"Ask a kid today in the US what they want to be when they grow up. No longer is musician or athlete the top answer. It's a YouTuber—an answer 3x more popular than astronaut." - Forbes, 2020

If you’ve used any social media sites in the last few years, you’ve likely come across the term ‘content creator’ quite a few times. Many of us that have heard of this are probably used to thinking of creators as the influencers we see selling us their lifestyle, products, and even courses. However, this is just the surface. There’s a whole ecosystem comprising the creators themselves, the platforms they’re native to, brands aligning with them, and solutions that help them optimise ‘content creation’ as their careers. This has become known as the ‘creator economy’.

Key Takeaways

- The creator economy is a global phenomenon, raising over $1 billion in 2021 and growing to be

The opportunities available in the creator economy are growing rapidly, with more platforms offering new creative avenues every day and an entire ecosystem built around them. Given the rapid growth rate, low barrier for entry, and the ubiquitous nature of social media, Nigerians can leverage this phenomenon to create opportunities through job creation, building companies to support the sector, or even using it to boost existing commerce.

What exactly is the creator economy?

The idea of a creator economy is a relatively novel concept, so there are a few different ‘definitions’.

SignalFire is a VC firm invested in platforms such as Clubhouse. It believes the creator economy is a class of businesses built by over 50 million independent content creators, curators, and community builders. These community builders include social media influencers, bloggers, and videographers, plus the software and finance tools designed to help them grow and monetise.

CB Insights has a more direct explanation. They think that the creator economy describes the independent businesses and side hustles launched by self-employed individuals who make money off their knowledge, skills, or following.

From these definitions, we can pick out the major themes. Firstly, the creator economy comprises several ‘personal enterprises’. That is, driven by individuals becoming brands or a business of their own, sharing content online. And although companies do form part of the creator economy, you’ll find that they take on enabling and supporting functions. For example, if I post a picture on Instagram sponsored by Coca-Cola—myself, Instagram, and Coca-Cola are working within the creator economy because I would likely be getting some sort of compensation from Coca-Cola. Still, only I can be considered a creator.

The creator economy comprises so many sub-sectors and supporting industries that estimates of the market size are likely to be inaccurate. Still, we can assess it in a few ways.

The first is the number of creators.

As indicated in Signalfire’s above definition, it’s estimated that about 50 million people worldwide are considered to be creators. However, because of the nature of the job (i.e. largely self-defined), it’s more helpful to look at people that earn a livable wage from creation (i.e. creating is their full-time job). I can open a YouTube account, post videos on it, and validly call myself a content creator. However, without generating any monetary value, I’m not sure I can say I’m part of the creator economy. Using this classification, the number of professional content creators is closer to 2 million or 4% of the total.

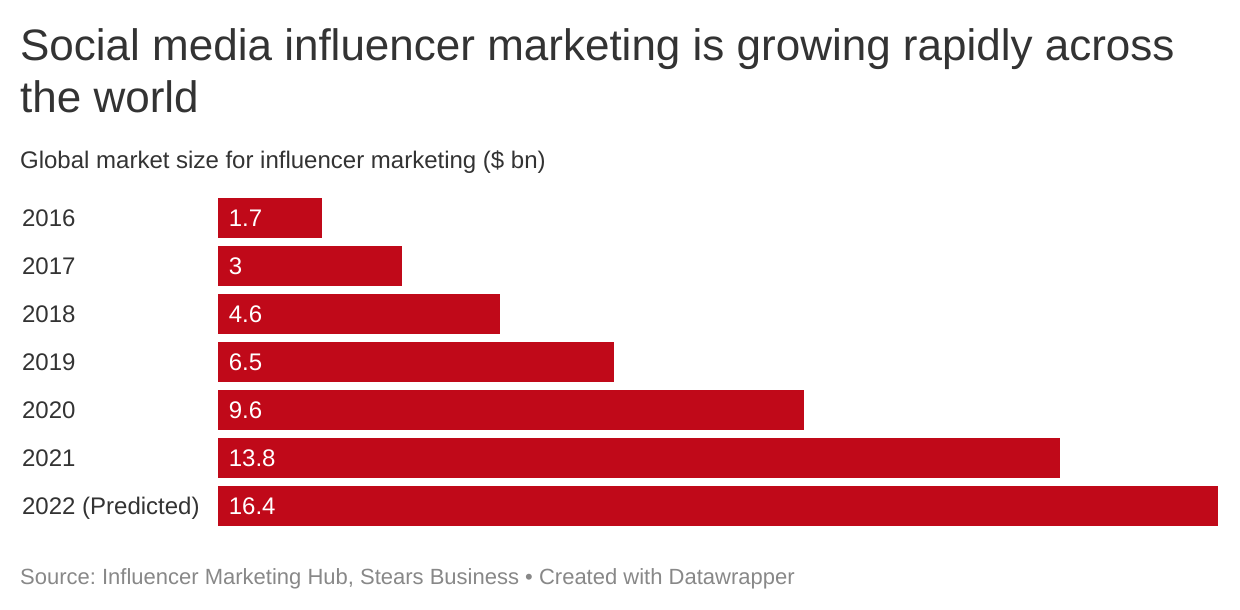

Next, we can look to understand how large it is by how much money the industry makes. As I alluded to earlier, businesses form part of the creator economy. They can be segmented into the platforms that content is hosted on, the companies or brands that pay for promos, ads, and visibility through creators, and the companies and start-ups that help to support creators' content (e.g. photo editing apps, influencer agencies, and financing companies). Combined, this industry should grow beyond $100 billion in 2022. Of this, the influencer marketing industry—the creators themselves—should surpass $16 billion.

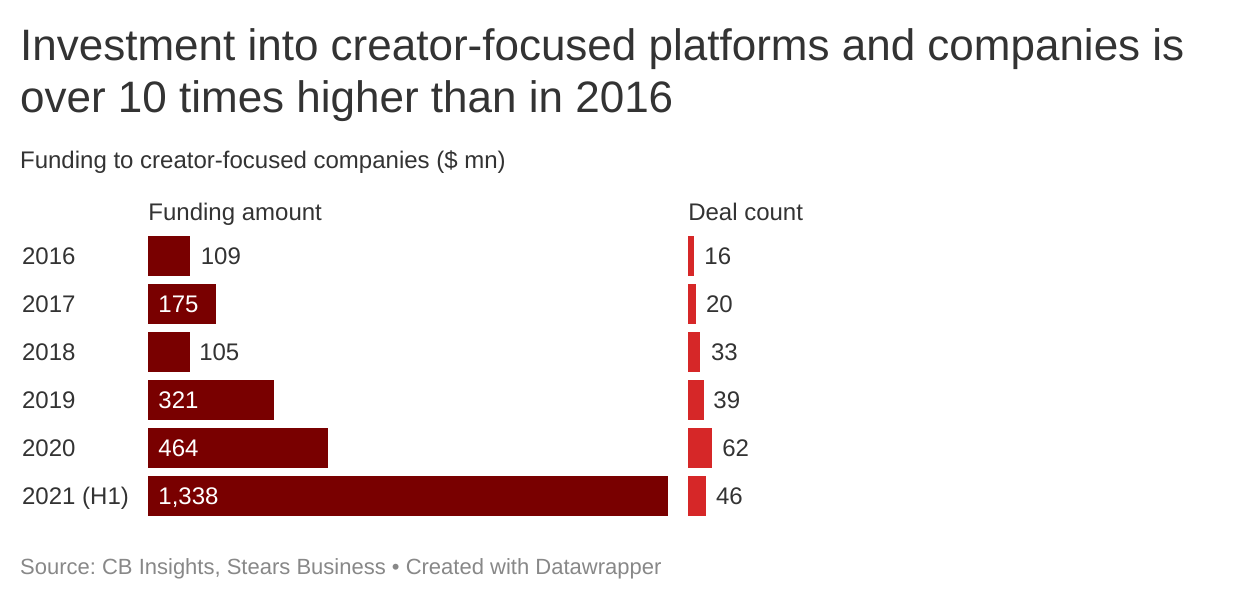

Platforms, agencies, tools, and businesses have grown alongside creators to leverage and support the growing industry. And the companies that provide these support and enabling products have received increased VC investment over the last few years, with a significant spike between 2020 and 2021. Many attribute this to the effects of the pandemic forcing interaction online and giving creators a more attentive following.

The creator economy represents part of a shifting paradigm

We have already looked at how much value the creator economy is set to bring in. However, that alone doesn’t tell the whole story of how much impact it could have. It’s disrupting existing industries such as entertainment and marketing. For example, 75% of companies globally now intend to market through influencers in 2022, and of those that do, 68% plan to increase their influencer marketing spend. It has already begun to disrupt huge industries. TikTok is another illustration—a content-sharing platform changing music consumption habits. The sway that the most popular influencers on the app have on the success of certain songs is so strong that record labels and music marketers pay TikTok influencers to promote songs.

Secondly, the creator economy is proving its ability to be a source of job creation. It allows people to take employment into their own hands using their talents, skills, and interests.

People have become successful off of content creation for anything you can think of. If a six-year-old can make $11 million a year by reviewing toys on YouTube, then there is space for pretty much all interests. Yes, this is an anomaly, and Ryan is definitely a part of the 1% of content creators. But, people really do make money from content creation, and many creators use this as a springboard into many other activities, such as starting their personal brands.

Considering that only 36% of Nigeria’s youth population (15-34 years old) is fully employed, the creator economy provides a perfect opportunity for anyone with a smartphone and any interest they want to share. Not unlike the gig economy, it’s forming part of the changing face of the workforce. The rewards may be skewed towards the top creators (like startups, the returns are unevenly distributed) but the opportunity is available, and, most importantly, vast.

Speaking of people making money online—the online audience is large and growing (33 million social media users in Nigeria as of Jan 2022), with a significant reach. We can start to understand the potential of these creation sites when we see just how far they reach. For instance, data shows that YouTube’s ad reach is equivalent to 15% of the Nigerian population, and YouTube ads reached 30% of Nigeria’s total internet users at the beginning of this year. This is an excellent opportunity for both brands and creators to leverage the attention given and it means that as audience size and engagement grows, there are more monetisation opportunities.

The creator economy can be just as big a deal in Nigeria as it is everywhere else

When we look at the creator economy, like any other industry, there’s the seller (creator) and the buyer (the audience or following).

You need both a creator that’s adding value and providing audiences with content they want to see and a loyal and engaged following that an influencer can leverage (and monetise).

So, the conditions that support both demand and supply must be present.

To make this easier to visualise, the birth of YouTube wasn’t enough to create value for YouTubers or video creators. These creators needed an audience. When that audience was built, brands found a new way to engage consumers, so they needed to find a way to use that reach (through ads, sponsored content). Once this happened, they also needed to be able to pay for this (digital payments) and to be sure that this audience will also spend money on their brands to make it worthwhile. Essentially, they needed to profile the audience to ensure they had the necessary characteristics of their ideal market, meaning they needed analytics.

The list goes on, but if we look at a creator economy value chain, we can divide it into three distinct parts: creating or producing the actual content, using this to build an audience, and then using the following you’ve built as leverage for monetisation.

We can use each part in the value chain to understand whether Nigeria can nurture its creator economy or even contribute to the global one.

Creating content

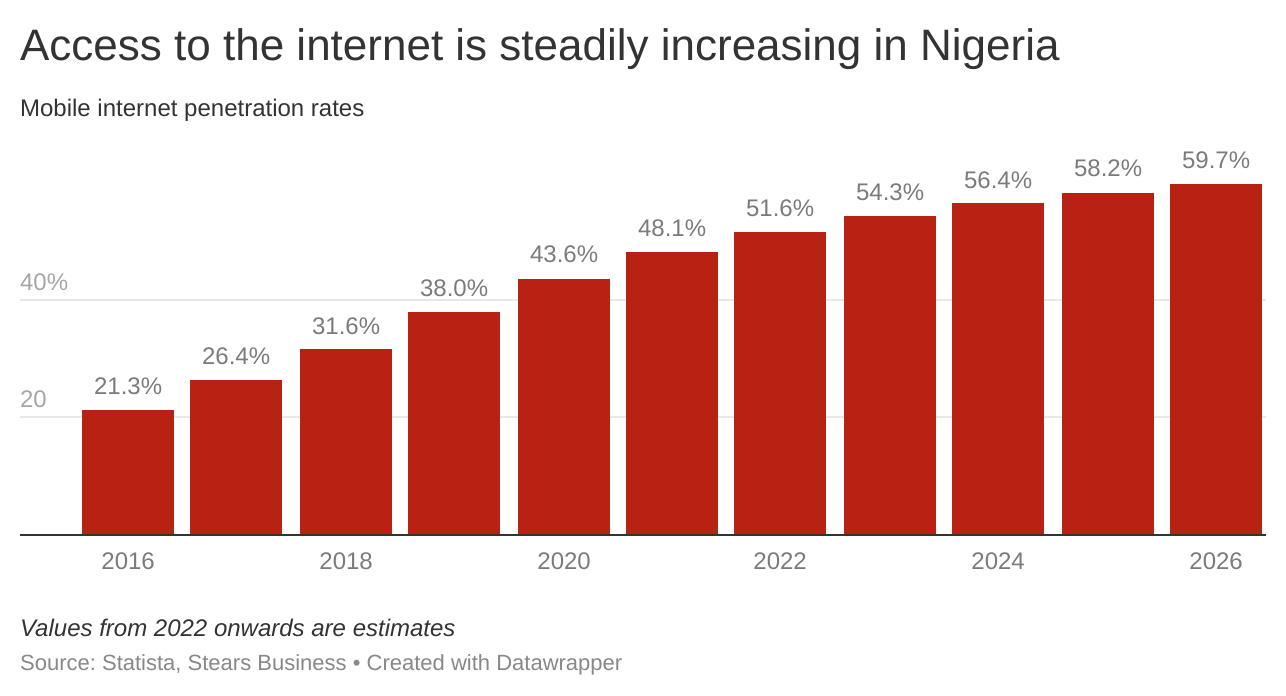

The barrier to entry is low, and now more than ever, Nigerians have access to the tools required to scale it. One of the most appealing things about the creator economy is its accessibility. Anyone can become a content creator with a mobile phone and a social media account. Entry-level smartphones are becoming more affordable (with the smartphone price being about $50 or 43% of the average person's earnings in a lower-middle-income country), leading to a rise in smartphone ownership. The entry-level for becoming a creator in the creator economy is low, and incredibly, is not much higher than being a consumer. With the uptake in smartphone ownership, access to the internet is becoming easier to achieve.

One barrier is the cost of data in Nigeria. An average Nigerian would have to work at least 30 minutes to be able to purchase the cheapest mobile internet bundle. In contrast, the average American would only need to work a fifth of this—6 minutes. This is a limiting factor as it means creators may be constrained by the amount of data they can afford.

After this, however, the main barrier to content creation is your imagination. I think we can confidently say that imagination and creativity are not scarce in Nigeria. After all, Nollywood is the second-largest movie industry worldwide, while Nigerian music is currently topping global charts and garnering international acclaim. And, of course, we can’t talk about creativity in content creation without giving an honourable mention to the Ikorodu Bois, whose creativity grabbed global attention, earning them an invitation to a blockbuster premier.

Once you’ve found your niche and can create interesting content related to it, it’s time to find the audience that wants to participate.

Building an audience

Mobile internet usage is increasing in Nigeria, and so is the time spent online. Nigeria has seen a 12% (+26 minutes) annual increase in the amount of time spent online—the global growth is 1% (4 minutes). Nigerians are also consuming more online content. 92% of internet users in Nigeria report watching video content online, and a third listen to audio content. Overall, 40% of internet users say they use social media because they’re interested in the content. This represents a massive opportunity for Nigerian content creators to leverage—audiences are interested.

Data is expensive, but platforms are innovating around it. Although data is a limiting factor, both platforms and telcos are finding ways around this. For instance, some apps have ‘Lite’ versions with limited features and lower data usage, allowing more people to use them. Likewise, telcos offer streaming bundles that enable users to access specific social media sites at reduced rates. For example, a ₦50 per day rate on Glo can get access to 50MB data alone or 100MB to stream YouTube.

Up to this point, we’ve seen that when the creators can access the internet and start creating their content easily, they’re able to build a loyal and engaged following, scaling their enterprise.

Now, we reach the third leg. Once an audience is built, creators need to be able to monetise. There are several ways to do this, primarily through ad revenue, brand sponsorships, and subscriptions. This requires an audience that is willing and able to buy, brands motivated to pay, and creators' ability to receive payment.

Monetisation

Nigerians have a propensity to buy. It’s not news that Nigerians don’t have high discretionary income. 7 out of 10 people who use the internet in Nigeria earn less than $3.20 per day. However, those who use the internet are still likely to buy, even if they spend less. We can use e-commerce as a proxy for online spending because if users engage with brand-sponsored content, the favoured outcome will likely be an e-commerce purchase. About half of internet users in Nigeria that interface with e-commerce go on to make a purchase. However, they spend only a fraction of what’s spent online globally. Nigeria's average revenue per customer is $96. Globally, it’s over ten times this amount, at $1,017. This has implications for the brands that target these customers, the bargaining power that creators have when negotiating their packages, and how well Nigerian creators can monetise.

One way that Nigerian creators can mitigate this is by positioning themselves to attract a global audience. That said, universal appeal is difficult to attain. Again, we can look to the entertainment industry as a proxy. People tend to buy into content that they are familiar with or can relate to. Wizkid topping the charts with a Justin Bieber feature is a bigger deal to us than it is to Americans because whilst many of us are familiar with American pop culture, the same can’t be said the other way round. The positive is that Nigeria is exporting so much culture and influence these days that this would likely change, and if it does, then our local content creators could have a lot more room to grow.

Social media marketing is essential for brands. Social media and content sites are becoming akin to review sites and sources of recommendations. 97% of Nigerian social media users use social media channels for brand research. Brands globally have leveraged this and have upped their spending on influencer and social media marketing. The growth in social media marketing is so steep—growing 15% per year, that it’s expected to overshadow television advertising by the end of 2022. The global creator economy has presented a unique opportunity for brands to connect with their consumer base more personally. The fact that so many social media users in Nigeria consult these channels to make purchasing decisions shows it works.

Furthermore, Nigerian brands are following a similar trajectory, with PwC estimating that by 2023, internet marketing will overtake TV marketing. This again shows great potential for creators in this market to take advantage of this shift. Brands need creators to reach audiences authentically, and creators need the brands.

Digital payments mean that creators can easily be paid. Finally, all of the above is well and good, but the rest falls flat without the ability to get paid. One of the enablers of working online is the ability to be paid online. This is excellent news for Nigeria. The fintech sector—payments, specifically—is growing exponentially each year. So far, it has powered many of Nigeria’s new generation startups and can do the same for the creator economy.

Verdict: Is the creator economy set to take Nigeria by storm?

Although it’s difficult to get concrete statistics on Nigeria’s creator economy, we can use the above factors to understand whether the right conditions exist.

Turns out they do.

Even with limiting factors like the cost of data, solutions are still being built, meaning these factors may stall but not stop the growth of the creator economy.

Furthermore, this represents another opportunity for budding entrepreneurs to build solutions supporting the creator economy. For instance, even though you technically only need a smartphone and data to participate, better production value often means higher engagement. There are startups specialising in influencer or content creator financing in other geographies to get higher quality equipment and more professional content.

Another encouraging factor is the parallel industries in Nigeria. The traditional creatives industry is one of the largest employers in Nigeria (second largest after agriculture), and what’s great about this is that many supporting functions can easily spill over into the creator economy, such as production, digital marketing, videography, editing, etc.

Even though the African and Nigerian market is only a tiny slice of the global content creation space, there are signals that the right ingredients are in place. Content creation itself is a novel concept, and the rest of the world is still gearing up to see its full potential.