Oil and gas producers are making ridiculous amounts of money right now.

The Russia-Ukraine crisis has caused a surge in crude oil and natural gas prices, and oil and gas producing countries and companies are skipping and smiling to the bank.

Key takeaways:

- The Russia-Ukraine crisis has caused a surge in energy commodity prices. While producing countries are making money,

Iraq exported $11 billion worth of crude oil in March alone, the highest it’s done in 50 years, thanks to soaring crude oil prices. For context, from January to March 2022, NNPC has made about ₦1 trillion from oil and gas, approximately $2 billion, before subsidy deductions. And in 2021, we made over ₦4 trillion from oil and gas, roughly $8 billion. So, Nigeria isn’t benefiting from the crisis.

But, this isn’t a fair comparison given that Iraq produces a lot more crude oil than Nigeria, as it is the second-largest producer in OPEC after Saudi Arabia. Also, they don’t have the vandalism and theft issues we have.

It’s not just Iraq, and it’s not just oil. Russia has doubled its revenues from oil, gas and coal sales. Despite supply cuts, Russia has made roughly €62 billion, approximately $65 billion, from fossil fuel exports since the invasion began. $65 billion is about 15% of Nigeria’s GDP.

But, even Nigeria has increased its gas revenues despite the upstream challenges. According to the NNPC’s FAAC report, our NLNG export revenue has grown from ₦113 billion in Q4 2021 to ₦150 billion in Q1 2022, a 33% increase.

As I said earlier, fossil fuel revenues are high right now. On the one hand, it means more revenue for oil-producing countries. And I guess we would be a little happier if Nigeria were also getting a slice of the oil money cake. But, on the other hand, given the importance of climate change, there’s good reason to be concerned that this revenue surge will only derail climate change efforts. The production and use of fossil fuels like oil, coal, and natural gas release carbon dioxide into the atmosphere, which is the primary driver of climate change.

The global environmental goal is to prevent average temperatures from rising by 1.5 degrees celsius. And the only way to achieve this goal is to reduce our consumption of fossil fuels like coal, crude oil, and, eventually, natural gas. Last year, countries worldwide gathered in Glasgow for COP26, the United Nations climate conference, where they made pledges to increase clean energy investments and reduce fossil fuel use. Even Nigeria’s president attended.

We must prevent climate change because the effects will be catastrophic. In Nigeria, we’re feeling some of the impact of unpredictable weather, making it harder for farmers to cultivate crops and for herders to feed their animals. This has led to violent clashes across Northern Nigeria. Climate change is the most existential issue of our time, and preventing it is of utmost importance.

So, today's question is, what does the Russia-Ukraine backed oil price surge mean for climate change efforts?

Different folks

Depending on your perspective, Russia’s invasion of Ukraine has been great for the oil and gas markets. This is why perspective matters. Fossil fuel-producing states are gaining from the high energy commodity prices. But, for consumers of fossil fuels, the invasion has been the opposite of great. Higher energy commodity prices bring higher petrol, diesel, and gas costs for cooking, heating, and industrial production. This means a higher risk of inflation and energy shortages, especially for the lower-income earners in the country.

And even if you’re an oil-producing nation, your citizens and your economy could still be negatively affected for the same reasons, i.e. higher energy prices and higher risk of inflation.

So, we have to consider both effects. First, we will consider how the Russia Ukraine invasion affects fossil fuel producers and how it’s affecting fossil fuel consumers. And both perspectives will be within the context of climate change.

This model is key because it allows us to capture the nuance in the conversation. It would be too easy to conclude that the Russia Ukraine crisis will negatively or positively impact climate change efforts. Instead, this article will unpack the different elements of the subject and how we should be thinking about it.

We’ll begin with the fossil fuel producers.

From Russia with love

We covered the impact of the Russia-Ukraine crisis on natural gas producers in a previous article. Still, Europe (especially Germany) is trying to shake its dependence on Russian gas. So, other producers like Qatar, the US, Algeria and Nigeria have an opportunity to ramp up production and make some money.

Ramping up production means increasing output (immediate actual output) and capacity (potential production). And increasing capacity requires investment.

In terms of oil output, buyers continue to shun Russian oil. According to the International Energy Agency, this will reduce global supplies by up to 1.5 million barrels per day (mmbpd) in April, and from May, this could grow to 3 mmbpd. For context, Nigeria’s peak production is 2 mmbpd.

What this means is that there’s an oil shortage. But OPEC+, the Organisation of Petroleum Exporting Countries (OPEC) and non-OPEC producing countries, excluding the US, are hesitant to increase their production to fill the gap. This is because of the uncertainty in the oil market. Recently, news broke that China was going into lockdown due to rising COVID-19 cases. For OPEC+, increasing supplies to maximum capacity could backfire if demand drops. This would bring the oil money sharing party to a quick end as demand and prices would fall, and revenues would decline, hurting oil-producing countries. The oil market outlook isn’t stable enough to warrant dramatic supply increments, especially as the price fluctuations aren’t driven by any market fundamentals.

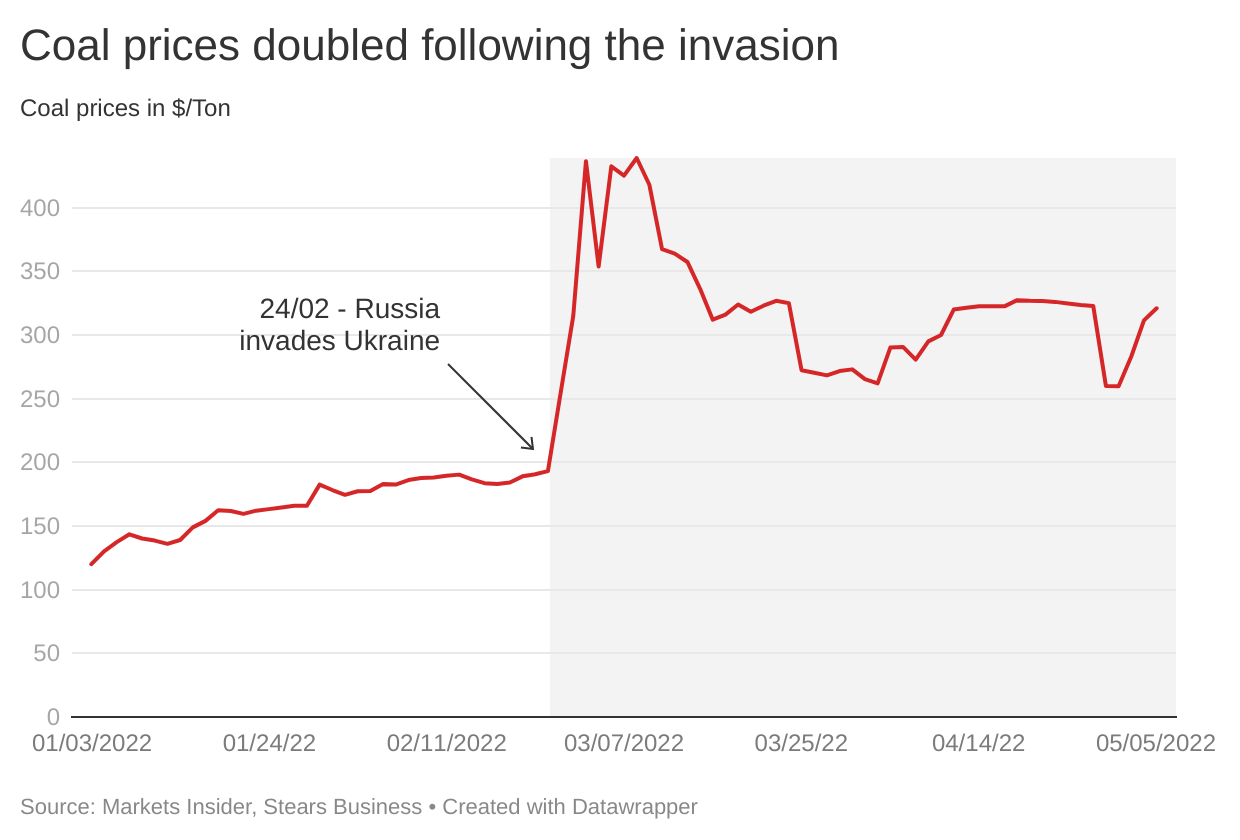

Unfortunately, a similar situation is happening with coal but with a different response. Russia is also a top coal producer, and the invasion sparked fears that coal production could be impacted.

But, coal is used mainly for electricity generation, and about 37% of the world’s electricity is generated from coal, mainly in China and India. The bad news is that coal is the dirtiest fossil fuel, and the general global consensus is that coal has to be eliminated from the worldwide energy mix today. Meanwhile, countries like India have ramped up coal production to prevent blackouts.

This is one of the major issues with energy crises. Any hint of volatility or shortage creates a demand frenzy as countries try to avoid energy disruptions because energy security is more important to governments than the energy transition from fossil fuels.

This makes sense in the short run because energy disruptions will increase the risk of inflation and affect the global economy. Right now, we need to drive our petrol cars to get around, and in colder climates, people need heating to survive cold winters. Increasing the supply of clean energy in the short run is difficult to do. Therefore, the next viable option is to increase fossil fuel use to avoid further energy disruption. But, in the long run, additional investments to increase fossil fuel production mustn’t be prioritised over clean energy investments.

There haven’t been massive investments in oil or coal just yet, because for oil, the market can’t be trusted, and coal has been written off as a dirty fossil fuel. But natural gas is the cleanest fossil fuel and is regarded as a transition fuel between renewable energy options and dirtier fossil fuels like coal. However, this doesn’t mean that natural gas demand, especially for developed countries, should increase exponentially to the detriment of clean energy solutions.

Qatar recently announced plans for the largest LNG capacity ever built to increase their demand by 40% in 2026. The project is estimated to cost $28.7 billion. Essentially, the energy crisis frenzy caused by the Russia-Ukraine crisis has made it okay for Qatar to make such huge investments.

LNG is sold via long term contracts. So, countries like Qatar and even Nigeria already have supply contracts with other countries like China for specific quantities of LNG. This makes it impossible for any country to meet the level of Europe’s demand previously met by Russia in the short run without increasing capacity. So, now that there’s a shortage in the market, Qatar has gotten approval and several interested partners and financiers for its LNG project. Nigeria has also reported renewed talks about the Morocco pipeline that will take gas to Europe.

One concern here is that there’s the risk of stranded assets. The IEA estimates that reaching net-zero emissions by 2050 will require global clean energy investment to more than triple by 2030 to around $4 trillion per year. So, while fossil fuel producing countries might be benefitting from the crisis right now, clean energy investment should also be increasing. If more countries increase clean energy in their energy mix, what happens to Qatar and Nigeria’s investments? On the flip side, if clean energy investments don’t grow, avoiding climate change will become more and more like an unattainable goal.

However, for fossil fuel consumers who are losing more than they are gaining, what is the implication of the crisis?

Don’t look up

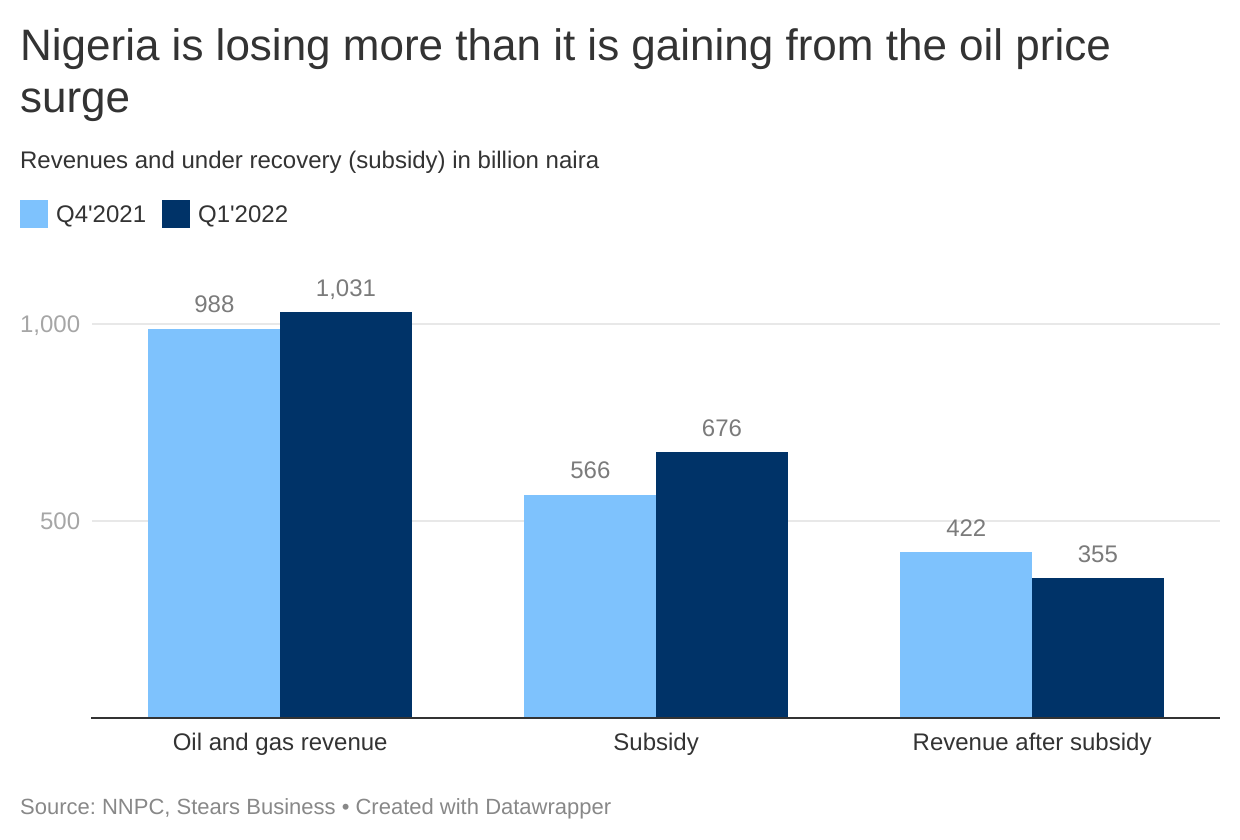

Despite our oil and gas production, Nigeria is one of those countries that is at a net loss from the Russia-Ukraine energy price surge.

Remember I said the NNPC made about 1 trillion from oil and gas exports in Q1 2022? Well, we spent about ₦800 billion servicing our petrol subsidy. And even though we made less revenue in Q4 2021 ( ₦987 billion), we spent less on the petrol subsidy ( ₦564 billion), giving us higher net earnings after subsidy deductions.

But, away from Nigeria, Europe is also in the middle of the energy crisis—they’re in search of new fossil fuel suppliers. Even though Europe is looking for new fossil fuel suppliers, it would be in Europe’s best interests to look towards renewables and clean energy sources for its medium to long-term energy needs. Although it’s impossible to not depend on other countries for energy to some extent, with renewable energy solutions, Europe’s dependence on other regions would still reduce.

For citizens of countries around the world, including the US and Nigeria, the impact of the energy crisis is higher prices for petrol, diesel, electricity, cooking gas, food, and industrial products. This translates to higher inflation rates for us.

Logically, these higher fossil fuel prices should make us increase the demand for clean energy solutions. In Nigeria, inverter providers are seeing spikes in demand. However, the affordability of clean energy solutions is still a significant issue. While the surging fossil fuel prices will make clean energy solutions less expensive in comparison, the high upfront costs are still a barrier. For instance, the people who would like to switch to renewable energy solutions can’t afford to buy solar panels upfront, so they would rather bear the cost of higher electricity prices. Again, in Sub-Saharan Africa, the cost of clean cooking is increasing, and the rate of clean cooking access isn’t growing as fast. While embedded finance solutions are available, they’re still too expensive for most of the population.

Another example would be a petrol-fuelled car owner in London. While this person might want to buy a Tesla to avoid the high costs of petrol, buying a Tesla is expensive and is not a purchase decision that most people can make instantly. What’s more likely is that this person would instead use public transportation and drive their car less.

But, speaking of electric vehicles (EVs), the energy crisis has also impacted EVs as Russia is also a top producer of precious metals like nickel that are necessary for EV battery production. So, this has made EVs more expensive. While we may want cleaner energy solutions, the upfront costs are still a barrier for many, and even clean energy solutions aren’t immune to the energy crisis.

It’s difficult to conclusively say how the Russia Ukraine crisis will impact the net-zero target by 2030 or 2050.

One certain thing is that the crisis has increased the supply of fossil fuels in 2022. There are a lot of elements to consider in answering the question of Russia’s invasion of Ukraine. It also doesn’t help that the energy commodity market is volatile and difficult to predict, especially in the past couple of years. But, our window for averting climate change is getting smaller, and the Russia-Ukraine invasion mustn’t distract us.