Aramco is to Saudi Arabia what the Nigerian National Petroleum Corporation (NNPC) is to Nigeria.

They are both National oil companies (NOCs), which are oil and gas companies owned primarily by their respective governments. The government of Saudi Arabia was the sole owner of Aramco until it pulled off the biggest IPO in history by selling off shares worth 1.5% of the company for close to $30 billion. And the Nigerian government owns 100% of the NNPC.

Key takeaways

-

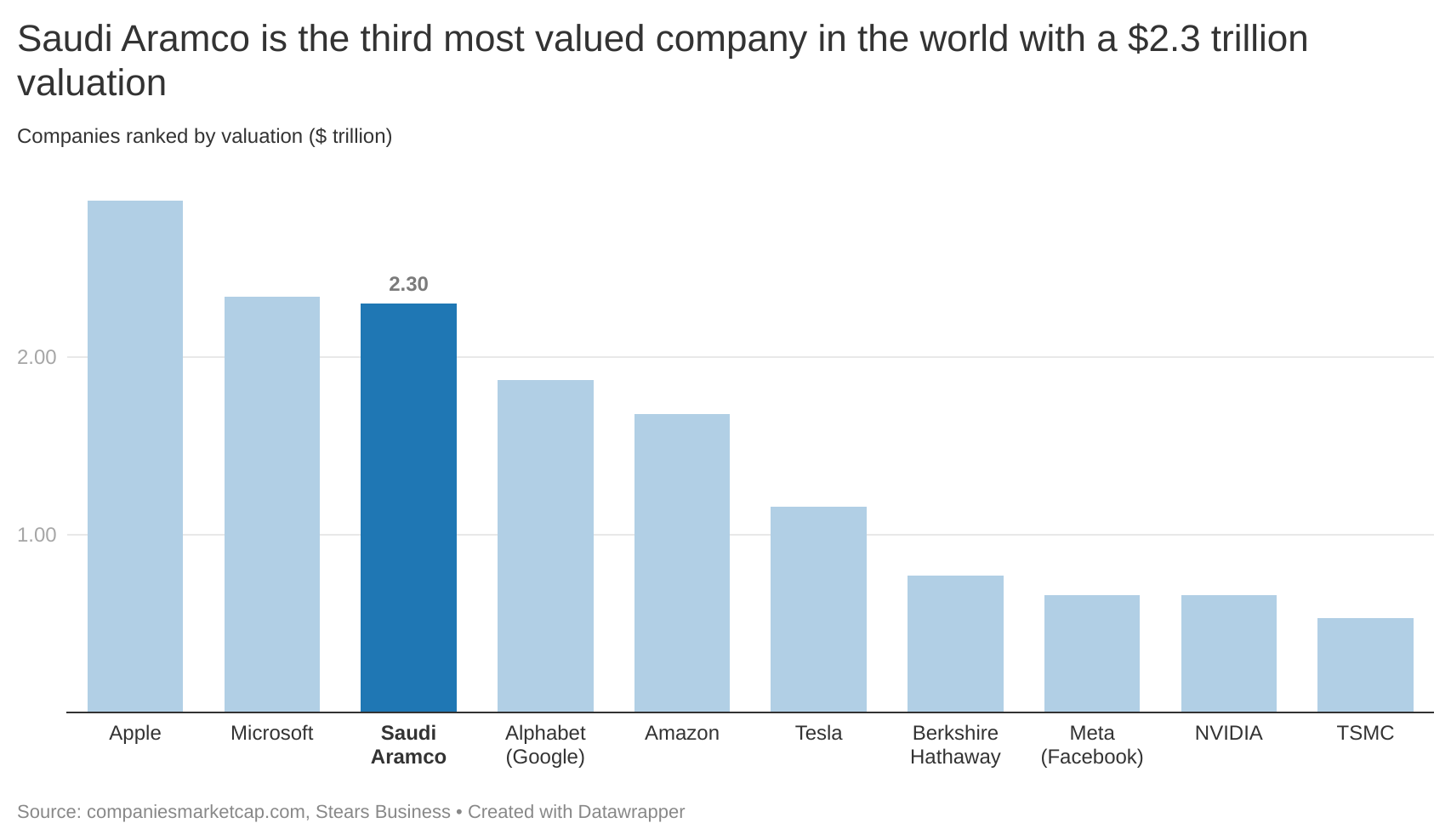

Saudi Arabia’s national oil company Aramco is one of the most highly valued and profitable companies globally. It’s currently valued at $2.3 trillion, after Apple and Microsoft.

-

It took four years to find oil in Saudi Arabia in 1937. Still, since then, Aramco has leveraged the country’s cheap production costs, and it has made investments in oil and even renewables to ensure that it stays relevant.

- While Nigeria’s oil company, the

But, the similarities end there. Comparing Aramco to the NNPC is like comparing apples to oranges—their only similarity is that they’re both NOCs, and in every other way, they’re entirely different.

For starters, Saudi Aramco is the third most valuable company globally, with a $2.3 trillion valuation.

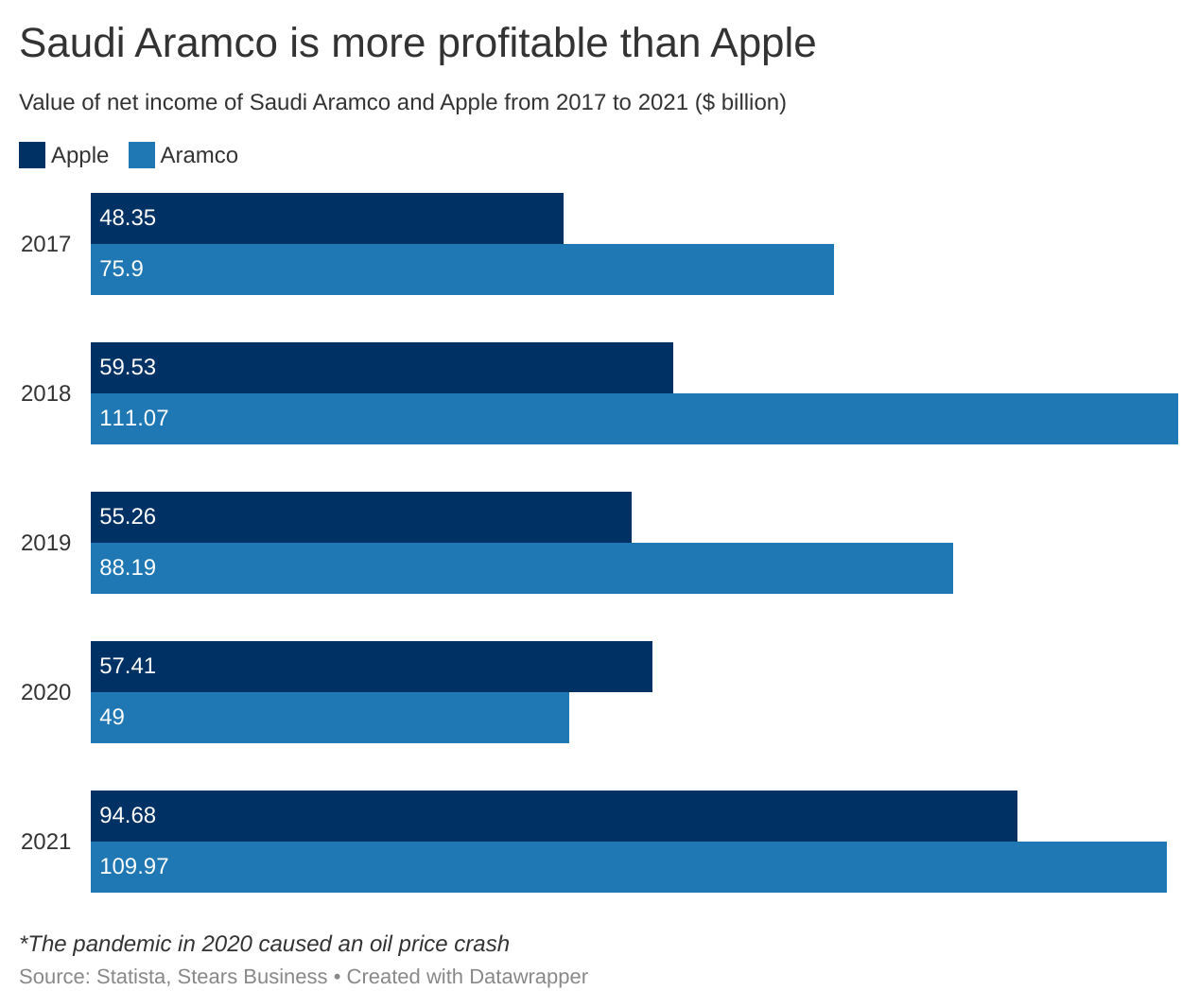

It is also the world’s most profitable company, as it made $110 billion in profits in 2021. But even back in 2018, before the current oil price surge, Saudi Aramco made $111 billion in profits, more than Facebook, Exxon Mobil, Alphabet and J.P. Morgan Chase’s profits combined.

As much as we like to say that tech is the new oil, oil is still oil when it’s done right. And Saudi Arabia’s Aramco is the best example of a national oil company getting it right.

On the other hand, the NNPC is the best example of a national oil company getting it wrong. In terms of valuation and profitability, the most glaring detail is that 2020 was the first time the NNPC made a profit in 45 years. And this less than $700 million profit was mainly a result of debt reclassification and financial manoeuvring.

With all the issues, from oil theft and vandalism to petrol subsidies funded by the NNPC, there’s not a lot of good news from Nigeria’s oil company. So, why don’t we switch gears and look at Saudi Arabia’s oil company for today as we assess their history and dig deep into why Aramco is the most profitable oil company globally.

Let’s begin where all good stories start—the past.

Humble beginnings

Saudi Aramco’s origins are a little different from other NOCs.

For countries like Nigeria, oil was discovered by international oil companies (IOCs), which were taking advantage of their host countries by drilling and exporting oil while paying the smallest amount of taxes or royalties possible. This prompted host countries to establish their national oil companies to take back control of their assets.

Aramco’s beginnings can be traced to 1933, before oil was discovered in Saudi Arabia. After World War I, there was an oil shortage, and Britain and France took over oil production in Iraq, leaving the US to find new oil territories.

Finding new oil territories meant signing concession agreements with countries without any certainty that any oil would actually be found. So, the international oil company would undertake all the exploration costs, and if there was oil, it would recover its costs and make profits. But, if there was no oil, it would exit with losses.

The concession model is similar to the tech Venture Capital model. The VC invests money into a bunch of startups because if even one is successful, it has the chance to make super profits that will more than makeup for all the others that failed. The same applies to the concession model. Oil companies would cast their nets wide and explore for oil in different countries because success in even one territory would make up for losses in others.

In 1932, SOCAL signed a concession agreement with Bahrain and found oil. Bahrain shares a border with Saudi Arabia, so the US-based company had high hopes for Saudi Arabia. Hence, it made sense for Saudi Arabia to sign a concession agreement with the Standard Oil company of California (SOCAL) in 1933. SOCAL formed a subsidiary called the California-Arabian Standard Oil Company (CASOC) to handle Saudi Arabian exploration.

Geological surveys and preliminary investigations started immediately, and in 1935, drilling began in the Saudi Arabian desert.

Two years later, in 1937, no oil had been found, and SOCAL considered quitting. However, their chief geologist’s resolve to keep drilling paid off. Four years after the 1933 concession agreement had been signed, in 1937, SOCAL finally struck black gold. They found the Damman 7 well, which was the first well with commercial quantities of crude.

Following this first sign of success, CASOC changed its name to Arabian American oil company (Aramco) in 1944. Four years later, Exxon Mobil bought a 30% stake in Aramco, Mobil purchased 10%, and SoCal and Texaco retained 30% each. Fourteen years after the Damman 7 field was discovered, the world’s largest offshore field, the Safaniya oil field was discovered in Saudi Arabia. Six years later, the world’s largest onshore field was found. Also, in 1950, Aramco finished a 1,212-kilometre pipeline called the Trans Arabian Pipeline, which linked Saudi Arabia to the Mediterranean sea to increase the efficiency of exports to Europe.

However, the problem with these concession agreements is how unfair they are to host countries if oil is found. Because host countries had little to no knowledge of oil production, IOCs would take the bulk of the profits and remit very little or even zero taxes. But, this is where Saudi Aramco’s origin differs from NOCs in other countries like Nigeria. Rather than starting their own company, charging taxes and royalties or entering into production agreements with IOCs, Saudi Arabia’s government gradually took over Aramco.

In 1973, the Saudi Arabian government bought a 25% stake in Aramco. By 1974, this grew to 60%, and by 1980, the government was the sole owner of Aramco. Eight years later, the Saudi Arabian oil company, Saudi Aramco, was established, and it took over all the responsibilities of Aramco.

The following year, Aramco’s mission changed from being an oil-producing and exporting country to an “integrated petroleum enterprise”. This meant expanding to other territories by purchasing controlling interests in refining and marketing companies, distribution terminals, petrol stations and research centres worldwide from Korea to Europe and the US. These moves made Aramco more than just a NOC, and since then, the company has been intentional about its expansion to ensure that it stays relevant.

More recently, Saudi Aramco has made massive investments into producing hydrogen and other petrochemicals to ensure that it remains relevant even in the energy transition. But, besides its single-minded dedication to achieving its objective, Aramco enjoys some advantages that other NOCs don’t.

Why is Saudi Aramco so successful?

Two major reasons contribute to Aramco’s success—Saudi Arabia’s cheap costs and Aramco’s investments.

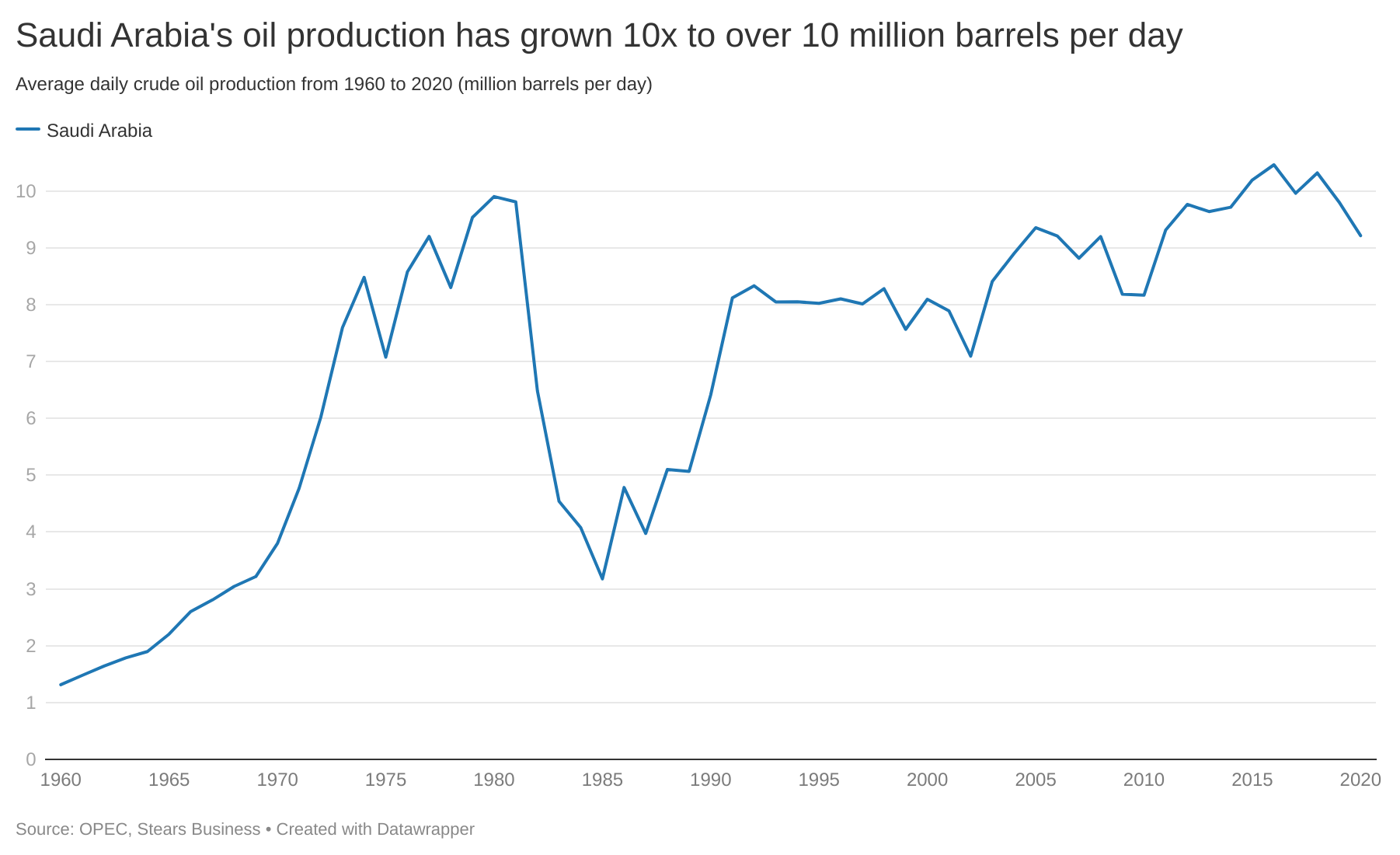

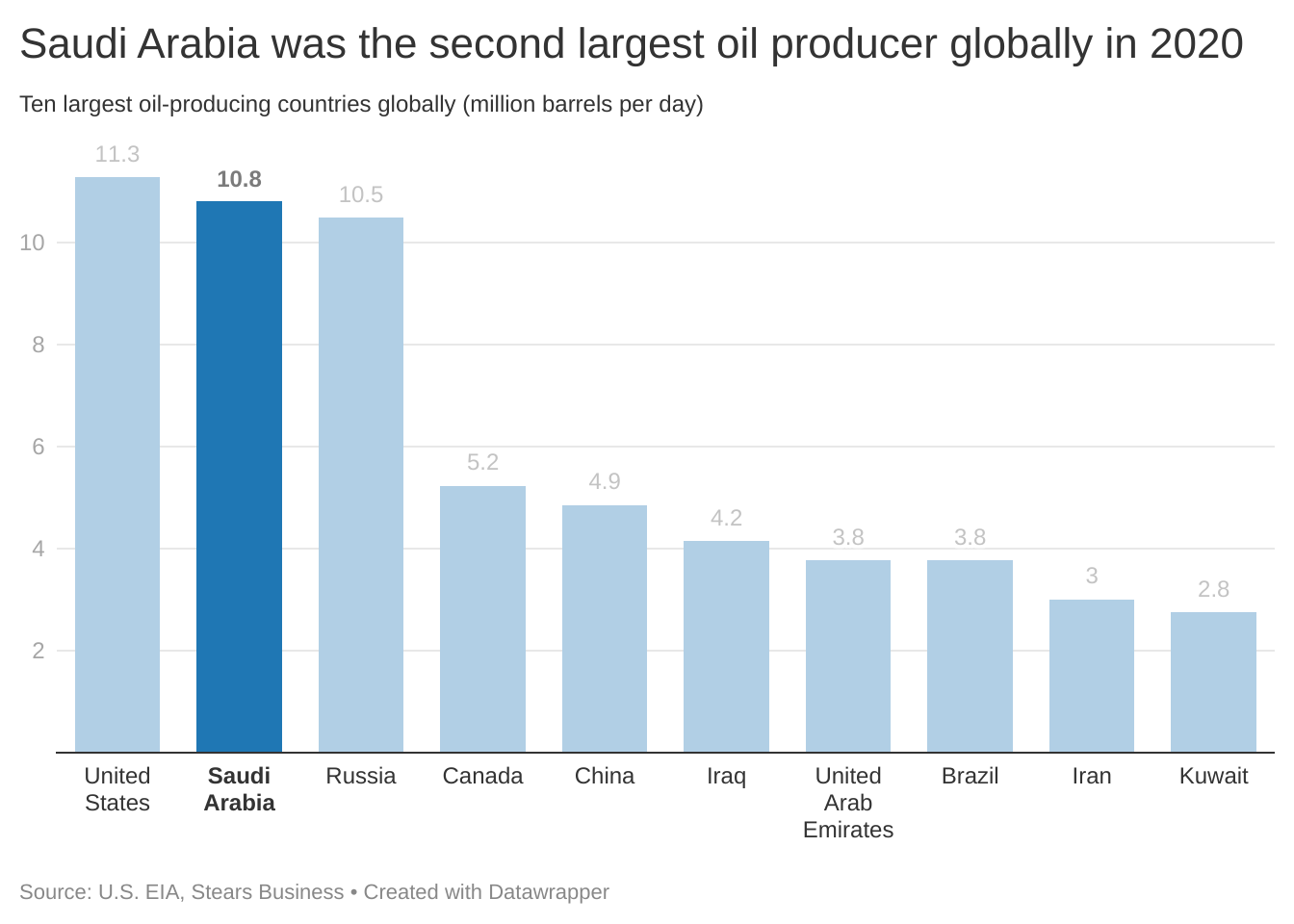

The Saudi Arabian economy is oil-based, and oil and gas contribute 50% of the country’s gross domestic product (GDP) and 70% of its export revenue. But, this isn’t surprising because Saudi Arabia has one of the most enormous oil production volumes globally, with over 10 million barrels per day. It also has the lowest production costs in the world. High margins and high volumes equal high profits.

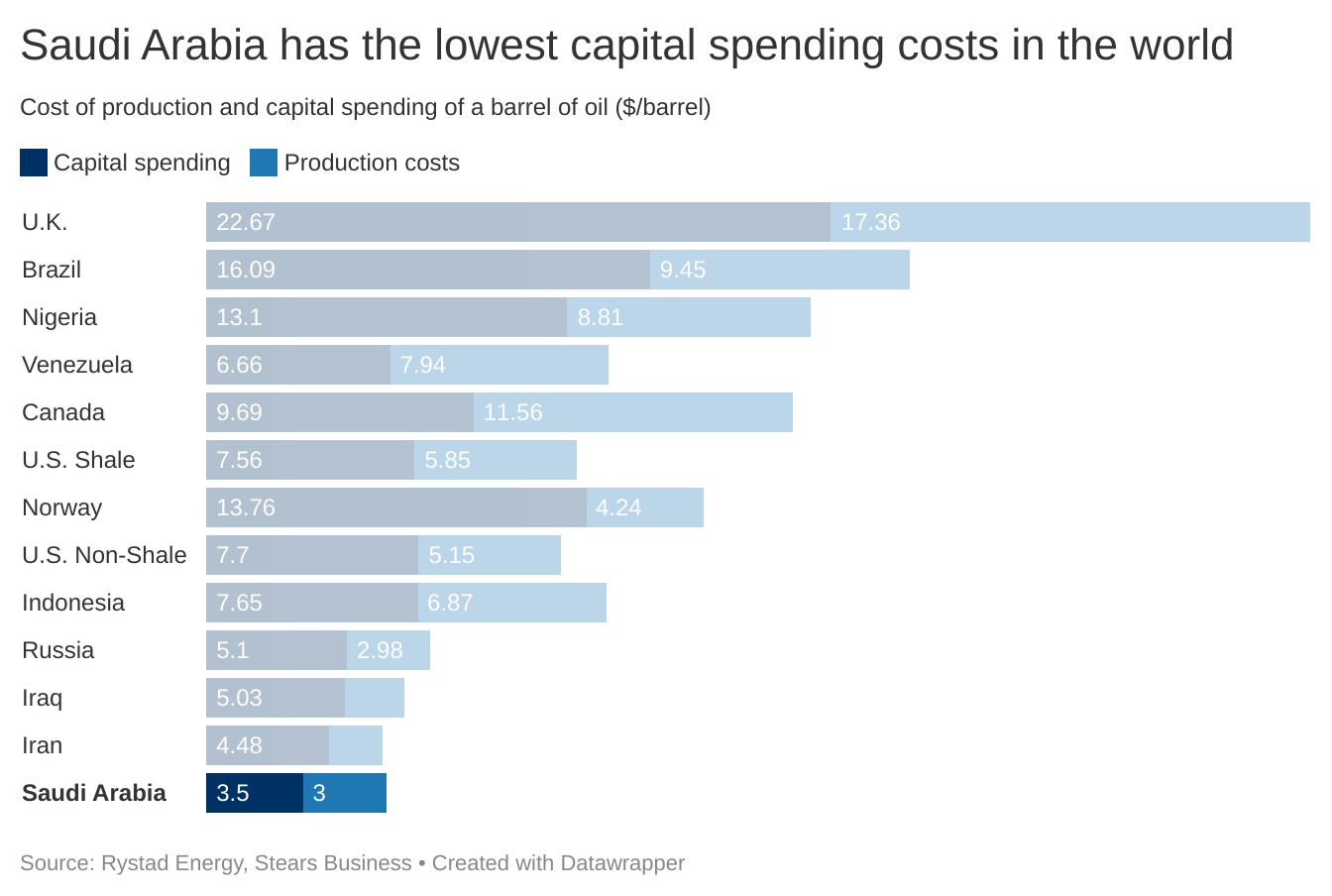

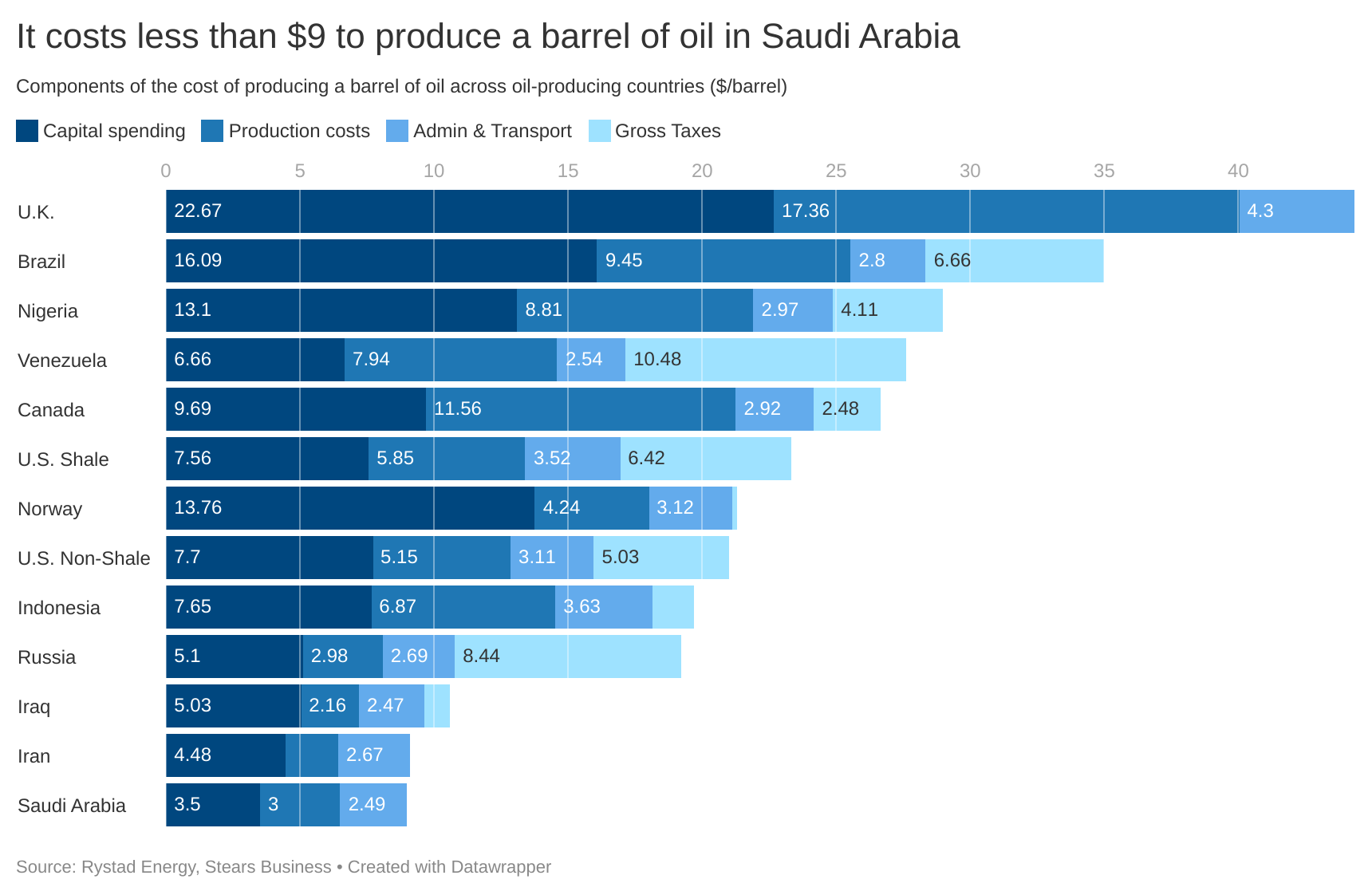

There are four components of the base costs of a barrel of oil—taxes, capital spending, production or extraction and administrative and transportation costs. We’ll assess Saudi Arabia’s costs based on these components in comparison with other countries. Let’s start with extraction costs.

The latest publicly available data is from 2016 from Rystad Energy, an energy insight company. It costs $3 to produce a barrel of Saudi Arabian oil because of the location and size of their oil fields. Oil in Saudi Arabia is located near the surface of the desert, so extraction takes less time and less machinery. It also has the largest fields so it can extract a considerable volume from one field. Interestingly, Russian oil is slightly cheaper in extraction costs at $2.98/barrel, thanks to bountiful resources and well-developed infrastructure. But, Russian oil isn’t as close to the surface, so capital spending and other components make Russian oil more expensive.

Extraction costs also influence capital spending costs at $3.50/barrel. With Saudi Arabia’s oil located closer to the ground, less time and machinery for extraction translates to less investment needed for extraction. Russia’s capital spending is more expensive at $5.10/barrel because more machinery is needed. In comparison, the UK’s oil fields are primarily offshore, and production costs are $17.36/barrel while capital spending is over $22/barrel. This means it costs 6x as much just to extract oil in the UK than Saudi Arabia.

Another component is administration and transportation. It costs $2.49 to transport a barrel of Saudi oil after extraction. Interestingly, it should be cheaper to transport a barrel of oil from Iraq, but due to political and security challenges, it’s a little more expensive because more security is required.

The last component is taxes. Saudi Arabia doesn’t charge taxes on oil production, and this means its production costs are less than $9 in total. This doesn’t mean the Saudi Arabian government doesn’t charge taxes on oil; it’s just not added to the production costs. In contrast, Russia charges 43.9% of the production cost of a barrel as tax which increases the cost of producing a barrel.

These components give Saudi Arabia a competitive advantage in terms of revenues and profits. Even though Saudi Arabia doesn’t have the highest production volumes in the world, its large margins mean that even if the cost of a barrel of oil was $25/barrel, Aramco would survive.

The second reason Aramco is so successful is how heavily it makes investments into its operations. Aramco is super focused on growth even till date. After declaring dividends worth $75 billion in 2021 (enough to fund more than eighteen $4 million Eurobonds for Nigeria), Aramco also unveiled its growth strategy. The company intends to invest about $50 billion this year alone to increase crude oil production to 13 million barrels per day in 2027 and gas production by over 50% by 2030.

But, Aramco isn’t just focused on oil and gas. Aramco’s ambition to become an integrated petroleum enterprise has shifted and as technology evolves, it's now focused on all kinds of energy. Aramco is investing in renewable energy and carbon capture technology to become a clean hydrogen production hub.

Essentially, Aramco, just like IOCs such as Total and Shell, is investing and rebranding to retain relevance in the energy transition.

As exciting as it is to talk about Saudi Aramco, we can’t forget our NNPC back home in Nigeria. NNPC started the process of reinventing itself with the Petroleum Industry Act (PIA) to become a private company owned by the government. This move also created a path for NNPC to IPO in the future. But, what can NNPC learn from Aramco?

Lessons for NNPC

We’ve gone through the two factors that make Aramco special. The first is low production cost, and the second is investment and determination to stay relevant.

The NNPC is losing the fight on both counts. With oil theft and production interruptions due to vandalism, production costs for Nigerian crude are higher than they’ve ever been. The group managing director of NNPC said production costs alone in Nigeria cost at least $17 per barrel. With costs this high, it’s clear why IOCs like Shell and Chevron would rather exit the country for countries with better margins.

On the other hand, investments in Nigeria’s oil sector have been very low for some time now. Between 2015 and 2019, $75 million was invested into Africa’s oil and gas sector, but Nigeria attracted only 4%. But with the high costs of production, why would anyone want to invest in Nigeria’s oil and gas sector? And with such poor revenue and insignificant profits due to expenses like petrol subsidies, the NNPC cannot make enough to significantly invest in its assets.

The NNPC needs to get its act together by reducing costs through elimination of oil theft and vandalism. This will make it easier to attract investors and increase oil production as profit margins increase. If this doesn’t happen soon, comparing Saudi Aramco and NNPC won’t be like comparing apples and oranges because NNPC might not even be in the conversation.