Last week, MTN Nigeria Plc announced the rollout of the 5th generation (5G) technology in seven major cities in Nigeria. The rollout is expected to cover the following cities within a month: Lagos, Abuja, Port Harcourt, Ibadan, and Kano, with Owerri and Maiduguri to follow afterwards.

This news was met with jubilation (especially within the tech community). Now Nigeria is on track to make the 5G network commercially available, joining other African countries like Lesotho and South Africa.

Key takeaways:

-

Eight months after paying $276 million for a 5G licence, MTN has begun the roll-out of the 5G technology in selected locations in Nigeria.

-

5G technology offers four major use cases with great benefits to the Nigerian economy. They include ultra-fast internet speeds, low latency, massive machine-type communications and Fixed Wireless Access (FWA).

- While we have seen improvements in 4G penetration, 4G adoption has lagged due to a slew of

The calls for celebration are justified. 5G is the current generation of mobile communications technology designed to outpace the preceding 4G networks with new capabilities and specifications that will foster innovation and development.

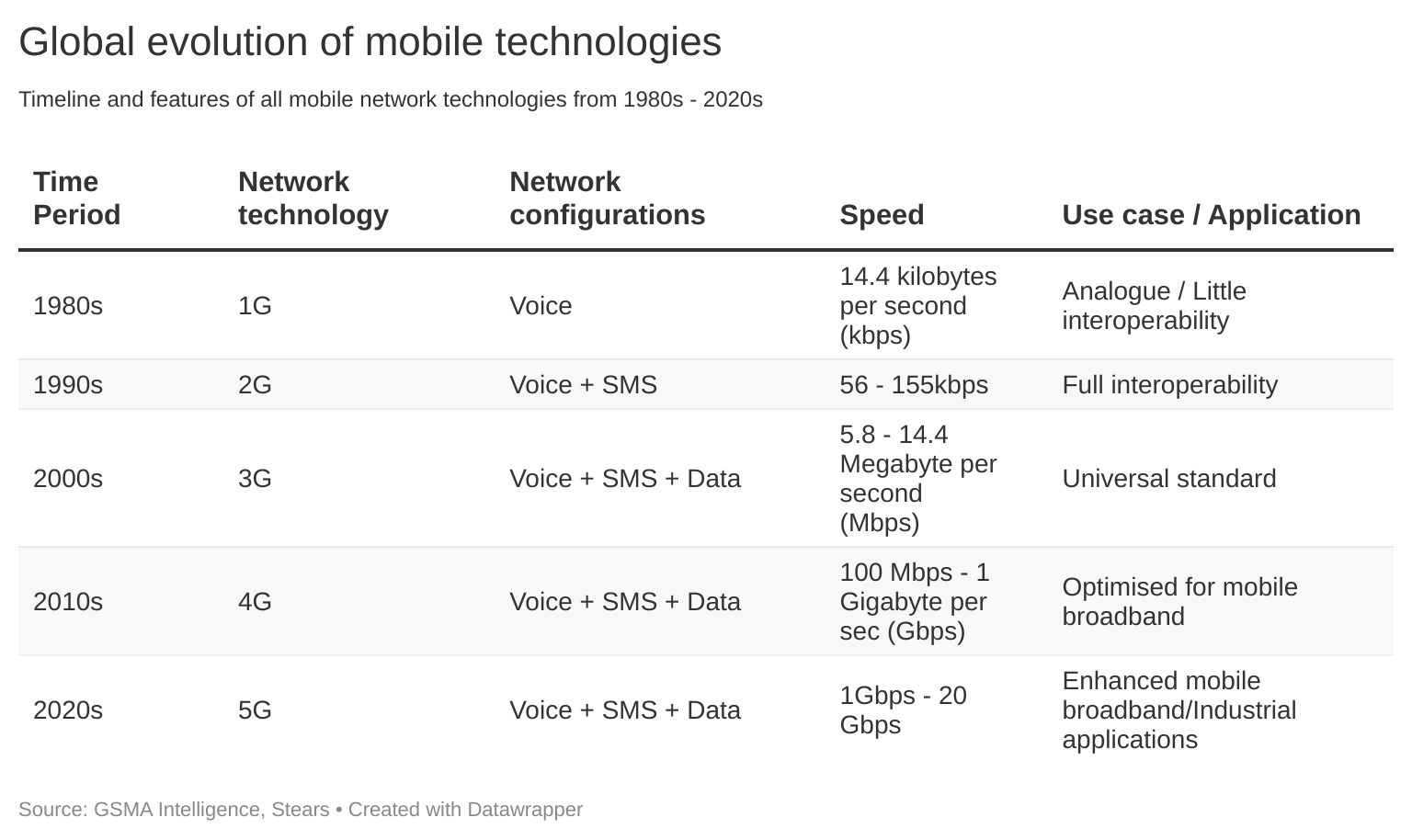

Over the past 30 years, the mobile industry has proven its ability to connect and transform the economy through its 2G, 3G and 4G networks. 5G builds on previous generations' successes and is expected to enhance existing services and enable new business models and use cases.

Before the introduction of 4G, early mobile technologies (1G, 2G and 3G) were heavily voice-oriented in their network configuration. However, as the world gradually moved from basic voice to data services, 4G was born.

5G, as an evolutionary technology, will perform all the 4G functions with the potential for more and at a significantly larger scale.

To be precise, 5G offers four major use cases that differentiate it from the other generations.

First, 5G is 100 times faster than 4G—including peak download speeds of at least 20 Gbps and a reliable 100 Mbps user experience data rate in dense urban areas. Say I want to download a 6GB movie. It would take approximately 49 seconds to download on the 5G network versus 50 minutes on average via 4G.

In addition, 5G offers low latency (delay in processing data over a network). 5G’s response time is as low as 1millisecond, compared to 3G (100 milliseconds) and 4G (30 milliseconds). This supports services such as virtual reality (VR), uninterrupted live streaming etc.

The third major use case is around massive machine-type communications. This includes the ability to support at least one million IoT connections per square km with long battery life and extensive wide-area coverage.

For instance, a manufacturing plant could have thousands of machines connected, where one machine tells the other what parts are or procedure is required to complete an order. All of these are in real-time and on a large scale.

Last is Fixed Wireless Access (FWA), which offers fibre-type speeds to homes and businesses in rural and urban areas in developed and developing markets.

This simply means that instead of waiting on fibre optic cables to provide fast internet speeds, 5G would be able to provide this with wireless connections.

Just as the Global System for Mobile Communications (GSMA) put it, “5G will be a key enabler of the Fourth Industrial Revolution or Industry 4.0—a time when technology is seamlessly embedded within society, especially in commercial and industrial processes”. Picture those ’90s movies that depict the future with driverless cars, artificially intelligent robot butlers and hologram video calls. Yes, all of those can be possible with 5G technology.

Last year, Accenture—a global IT and consulting firm, reported that 5G could create an additional $1.5 trillion in the gross domestic product (GDP)—equating to 6.5% of US’ 2021 GDP and 16 million new jobs for the U.S. between 2021 and 2025.

The European Commission, in a similar study, estimated that the benefits of 5G in Europe could reach €113 billion annually by 2025 in four key sectors, namely: automotive, transport, healthcare and energy, creating about 2.3 million jobs.

I could go on and on about the potential monetary benefits of 5G. Still, the bottom line is that 5G will enable existing and new technologies to drive productivity and efficiency.

While evidence like these shows that the rollout of 5G in Nigeria is good news, I began to think about the current state of Nigeria’s mobile internet industry and how 4G has struggled to permeate the nooks and crannies of the country (we see how later on). I asked myself, “is Nigeria truly ready for 5G?”.

As I type this article, I’ve had to toggle between connecting to the internet on my 4G MiFi and my phone’s internet hotspot due to the unreliable internet connectivity plaguing Nigerians.

This article will use an indicative framework from GSMA to assess Nigeria’s readiness for the 5G technology. Also, we would be drawing insights from industry experts to navigate through some of the issues that might hinder 5G adoption.

We will kick off by assessing Nigeria’s current mobile broadband (3G & 4G) state and then examine the country's readiness for this evolutionary technology.

Current state of mobile broadband technologies

As we saw in the chart above, the new millennium (the year 2000) ushered in an era of mobile broadband services designed to accommodate the new demand for data.

Since we already established that 5G will be built upon the success of these technologies, it’ll only make sense for us to study the level of penetration of these technologies into Nigeria’s digital economy.

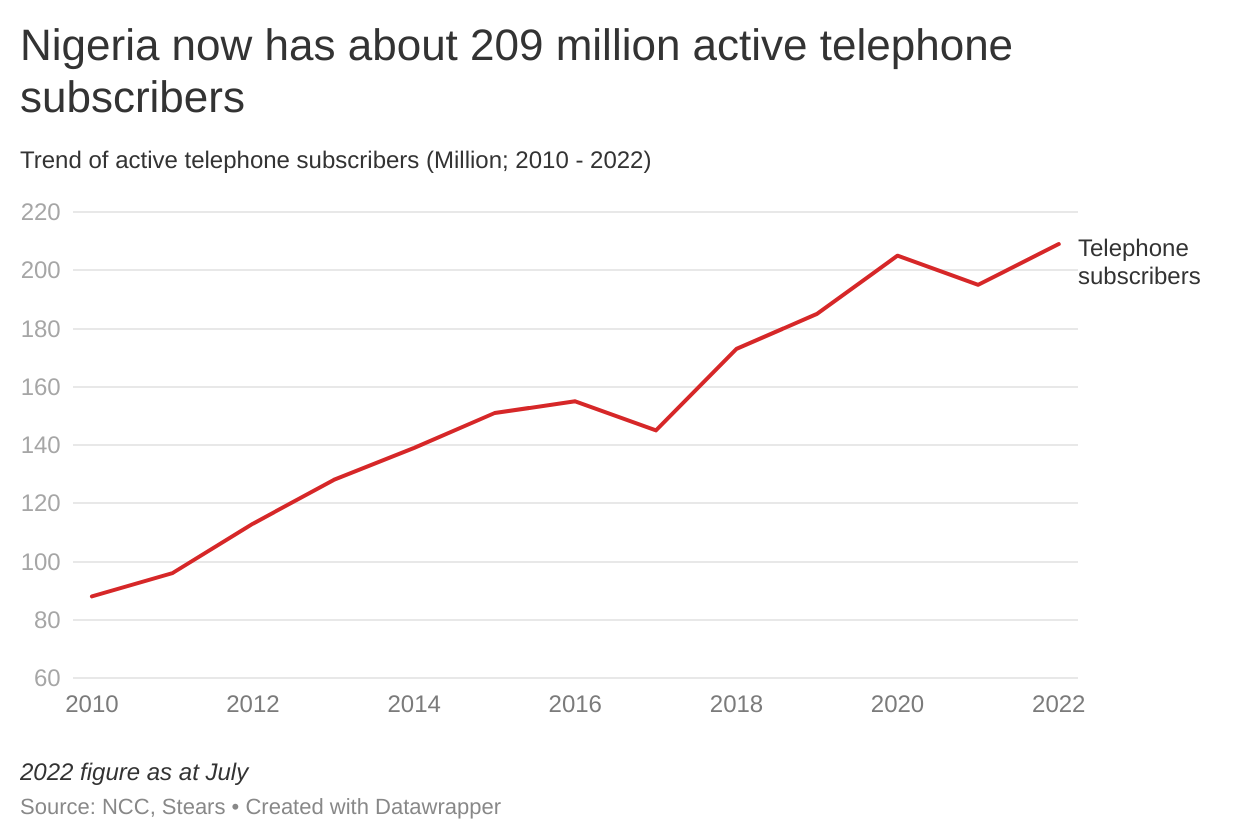

According to the Nigerian Communications Commission (NCC), the total number of telecom subscribers stood at 209 million as of July 2022, up 29% from July 2018.

Furthermore, the NCC states that internet penetration—the number of people with access to and knowledge about the internet, be it via 2G, 3G or 4G, stood at 80% (152 million) as of July 2022. This compares to 54% in July 2018.

Simply put, of the 209 million subscribers with active telephone lines, 152 million have access to or knowledge about the internet.

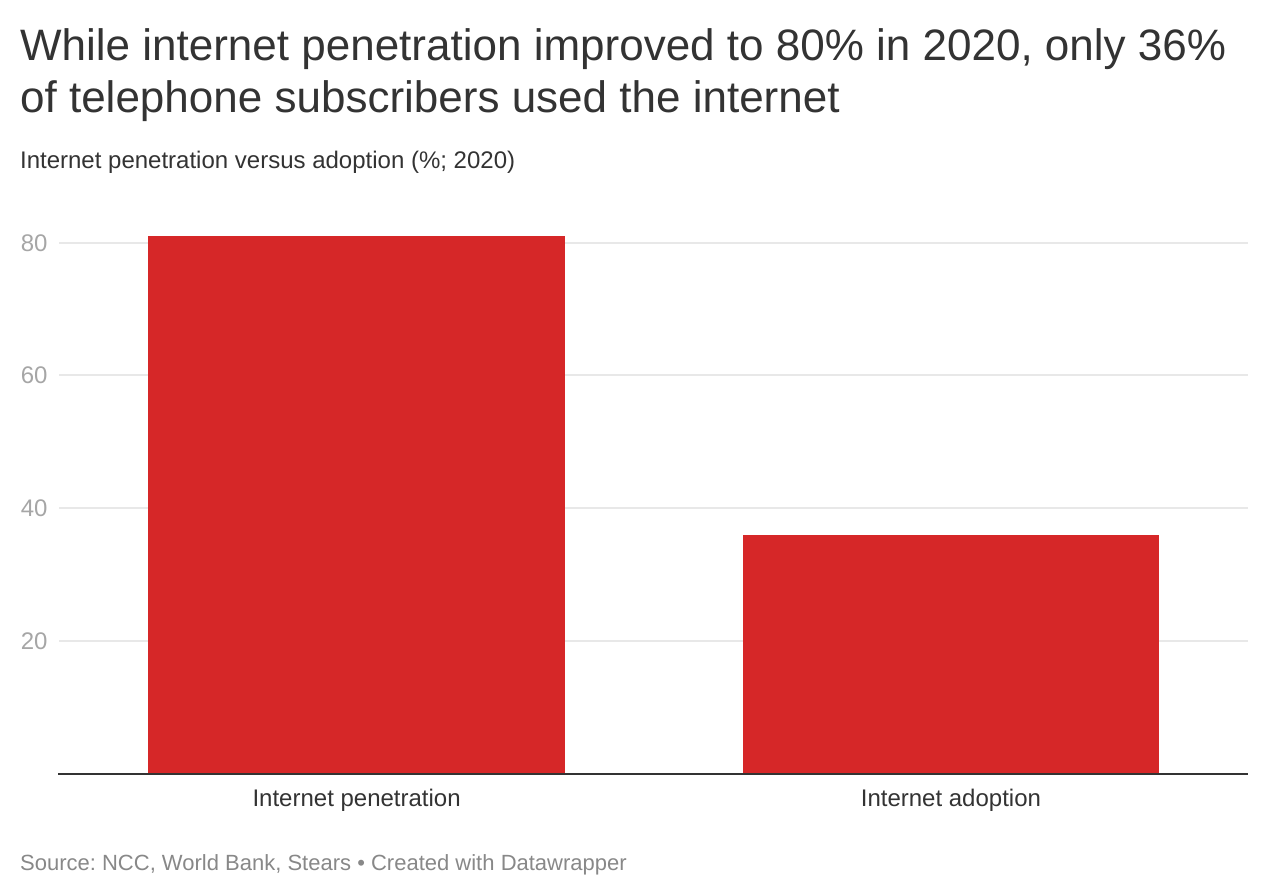

However, according to the World Bank (most recent data available), internet adoption (number of people with only access to the internet) stood at 36% of telephone subscribers in 2020 (versus internet penetration of 81% in 2020). Just 68 million people had access to the internet as of 2020 (although we acknowledge this figure could have risen as of 2022).

Yet, this rate is not up to some African countries like Morocco (84%), South Africa (70%) and Ghana (58%), but above the African average of 33%.

Think of penetration and adoption as the forces of supply and demand. Penetration has to do with the supply of the network (i.e. mobile coverage), while adoption has to do with the demand for the network (i.e. actual users).

An example is MTN announcing its presence (penetration/coverage/supply) in some remote rural areas in Ikot Ekpene (in Akwa Ibom state). When a citizen within the area connects and uses the network, it adds up to the adoption rate(demand).

This distinction is important to help us understand some of the issues that could impact our readiness for 5G—since we already established that 5G will be built upon the success of the previous technologies.

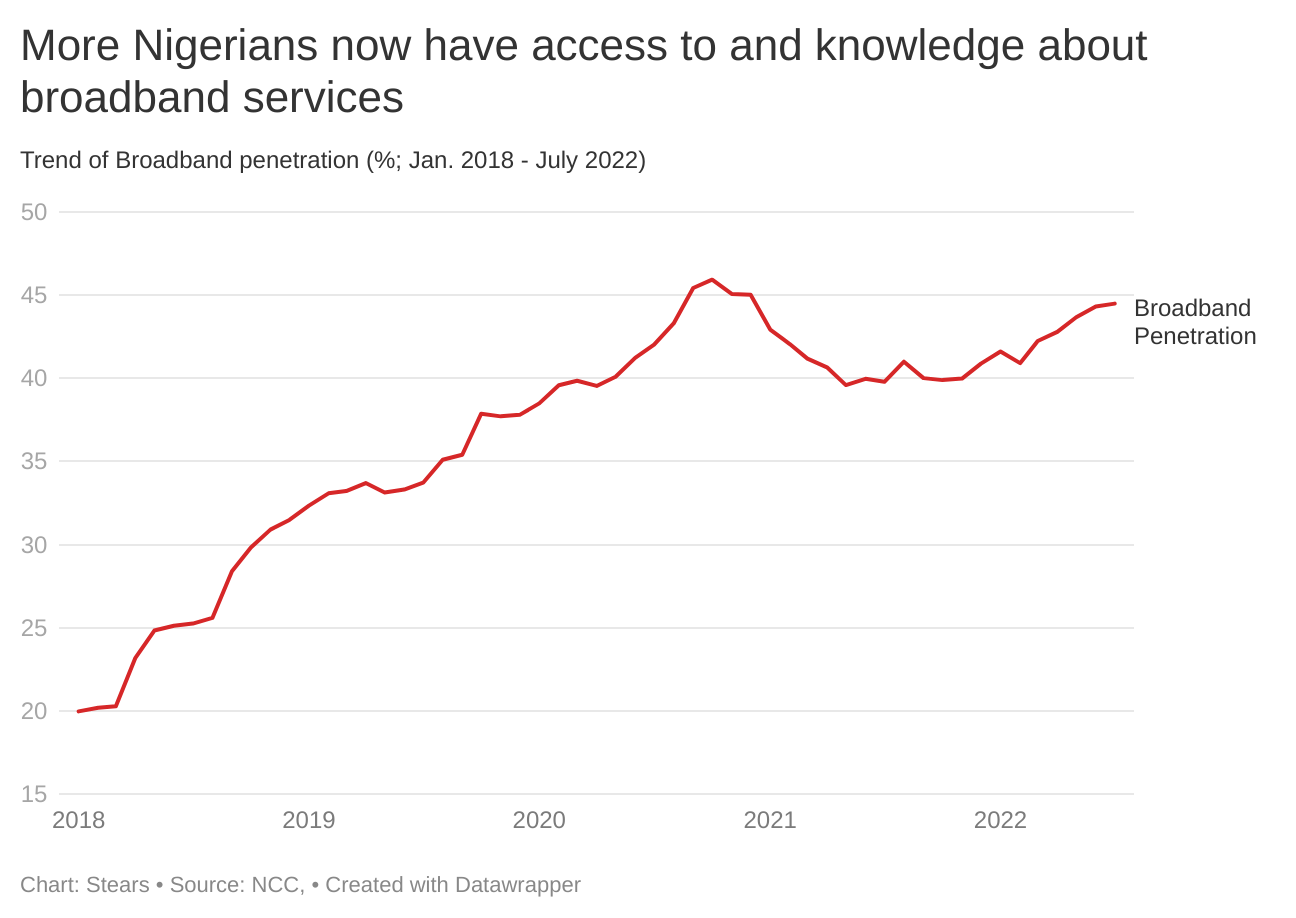

Since we focus on just 3G and 4G (broadband), we need to look deeper. First, we would start with broadband penetration (supply) and then move on to demand (adoption).

Broadband penetration

Broadband (3G and 4G) penetration stood at 44.5% in July 2022, up from 25% in July 2018. This means that 44.5% (85 million) of telephone subscribers were connected to the internet via fixed or mobile (wireless) broadband services.

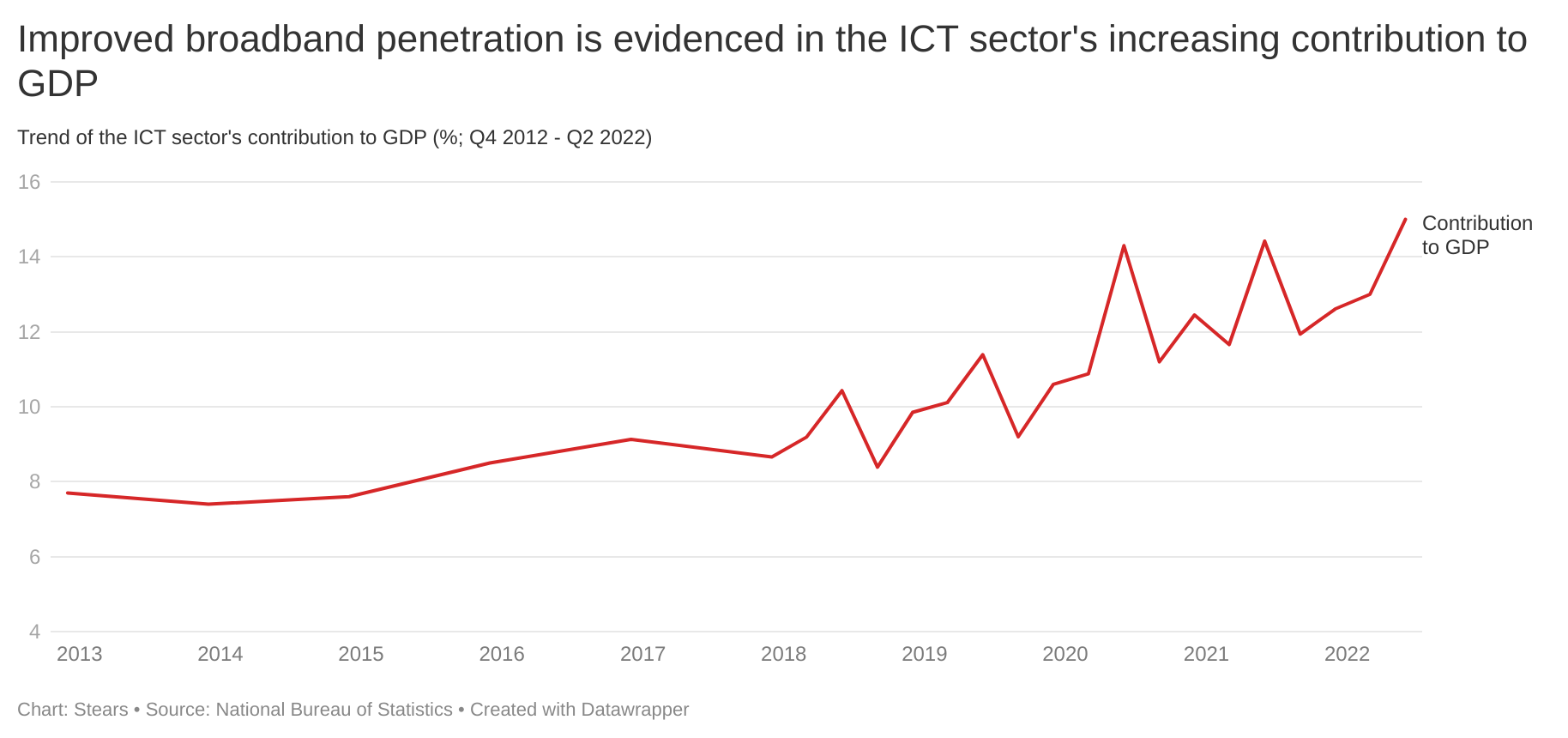

This is positive news, as World Bank research estimates that a 10% increase in broadband penetration in developing countries (like Nigeria) is associated with a 1.4% increase in GDP.

This is evidenced in the ICT’s contribution to GDP growth from <1% in 2000 to 15% in Q2 2022.

However, since fixed broadband constitutes less than 1% of broadband penetration (versus 98.9% of mobile broadband), we would be focusing on just mobile broadband penetration.

This means more people connect to broadband via their mobile phones instead of fixed broadband—like satellite broadband Internet, Wireless Local Area Network (WLAN) etc.

Going further, according to the GSMA, “state of mobile Nigeria’s 3G and 4G coverage stood at 80% and 60% in 2020, up from 70% and 17% in 2018, respectively.

This means that in just two years (2018-2020), more Nigerians had access to and knowledge about faster internet connections via mobile phones.

The improvement in penetration (especially 4G) can be attributed to a concentrated effort by the Federal Government to boost broadband penetration.

Following Buhari’s victory in the 2019 elections, he made due on his promises to treat broadband as critical. As such, the Federal Government and the National Communications Commission (NCC) rolled out the Nigerian National Broadband Plan (NNBP) 2020 - 2025.

The plan highlighted targets like a 70% broadband penetration by 2025—penetration was around 32% in January 2019. So we had a 38% gap to fill in five years. There was also a minimum target speed of 25Mbps in urban areas and 10Mbps in rural areas, while a target price of ₦390 or $0.94 (based on the current official rate) was set as the price for 1GB worth of internet service.

But reviewing these targets shows Nigeria’s broadband penetration had only reached 44.5% as of July 2022—a progress of only 12% in almost three years! This slow progress also impacted the speed and cost of internet services. Nigeria’s average broadband speed of 8 megabytes per second (Mbps) in 2021 doubled to 16.5 Mbps as of Q1’22. But remember that the target is 25Mbps, which is still low compared to the global average of 29.8Mbps.

According to Adedayo Longe—Head, Advisory Services at LoftyInc Allied Partners Ltd (with a focus on the telecoms sector), “one of the major issues that have inhibited significant progress in broadband penetration is around right of way (RoW), epileptic power supply, persistent insecurity, theft and vandalism”.

In the NNBP, the incumbent administration hoped to extend broadband coverage to 120,000 kilometres with fibre optic network cables. And implementing a national, harmonised price of ₦145/linear meter for RoW fee in all 36 states was vital to achieving this objective quickly.

Federal and state authorities charge telcos RoW fees to install infrastructure such as fibre optic cables along roads. However, the FG could only enforce these RoW charges on federal roads, leaving state governments to charge way higher. Lagos state’s RoW charges per linear metre are as high as ₦1,500 compared to the ₦145 recommendation.

But Lagos is not the only state to blame. In January 2020, 14 states increased their RoW to all-time highs, ranging from ₦3,000 - ₦6,000 per linear meter.

This coupled with epileptic power supply, persistent insecurity, cable theft, and vandalism, have all hindered improvement in fibre network coverage which stood at 54,725 km in 2021 (versus 30,000km in 2018). This is still a far cry from the 120,000 km needed to achieve 70% broadband penetration by 2025.

These issues will also affect 5G penetration, but how about adoption?

We are not adopting

To analyse the current situation around broadband adoption, we would be looking closely at 4G adoption (since it's the closest to 5G).

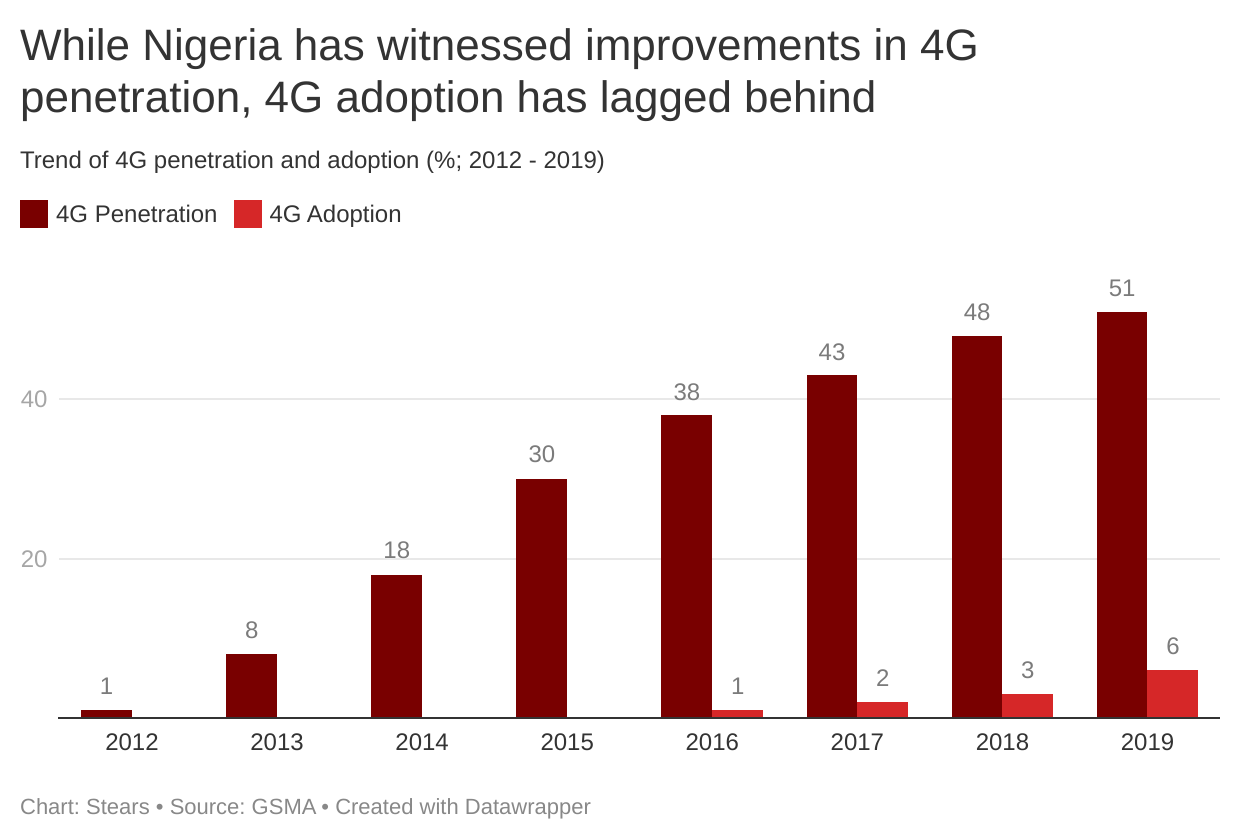

According to GSMA, 4G adoption stood at 6% of connected subscribers in 2019 (latest available data), growing by just 5% from 2016. Meaning that while coverage has spread impressively, 4G usage has lagged.

GSMA attributes the mismatch between 4G coverage and adoption to the affordability of smartphone devices, quality of service & speed and access to such services beyond major urban areas.

Let's dissect these issues individually to understand the issues limiting 4G adoption, as these could also spill over to impact 5G.

The Alliance for Affordable Internet estimates that a smartphone priced at $62 could cost almost 41% of the average monthly income of $150 in Nigeria as of 2021 (versus the African average of 63%), while a similarly priced smartphone costs only around 12% of the average monthly income in the Americas.

When we consider that Nigerians spend 56% of their income on food, leaving just 44% of that left to cover other expenses (like rent, data etc.). It becomes apparent that at 41% of average monthly income, 4G-enabled smartphones are too pricey for the average Nigerian.

At the same time, 2G phones bought from Chinese factories at around$5-$8 are resold in Africa for$15–$25 (17% of average monthly income in Nigeria).

The relatively low price of 1GB of data at $2.49 (1.66% of the average monthly income) is within the UN’s Broadband Commission “1 for 2” target. The target says 1GB of data shouldn’t cost more than 2% of the average monthly income. But the high cost of smartphones has acted as a barrier to entry for 4G adoption in the country.

Furthermore, Adedayo Longe attributes the low adoption of 4G to “major infrastructure challenges and market failures, particularly in rural areas”.

The issues we highlighted above, including high costs of smartphones, RoW, cable theft, insecurity and vandalism, have led to network operators focusing on delivering network services to the most profitable geographical areas. These are primarily urban areas, capital cities, and intercity routes, to the disadvantage of almost half the population (47%) who live outside those areas.

In addition, network operators have witnessed a slight revenue decline due to pricing pressure induced by competition. These operators have not transitioned to generating significant revenues from data as they have in more mature markets, translating into reduced investment and infrastructure rollout.

The World Bank, in its Nigeria Digital Economy Diagnostic Report, 2019” states that “voice ARPU will drop from $33.09 in 2017 to $19.47 by 2022 (the decline in Naira will be less noticeable, decreasing from Nigerian Naira ₦4,516 to ₦1,986). Broadband ARPU will also decrease, although less severely, from ₦10,401 to ₦9,468 over the same period.

These effects have been compounded by the snail-like growth rate of the economy that has forced operators to slow down or postpone their investment plans for network expansion.

We can see serious issues have hindered the penetration and adoption of broadband and are set to impede 5G too.

While those mentioned above don’t necessarily tell us if we are ready for 5G, they form the basis for answering if Nigeria is ready for 5G”.

So are we ready?

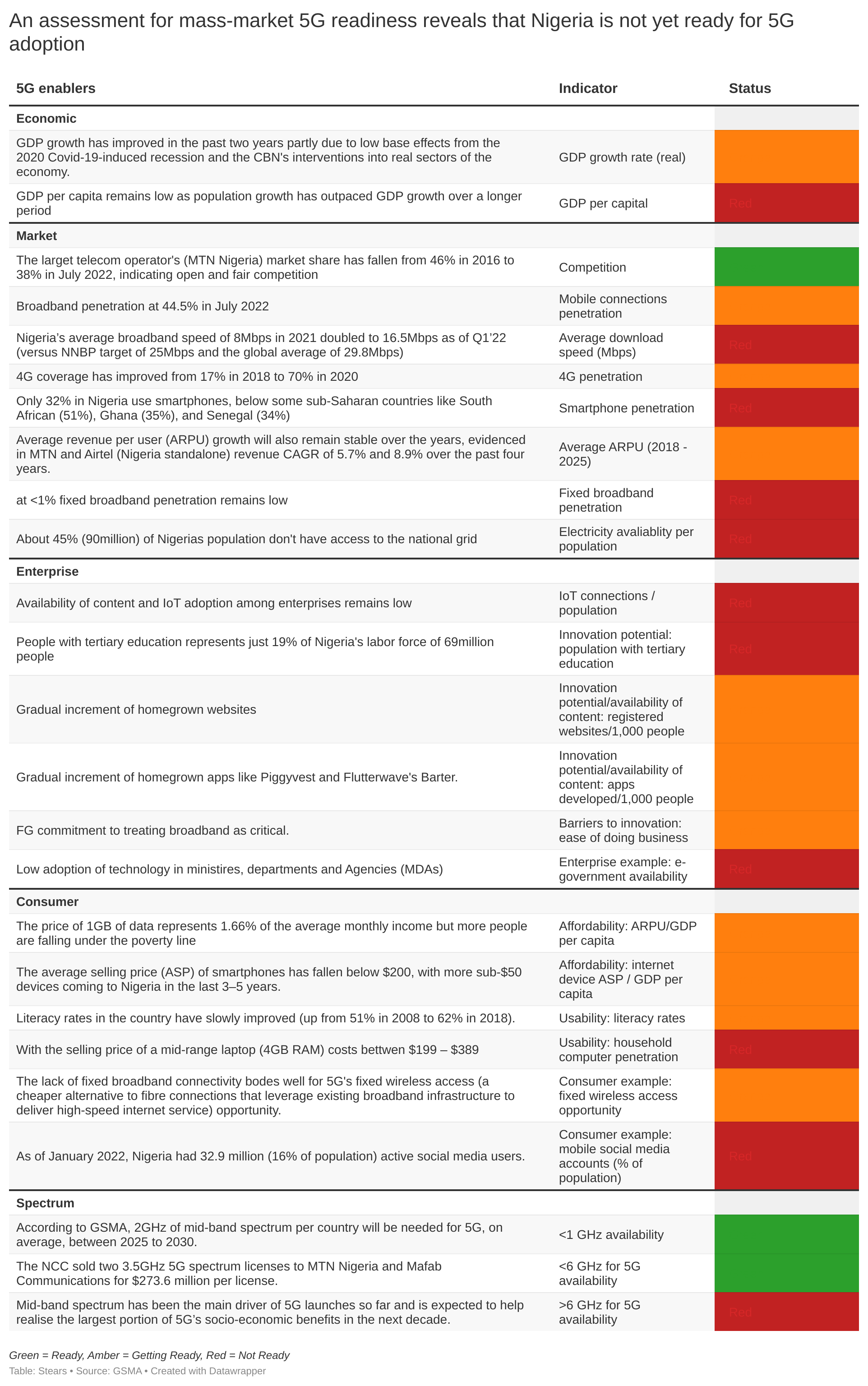

To answer this, we would leverage the GSMA’s “Basic, Economic, Market, Enterprise, Consumer, Spectrum (BEMECS)” indicator framework to evaluate Nigeria’s readiness.

The tool uses a traffic light system (Green = Ready, Amber = Getting Ready, Red = Not Ready) to analyse some variables under each indicator to tell if we’re ready or not.

The chart above paints a picture of a country that is not ready for 5G yet. As I pointed out earlier, while the country has improved 4G penetration, it hasn’t translated into 4G adoption.

However, as a natural progression from previous generations, 5G is inevitable in Nigeria. The advent of the 5G era in the region is a question of ‘when’ rather than ‘if’.