Just last week, traders and analysts were speaking of “capitulation”—a sign of panic, feverish selling, awful sentiment—to determine if the financial markets were crashing and nearing their bottom.

Yes, selling has been pretty frantic as the Nasdaq recently fell 12% in a week—declining in magnitudes rarely seen. Some even pointed at the small proportion (15%) of the S&P 500 stocks trading above their 50-day moving average. A trend that is meant to be indicative of a near-term bottom market.

Key takeaways:

-

Between the Russia-Ukraine crisis, rising commodity prices, fluctuating market sentiments, and questionable company valuations, it’s hard not to see the signs of a market contracting.

-

Companies that fail to prepare for the downturn could see themselves culled as an analysis by Bain noted that companies that stagnated following a recession didn’t have contingency plans or think through alternative scenarios.

- Practically, this means companies need to control their burn rate

But the markets continue to surprise.

This week, global stocks have pushed up as traders move back into riskier assets after the worst streak of weekly losses for equities since 2008.

According to JP Morgan, equity markets may have priced in too much recession risk. Given already substantial multiple drops, reduced positioning and downbeat sentiment, the stock market “could recover if a recession doesn’t come through.” The US bank remains sceptical of whether the outflows seen last month are the beginning of prolonged market outflows.

We could continue to cycle through the barrage of indicators that tell us the market is about it upend itself; from the Vix (or fear index) hitting 35 last week, a reading often seen near market bottoms, or CNN’s Fear and Greed Index, a composite tool tracking seven indicators, falling into the “extreme fear” zone in the same period. The message is clear, the market is nervous, but it is unclear if this means the economy will go into recession.

We’ve seen the market’s confidence oscillate over the last few months but generally trend downwards, with stocks subsequently hitting new lows. After each period of fervour, albeit shortlived, the rest of the market expects a decent rally, but no one knows if it will be sustainable.

It’s hard not to feel like we are circling the drain between the Russia-Ukraine crisis, rising commodity prices, fluctuating market sentiments, and questionable company valuations. Add the US Federal Reserve’s bullishness on increasing interest rates regardless of whether it “hurts the economy”, it would be financially imprudent for any self-respecting investor, operator or the like to ignore the signals.

Yesterday, we provided a macroeconomic view on how to think about the current market contraction trends.

Today, we go through what exactly is causing a stir in the markets, but more importantly, we look at how to future-proof your business or strategy for an economic downturn.

Businesses in Africa are more connected than ever to the global financial markets. A US investor clawing back funds to adjust for a market correction does not just impact Silicon Valley but Yaba and the Silicon Savannah.

So what exactly is happening in the economy?

First, the war in Ukraine has caused some disruptions to the global supply chain. The economic damage from the conflict is expected to contribute to a significant slowdown in global growth in 2022 and add to inflation. Fuel and food prices have increased rapidly, hitting the hardest vulnerable populations in low-income countries.

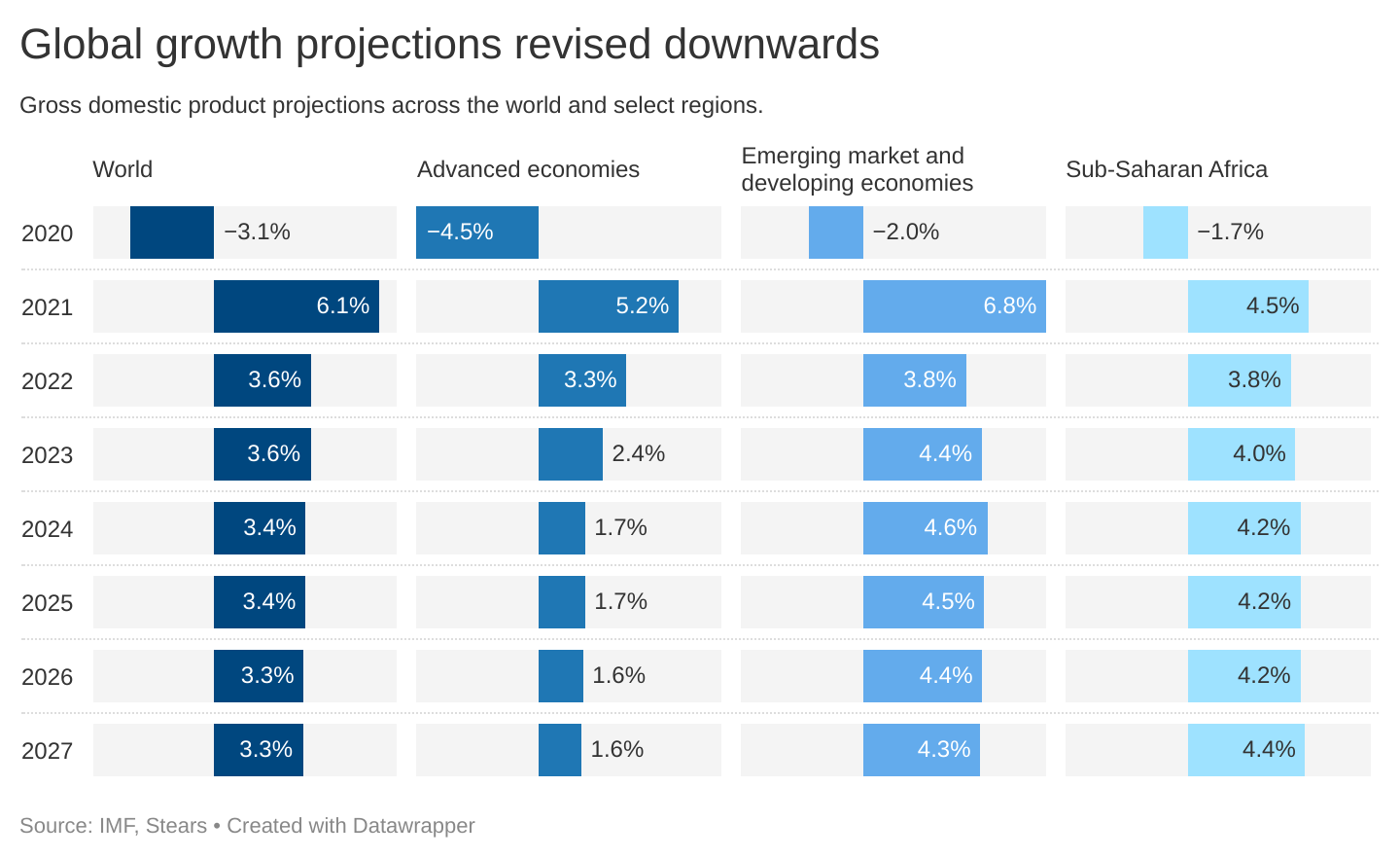

According to the IMF, global growth is projected to slow from an estimated 6.1% in 2021 to 3.6% in 2022 and 2023. This is 0.8 and 0.2 percentage points lower than projected last January.

Beyond 2023, global growth is forecast to decline to about 3.3% over the medium term

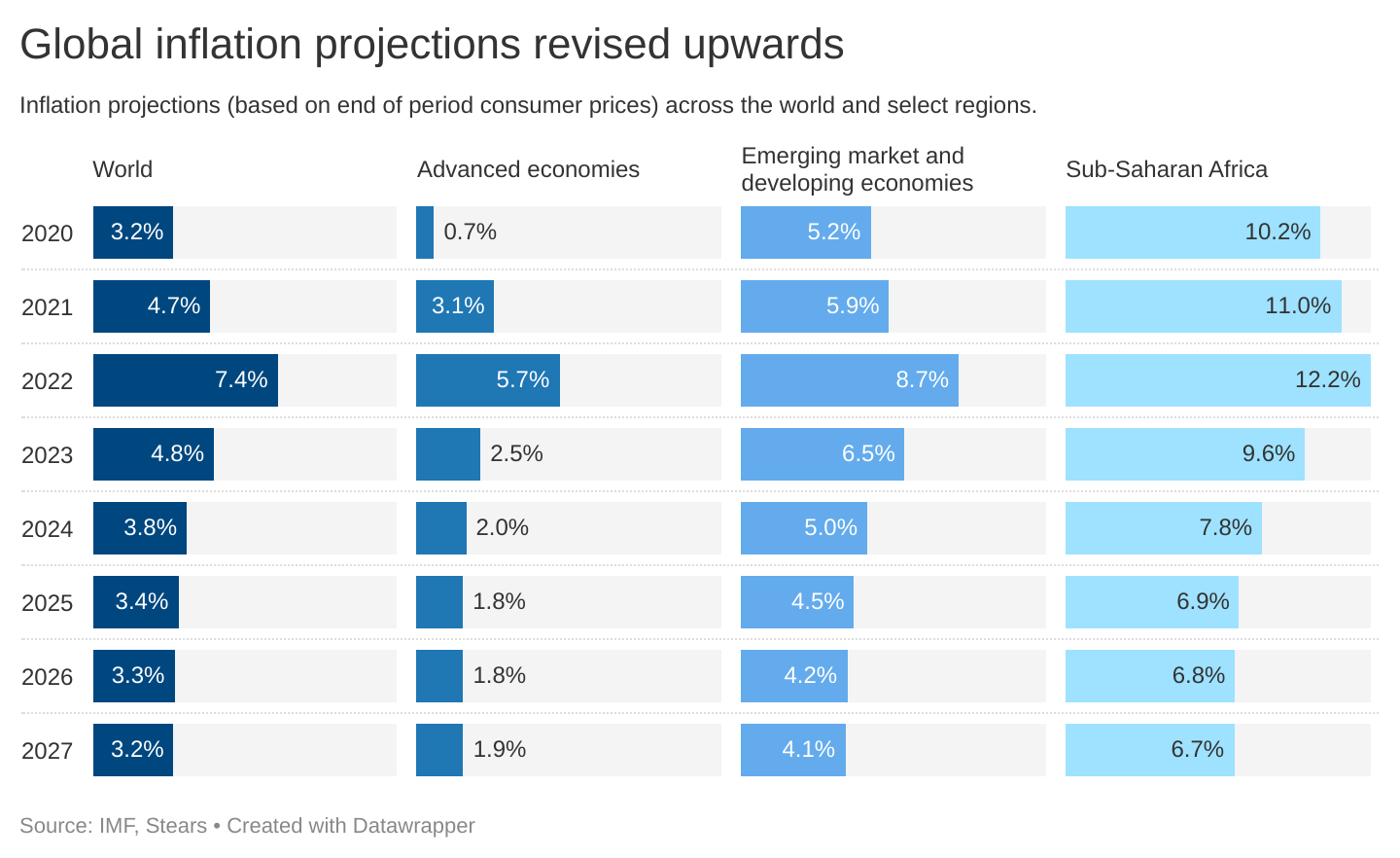

War-induced commodity price increases and broadening price pressures have led to higher inflation projections of 5.7% in advanced economies and 8.7% in emerging market and developing economies for 2022—again, worse than was projected last January.

It is no surprise that the word “recession” is being thrown around by commentators. The almighty invisible hand of the market has come to “correct”, and no one is safe.

Inflation has been rising across markets, primarily due to the influx of money coming from central banks and rising prices. The increased market liquidity meant cheaper money and more funds flowing through public and private markets.

It is essential for emerging markets to highlight the effect of currency devaluation, which has raised the local cost of production and consumption for import-reliant countries.

In turn, this has put inflationary pressure on economies. Think of higher prices on daily necessities, whether at the fuel station or the supermarket.

A key lever central banks tend to pull is interest rates to slow or reduce this pressure. The mechanics are relatively straightforward: by raising the central bank interest rate—the rate banks charge one another for overnight loans—the central bank sets off a domino effect. Banks pass on the cost to their customers (business or consumer), and borrowing costs increase.

In theory, this slows demand for goods and taps the brakes on inflation.

Raising interest rates reduces the incentive to borrow money which reduces liquidity—to an extent.

Although, some argue that the most prominent effect is reducing market leverage. Leverage here refers to using a smaller amount of capital to gain exposure to larger trading positions using borrowed funds (also known as margin trading). It is used across various asset classes, such as forex, indices, stocks, commodities, treasuries and exchange-traded funds (ETFs). It can magnify potential profits but can equally increase losses.

Bracing for impact: valuations will continue to take a hit

A recent analysis by Bain on the Great Recession found that the top companies in the market saw their earnings climb steadily throughout the recession period and continue to rise afterwards.

The key to this was how prepared the companies were.

In their analysis, Bain noted those that stagnated didn’t have contingency plans or think through alternative scenarios as companies need to be able to switch to survival mode, make deep cuts and react defensively. The strategy is simple for investors, focusing less on the short-term (less than a year) and looking for longer-term (3-5 years) winners. This means more scrutiny on companies and their ability to adapt or survive a downturn.

Investors should also expect to see lower valuations in the market—if they haven’t already—affecting both their entry and exit pricing.

Stocks in public markets tend to move in the opposite direction to interest rates as higher interest rates mean that future revenue is discounted more. This adjustment in confidence will drive company valuations down across all markets.

For private companies, public markets also provide a sound basis for recalibrating valuations because public markets tend to see the effects of decreased valuations first. Currently, the median public company software valuations have dropped from 12x forward revenue to 5x or less since highs in October 2021—an almost 60% decline.

Similarly, fintech and consumer internet companies are also down 70-80%.

Sectors will be affected differently, but the days where companies could raise at a valuation of 100x of ARR—equivalent to run-rate revenue—are all but gone. Adjusting for the decline in public market multiples, operators could be expected to grow their ARR by 5-10x to maintain their last private valuation.

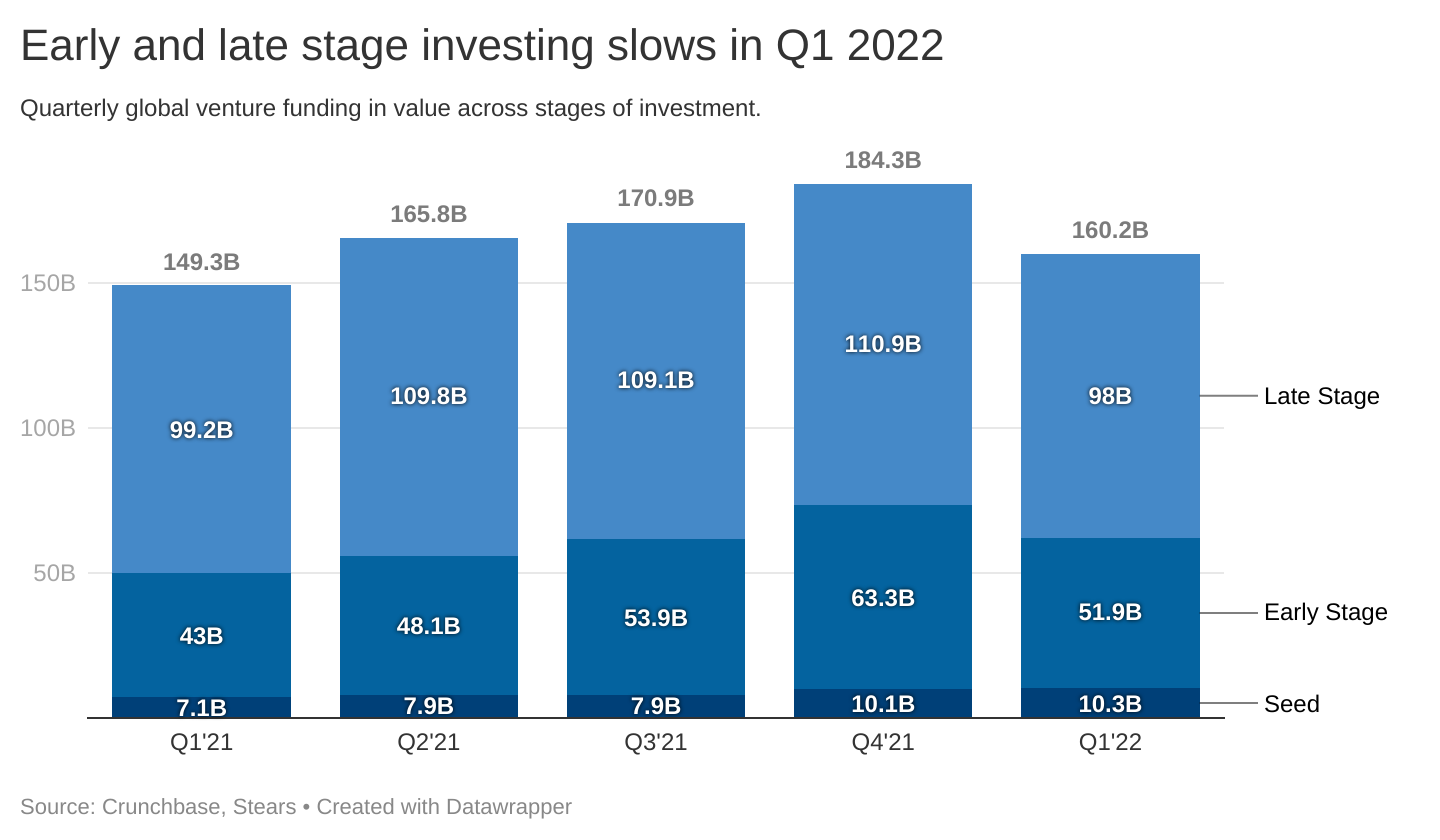

While some already suggest the venture markets are tapering off—citing recent data on funding for Q1 2022 from Crunchbase—the impact on venture markets will become more apparent in the coming months.

For now, it’s all about creating value efficiently for companies.

Speaking with Stone Atwine, founder and CEO of Eversend, the one-stop-shop multi-currency app for exchanging, sending and receiving money, he echoed this view.

Atwine is originally from Uganda but worked in multiple African countries, including Kenya, Malawi and South Africa. From personal experience, he found cross-border remittances on the continent to be challenging—a fact we can attest to.

As a company that’s primarily been bootstrapped, raising a $1 million in the pre-froth—small in comparison to the mega raises we’ve seen in early-stage African ventures,— he emphasises that sustainability has been key for them. A poor understanding of the fundamentals and market dynamics could mean “[traders] in Lagos arbitrage you to zero assets if you’re not careful”, he jokes.

Atwine remains positive of the long-term potential of the African fintech market, though believes it is more important now for companies to focus on strong fundamentals, unit economics, building up reserves and generally tightening up their belts.

Back to the fundamentals

As a business looking to brace for a potential downturn, the fundamentals are not rocket science, but it’s worth reminding.

First, don’t crash the company.

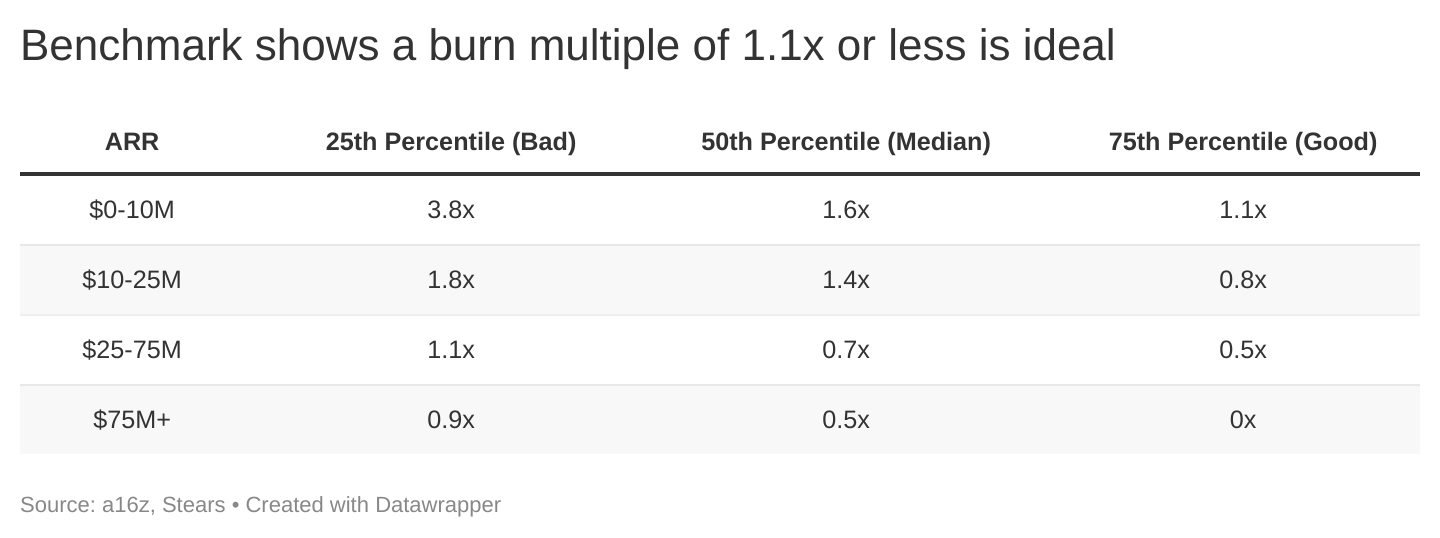

Or, more importantly, don’t run out of money. For venture or growth companies, it’s a question of how much runway you have. Some investors recommend a 2-3 year runway to weather a recession, but what’s important is whether you can control your burn multiples. This is perhaps a more comprehensive way to look at whether a company’s growing efficiently because they are all-encompassing of your business activities.

Companies spending millions to acquire customers that will never pay for the product need to be more scrupulous as the customer acquisition cost alone is not reflective of the overall financial impact.

As Atwine noted in our conversation, Africans (but really most consumers) are fickle and can be very price sensitive when you start charging for a product or service. “More investors will focus on unit economics, especially in Africa,” he adds, and this could drive customer acquisition costs down in certain market segments.

In burn multiple terms, if a company burns $100 million to add $10 million in ARR, it would have a burn multiple of $100/$10, or 10x. Lower burn multiples are ideal, and according to the private company data from a16z, a reasonable multiple is around the range of 1.1x or below.

This back of the envelope calculation might help a growth stage company, but for value companies with more steady growth and better margins, or even public companies, the place to focus is on debt. These types of companies ideally want to deleverage before a downturn. Surviving a downturn requires better financial management because a recession usually brings lower sales and, therefore, less cash to fund operations.

More debt in a company means more cash is needed to make interest and principal payments. When a recession hits and less cash is coming in the door—compounded by higher interest rates than when the debt was taken out—it puts businesses at risk of defaulting. Companies with more debt are forced to cut costs more aggressively, often through layoffs, to keep up with payments. These deep cuts can harm productivity and restrict the ability to invest in changes that help a company thrive post-recession.

Leverage effectively limits a company’s options and opportunities in a downturn.

Now, not all debt is bad, as a study by Harvard Business School found that leveraged companies owned by private equity firms fared better during the Great Recession than similarly leveraged non-private-equity-backed firms. The study suggests that the former group showed better performance as their owners could help them raise capital when they needed it and manage the impact better.

Other key areas to double down on as a company include organisational and operational efficiency. A key determinant of surviving harsh economic conditions is how flexible and adaptive a company is, and this comes from better decision-making processes and lean and operationally efficient teams.

While the fundamentals sound simple enough, these can be practically difficult to achieve as organisational change is not just about the financials but also having and motivating the right people towards the right priorities.

Perhaps more concerning is how far the markets have departed from the fundamentals post-pandemic. We allowed far less efficient companies to be built with little oversight or care for the fundamentals of the business—and for this, many will pay.

Tiger, tiger, burning bright

The last few weeks have also been a tumultuous time for the alternative finance markets.

Global tightening of monetary policy by central banks worldwide to fight inflation has put selling pressure on digital tokens as investors flee away from risky assets—so no market is safe.

According to Bloomberg, a massive sell-off in cryptocurrencies wiped over $200 billion of wealth from the market in just 24 hours, with cryptocurrencies tumbling and stablecoins looking, well, far less stable.

Coinbase, the US cryptocurrency exchange platform, has seen its stock price drop by over 70% this year.

Investors in the crypto space are no strangers to wild swings in the market. However, this time, the victims of the widespread market contraction include the poster child for frenzied technology investing—Tiger Global.

Tiger Global, the hedge fund known, according to PitchBook, for its “rapid dealmaking cadence, large check sizes, and boilerplate term sheets”, is dumping stocks across public and private markets. The firm, which led Mono’s $15 million Series A and Union54’s $3 million seed round, entered the venture world with a vengeance. Its dealmaking speed raised questions about what faster decisions with less information and due diligence could mean for the market.

Now Tiger Global finds itself in a bit of a pickle.

According to the Financial Times, Tiger Global’s public stock positions “fell from $46 billion at the end of last year to just over $26 billion at the end of the first quarter of 2022”. It has cut down or completely exited its holdings in the streaming platform Netflix, dating app Bumble, vacation rental company Airbnb, trading app Robinhood, Chinese ride-hailing group Didi and “God’s way of saying people have too much money” Peloton.

In the mix of the “Tiger dump” was its stake in Coinbase, which the firm sold for around $724 million at the end of last year.

Other funds investors have also shed their holdings in tech stocks and crypto-assets as they reassess their positioning in the changing market. A market Tiger Global noted has not been “cooperative given the macroeconomic backdrop.”

While the disappointing performance in public markets may continue to roll in over the coming months, it may take longer for data on the private markets to surface. Already though, early-stage founders are noting the changing tunes of venture investors who have to start recalibrating as the performance in public markets is reflective of where their investments could end up.

Whatever you want to call them, recessions and contractions are part of a normal economic cycle. Granted, government interventions can ease or intensify its impact—sometimes even delay it. But it is not a pleasant experience for most, and the fear-mongering around it can worsen its impact.

For businesses, the culling effect is not new.

Yet, most end up in the cull in every economic cycle by failing to prepare. A testament to our short memories. For those who wish to wait until the writing is on the wall to take action, we wish you the best of luck in all your endeavours.