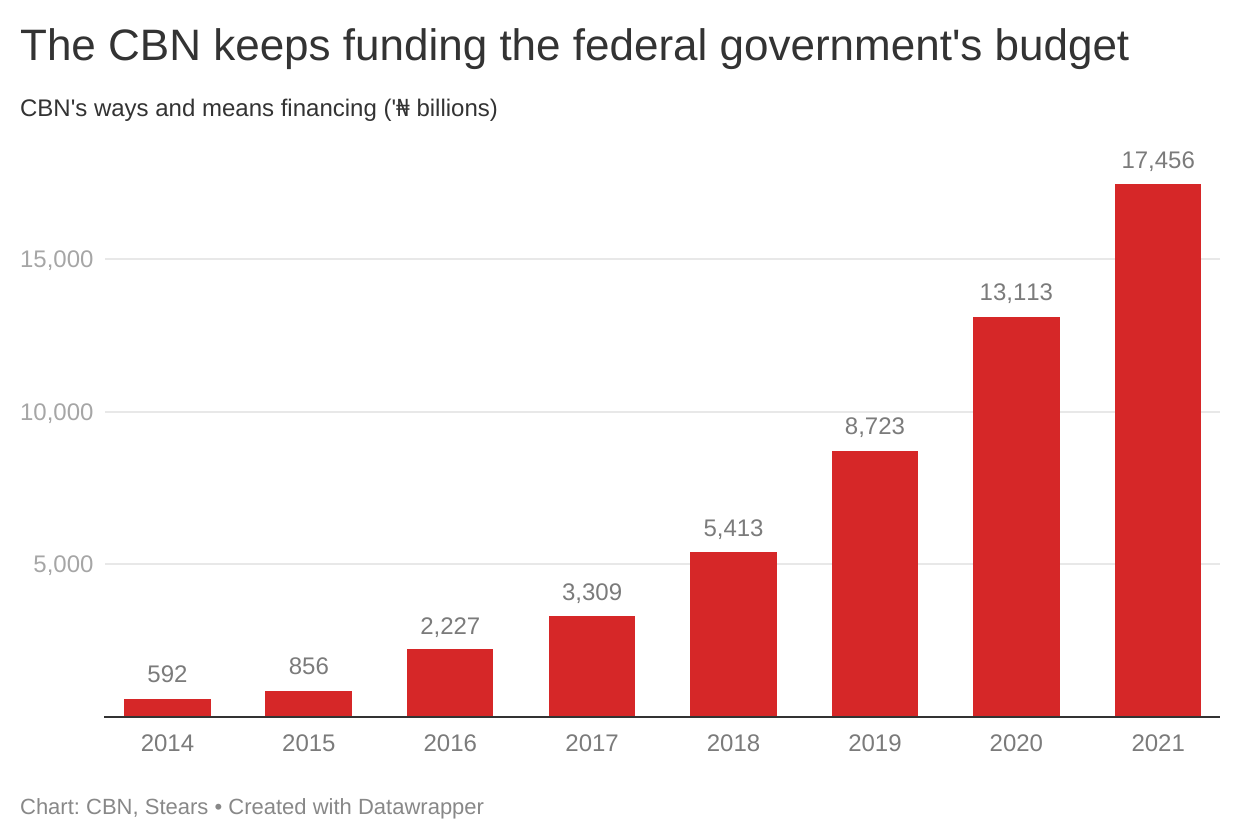

Another way the CBN has abetted inflation in the last five years is by continuously funding the federal government’s budget deficit through its ways and means financing. We’ve written extensively about that here but the summary is that the federal government has basically been increasing money supply during an inflation.

Economic theory states that inflation is sometimes caused by too much money chasing after a few goods. So, to reduce inflation, central banks try to mop up the money in circulation. The CBN however has done the opposite in the last five years. Despite the increasing inflation, the CBN has consistently loaned the federal government money, further driving inflation up.

Therefore, the CBN has not only been complicit in not reducing inflation but has been actively involved in causing prices to rise significantly. And that has been primarily because it continues to fund the FG’s budget and has been unable to maintain the forex reserves such that it retains this value of the Naira.

No money, more problems

This leads us to the second responsibility of the CBN: to maintain external reserves to safeguard the international value of the legal tender currency (Naira).

As the government's banker, the CBN stores its foreign assets and preserves the reserves to access foreign currency when needed to meet its external obligations like debt servicing and trade. So, how have our foreign exchange reserves performed over the years?

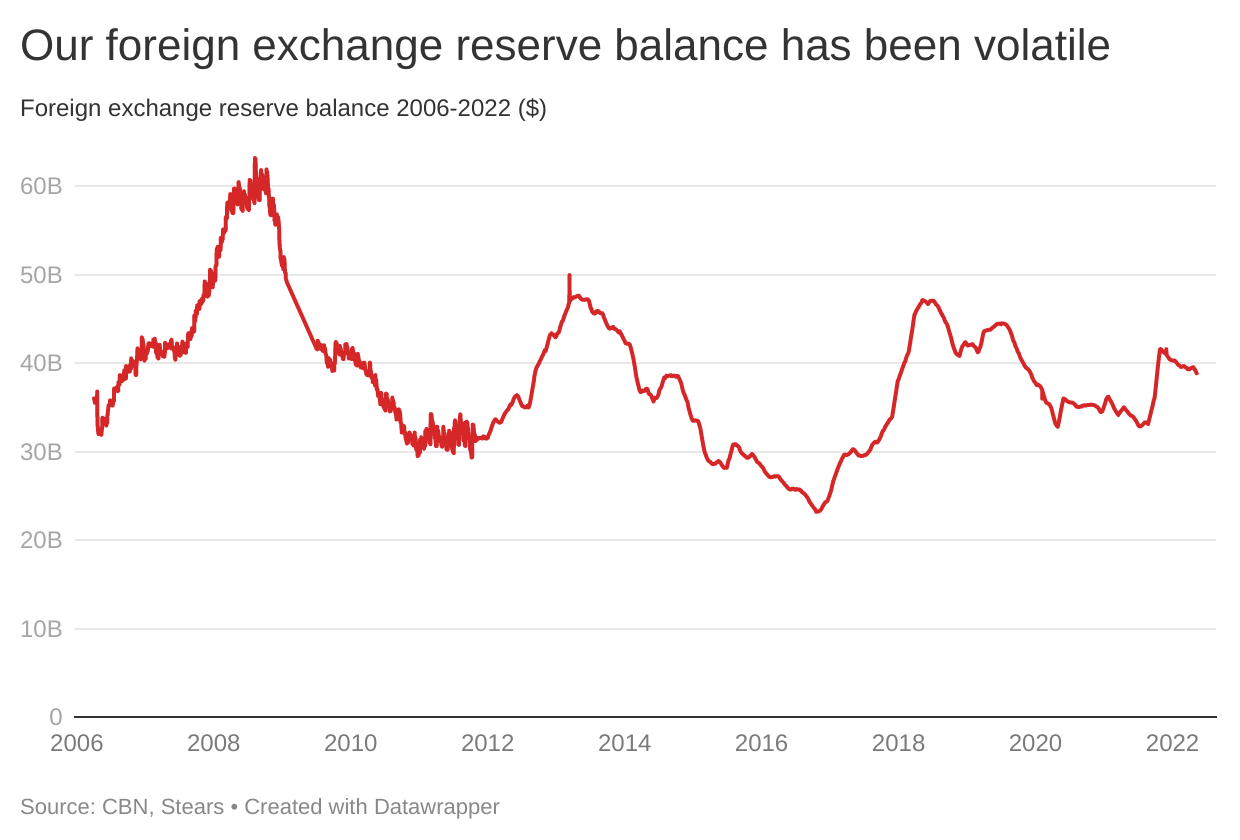

Our foreign exchange reserves have taken a significant hit in the past eight years due to the decline in oil revenue. However, looking at the reserve balance alone tells us that we're not doing badly—our foreign reserves are average compared to the late 2000s. Indeed, we've had staggering lows like in 2016 when the foreign reserve balance was about $23 billion.

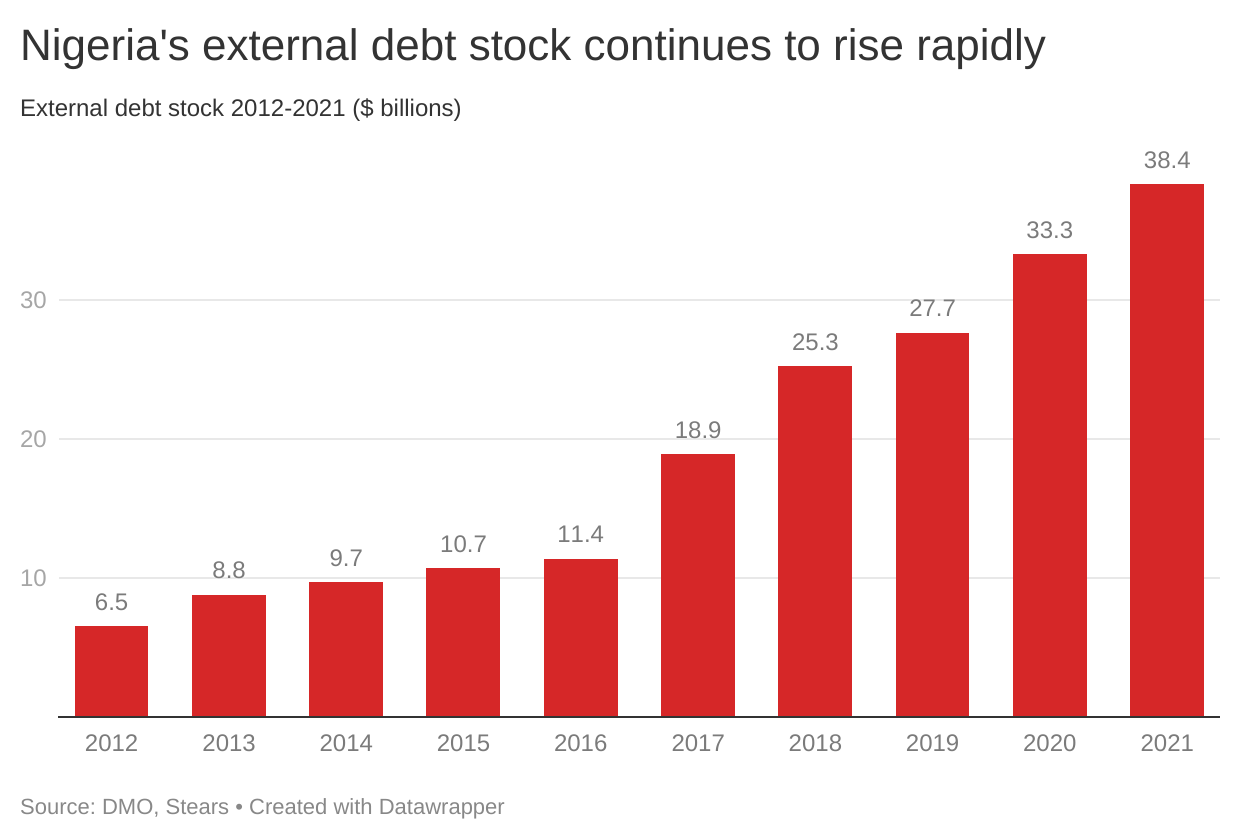

However, this picture doesn't tell us that the foreign reserves have been funded mainly by loans, which we would have to repay in the future.

For instance, our foreign reserve inflows in the first quarter of 2018 were about $16 billion, almost three times in the same quarter of 2017. Still, oil revenue—which was usually the primary source of income—contributed only about 19% to the inflows, and the rest was funded mainly by loans and revenue from government agencies. So, even though our foreign reserves seem stable—enough to meet eight months of goods import needs, it was primarily funded through Eurobonds and loans we have to repay.

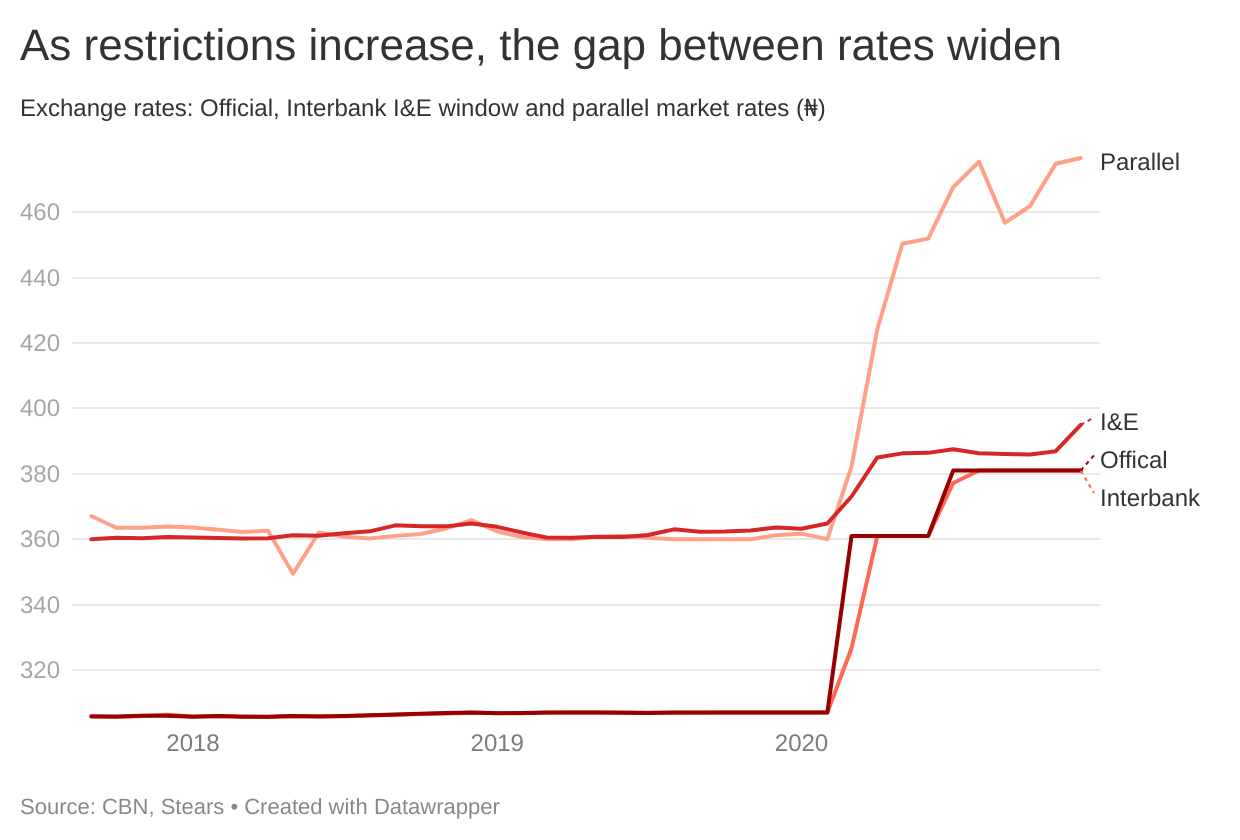

The CBN has also been able to keep the exchange rate at sustainable levels because it has restricted access to the foreign exchange. The foreign reserves are held to meet external obligations, whether they are trade obligations—from buying raw materials and machines for production, paying for a course online or spending on a vacation outside the country. However, the CBN has placed limits on access to foreign exchange by banning importers from accessing foreign exchange from official sources for the importation of 41 items, preventing manufacturers from accessing foreign currency and placing restrictions on individual spending through banks to as low as $20 per month.

So, the CBN was able to retain its reserves at decent levels because it was filling it up with debt and hoarding it.

Beyond that, the CBN manages the foreign exchange reserve to preserve the value of the Naira relative to other currencies. This does not necessarily mean the exchange rate has to be low because while that might be good for importers because imports will be cheaper, it will make exports more expensive, which may deter foreigners.

However, the purpose of the reserve is to allow for a stable and predictable currency. That is, one reflective of the demand and supply needs, not one that is overvalued and fluctuates often. Here's how the exchange rate has performed over the years:

As we can see, the CBN has been forced to devalue the Naira over time because of its inability to meet forex demands, given the low foreign reserves. Simply put, to meet the demand for foreign exchange, the CBN has had to pick and choose who to give forex to and was still unable to provide foreign exchange to legitimate beneficiaries—like investors, at the same time. Around September 2020, there was an estimated demand backlog of about $1.5 - $1.8 billion for foreign investors who wanted to exit the country due to the recession. Given the high demand and despite all the restrictions, the CBN had to devalue the currency several times.

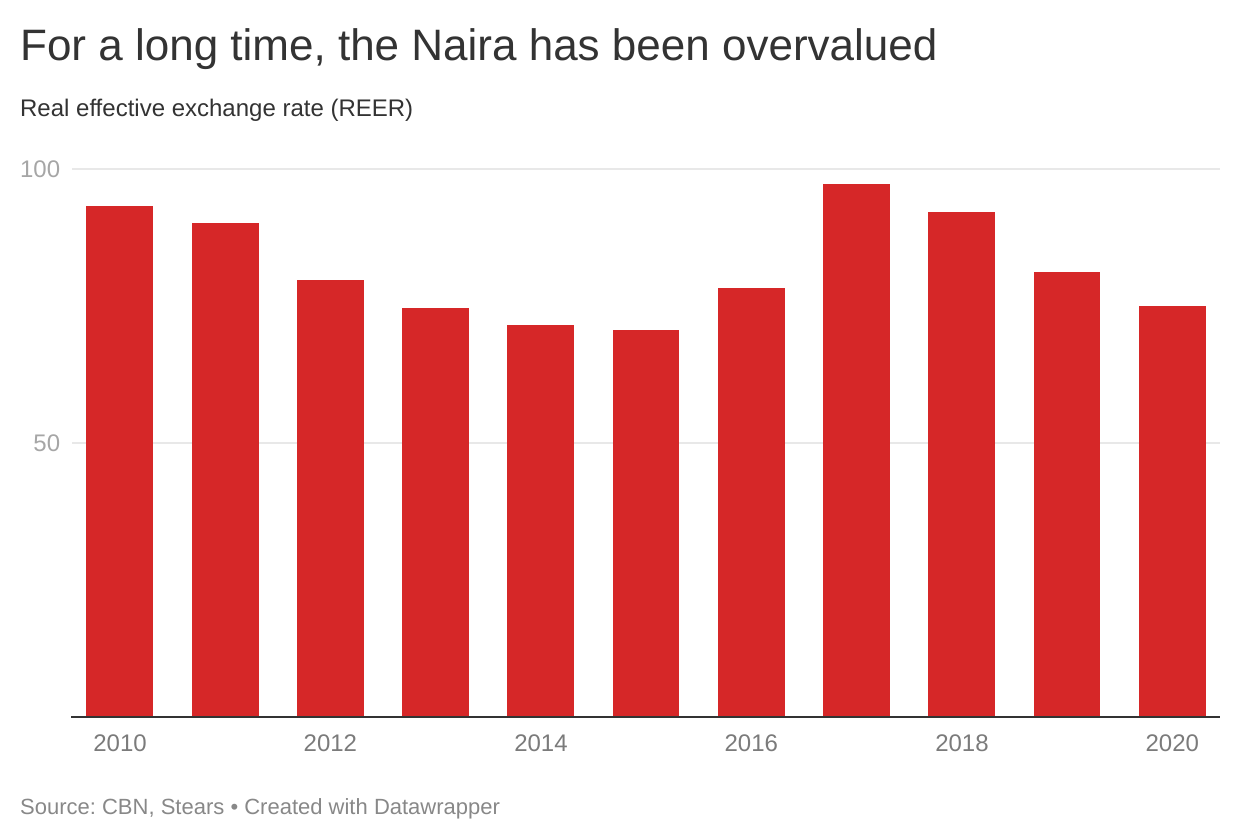

But even with the continuous devaluation, the CBN was unable to meet foreign exchange requirements because the Naira was still overvalued. To show you what I mean, we'll be using the Real Effective Exchange Rate (REER). The REER measures the value of a country's currency relative to a basket of other currencies, over 100. When the REER is 100, it means the Naira is well-priced; if it's lower than 100, the Naira is priced above its actual value, and a REER above 100 means it's undervalued.

The REER tells us that the Naira has been grossly overvalued relative to other currencies despite being at relatively the same rate for some time. This is mainly because of the CBN's control of the exchange rate and the restrictions on accessing foreign exchange from official sources, and it explains why the black market rate is much higher than the official rates.

This means that people cannot make sound business decisions because of the lack of consistency in the exchange rate, especially considering the CBN's policies around foreign exchange. One day, the CBN bans Bureau De Change (BDC) operators from accessing foreign exchange; another day, it announces that banks might no longer have access to foreign exchange. It also orders banks to shut down bank accounts for people receiving remittances through cryptocurrency.

The suddenness and harshness of the policies make the foreign exchange scene very unpredictable and bad for business. As we established earlier, when people cannot predict what will happen, they expect inflation and therefore induce it.

Finance-health check

The final measure we'll be looking at is the country's financial stability. Financial stability, in this case, refers to the ability of banks and non-bank financial institutions to withstand shocks in the economy. In simple terms, it's knowing that deposits, credit and investments are safe regardless of the economy's shocks.

To measure financial stability, we'll look solely at the banking sector to measure the performance of deposits and credit in the economy. First is the safety of deposits, and one way to measure that is through banks' capital adequacy ratio. With this metric, we're simply asking the question: do banks have enough capital to withstand any losses they may incur due to a downturn in the economy? So far, yes. The Capital adequacy ratio for banks in the most recent publication by the CBN is 15%, which is higher than the benchmark of 10%.

Banks' capital adequacy is mainly credited to the financial sector recapitalisation exercise by past governor Lamido Sanusi. However, Governor Emefiele can be commended for driving financial stability in the bailout and smooth transitioning of distressed banks. An excellent example of this is the case of Skye Bank—now Polaris Bank.

In 2015, Skye Bank was heavily distressed, with a capital adequacy ratio of 7.7% (much less than the 10% threshold) and a 92% loan-deposit ratio (LDR). By 2016, the situation had gotten so bad that the bank could not release its financial statements. Noticing this, and since the bank was one of the Systemically Important Banks (SIBs), which were banks whose failure could disrupt the country's financial stability and economic activity, the CBN created a bridge bank to take over the management of the bank.

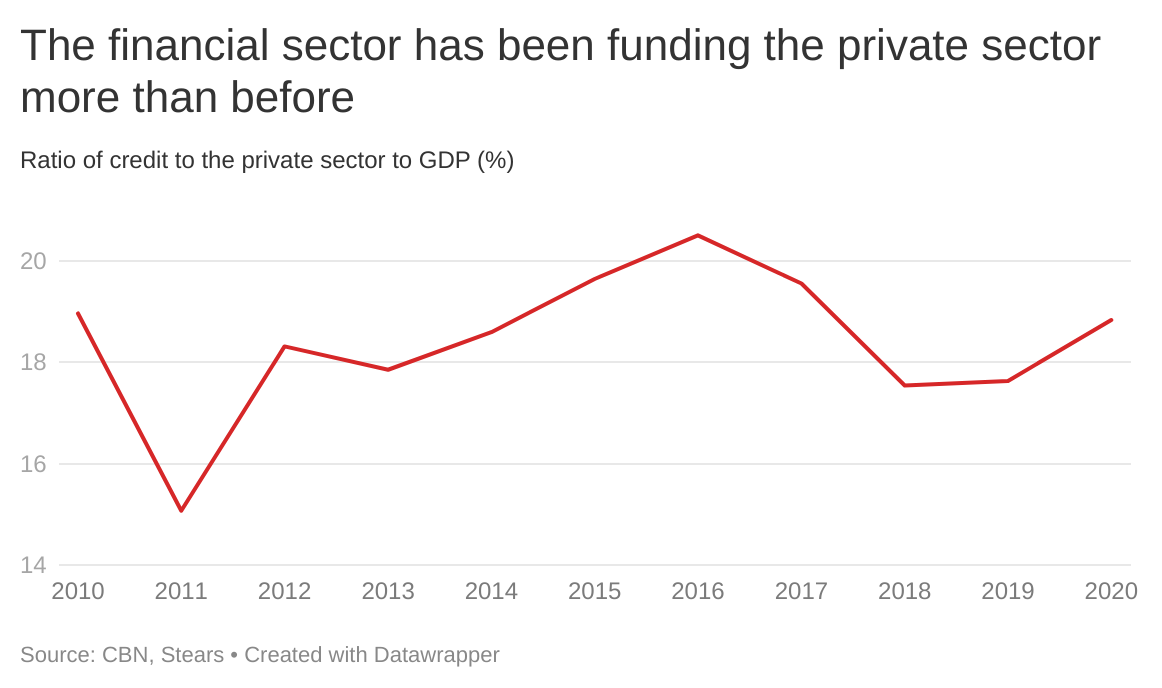

The next thing we want to measure is sufficient credit for people in the country. Credit is very critical to investment and economic performance/growth. To look at credit, we'll employ the financial deepening, using the ratio of credit to the private sector(CPS) to GDP.

There has been a steady and consistent rise in the ratio of CPS to GDP. The CBN should be commended for inducing economic growth, especially considering that the economy has witnessed two recessions. For credit to generate desired change in the economy, it is also essential for credit to be spread across the economy, especially in sectors critical to employment, to induce consumption.

The primary beneficiary sectors of credit are oil & gas, manufacturing, finance and general services. For every ₦5 credit that goes out to the private sector, at least ₦1 goes to the oil and gas sector. This is understandable to the banks because they typically can pay back such loans. However, the two recessions we've been in have been induced by low oil revenue, which means that loans to the oil and gas sector might also be vunerable to such shocks. Also, the oil and gas sector is not a major employer of labour (compared to other sectors like manufacturing and agriculture), which means the credit is mainly enjoyed by a small proportion of people and cannot induce the kind of consumption that can successfully generate growth.

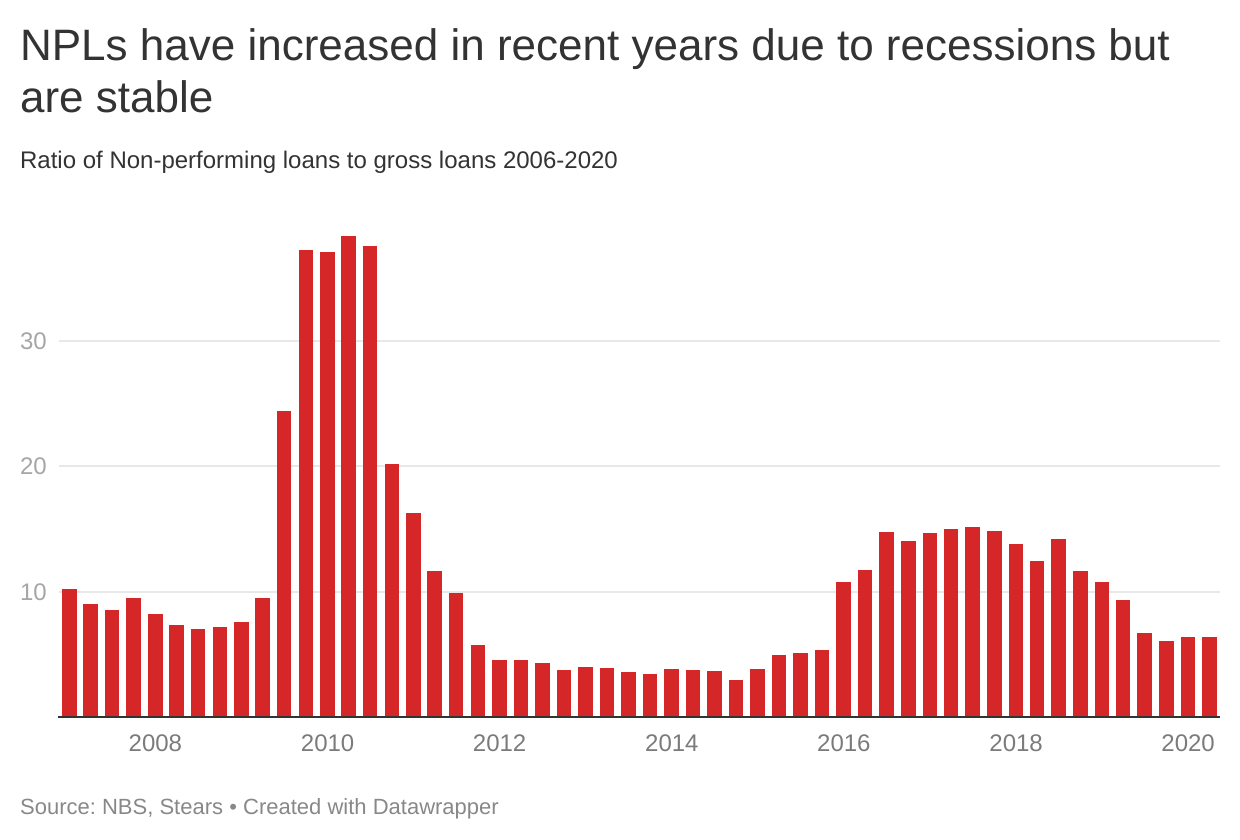

Increased credit to the private sector could also induce inflation because more money is injected into the economy. Also, increased lending during a recession could lead to an increase in bad debt. If companies are not doing as well as they should, default on their loans is higher. Therefore, another measure of financial stability is the proportion of non-performing loans.

There has undoubtedly been an increase in Non-performing loans in the country recently. However, it can be explained by the recessions.

Back to the drawing board

It is safe to conclude that the financial sector has successfully managed to stay controlled despite the shocks they've been exposed to. However, in the exchange rate and inflation department—which are more important and directly related to growth, the CBN still has some work.

The stable financial system does not mean much to Nigerians if the companies with sufficient capital to employ people and generate growth are not available or if existing companies are folding up because they have no access to adequate foreign exchange to conduct their business successfully.

It is worth noting that although the CBN is not responsible for earning money to increase the country's foreign exchange reserves, it's responsible for guaranteeing the safety of investments and funds brought into the country by foreign investors. When foreign investors are unsure of the CBN's stance towards their businesses, they withdraw their money to other saner and more accommodating climes. Therefore, one thing the CBN has failed to do in the present administration is give the country confidence in its ability to restore order and normalcy to the economy in times of distress. This has been communicated through the moving inflation targets, the inconsistent devaluations (after announcements that there would be no devaluation) and the sudden policies and shutdowns in the financial sector.

When people are unsure of the CBN's perception of their business, no rice pyramids or loans to farmers will make them bring their money into the country, and Nigerians pay the price of high inflation and exchange rates.