Video games are interesting.

I would know because they formed a big part of my favourite childhood memories. While this has mostly been for fun, leisure, and to feed my imagination, there are other people that have taken this more seriously. These people have become professional gamers who earn a living playing against other gamers in sporting competition styled events—or Esports—and by streaming on platforms such as Twitch.

Key Takeaway

-

Web3 is changing how value is generated, recorded, and transferred digitally. Web3 promises that creators will be able to own the right to their content and extract value directly through the blockchain and tokens

-

Through the blockchain and NFTs, Web3 is giving rise to new forms of gaming, one of which is P2E games. P2E games have raised $2.5 billion in the first quarter of 2022.

- Optimistic estimates suggest that 16% of Nigerians have played blockchain P2E games and are

While earning from playing games has been reserved for the most skilful gamers, all this is changing in Web3—the next iteration of the internet. Individuals around the world can pull out their phones, start playing games and see their wallets or bank accounts grow fat. To understand how this plays out, the first place to start is by exploring Web3.

So what is Web3 all about?

If you check google search trends, you would see a surge in people asking, "what is web3?" While this interest is relatively recent, the term has been with us for quite some time, circa 2014, when Gavin Wood, one of the creators of Ethereum, coined the term.

To quickly understand what Web3 is all about, it helps to look at what came before. Between the 1980s, when the consumer internet was created and somewhere around 2004/5, we had the first iteration of the world wide web or web 1.0. In this version, the flow of information was unidirectional; most websites were static pages where information was published. The users or visitors could only consume information but could not contribute—the internet was "read-only", and publishers accrued all the economic value.

With the creation of social platforms like MySpace and Facebook, users could contribute to websites and platforms, which resulted in a deluge of user-generated content on the internet. This became web 2.0, the version of the internet that we can call "read-write," where users got involved in building and increasing the value of internet-based social networks or communities.

As more users got involved in creating content on platforms, the platforms—through network effects—became more valuable to both users and companies trying to reach these users. Most platforms moved to monetise this attention by charging users subscription fees to access content or allowing companies to advertise to their users and ultimately capturing outsized value for content primarily created by individuals.

Some of the most successful technology platforms use a combination of these. While Facebook, Instagram and Twitter capture almost 100% of ad revenue, platforms like Youtube and Spotify share a portion of revenue with creators.

The emergence of web 3.0 (generally stylised as Web3) can be attributed to bitcoin's creation and its underlying blockchain technology. This is changing how value can be generated and recorded digitally and making people rethink centralised platforms' role. Though still in its early stages, Web3 promises that creators will be able to own the right to their content and extract value directly through the blockchain and tokens; this will be the "read-write-own" version of the web. Chris Dixon, a partner, leading crypto and Web3 investments at one of the most influential venture capital firms, a16z—calls this "... the internet owned by the builders and users, orchestrated with tokens."

You are likely to hear Web3 optimists exchange terms like decentralised, user-owned, secure, permissionless, trustless etc. These simply mean that we would not need "trusted" gatekeepers (platforms, middlemen) to determine how we interact, generate content and exchange value. Users will be the ones to make this decision ultimately, and users will also determine how their data is used and share in the value generated. You quickly notice that all this is driven by dissatisfaction with the unbridled powers that web 2.0 platforms wield and the need to "break" their hold.

We are already seeing web 2.0 platforms like Substack remove gatekeepers and make it easy for literally anyone to publish content and get paid, but Web3 promises to do this at a more disruptive pace. This looks like decentralised finance that allows individuals to lend directly to people in need without the banks (gatekeepers). Or Non-fungible tokens (NFTs) that enable creators like Artists and Musicians to publish their work digitally and auction it to collectors without going through Art houses or record labels (also gatekeepers). But Web3 is not stopping there. The next iteration of the internet is catching up with the world of video games, a sector that is even older than the internet.

Playing on the blockchain

Video games have evolved from when they were invented in 1958. If you pick a video game now, you are guaranteed visually appealing and engaging worlds and characters across several consoles, computers, and mobile phones.

Most video games are pay-to-play, which means that people have to purchase the console and video games to play them. Where they are not, they will most likely require purchasing in-game assets like power-ups, extra lives, character skins, or even virtual equipment that are essential for progressing within the game. These in-game virtual goods are definitely big business. As of 2020, the online microtransaction market, which consists of sales of in-game virtual goods and related services, was valued at roughly $33 billion.

Even though players trade these virtual goods, the rights are owned by the game developers or creators, who hold the power to decide what happens. Interestingly, Vitalik Buterin, the creator of Ethereum, attributed his discontent with centralised platforms to the game developer Blizzard tampering with his character's amour in the Warcraft game. The seeds for Ethereum were sown then.

The ownership and rights to virtual goods are what blockchain games address. Blockchain games use elements of the blockchain, particularly tokens, to change the way games are played, and virtual goods are owned and traded. In these games, the characters, attributes and modifications—or virtual game assets (VGA) for the purpose of this article—are created as NFTs registered on the blockchain. Players can create this and own the rights to it. These VGAs then become useful to the players within the game. After all, they help the players win and are also useful outside the game because they can be sold on NFT marketplaces such as OpenSea or P2P through wallets for cryptocurrency or fiat.

One of the most popular blockchain games is Axie Infinity. Axie Infinity is a Pokemon-styled Player versus Player (PvP) game, where players assemble a team of Axies (the game's main characters) to battle each other for prizes. The Axies are actually NFTs that can be traded between players. According to data from Crypto Slam, which monitors sales of NFTs, Axies are the top-traded NFTs with over $4 billion worth of value traded so far, owned by more than 2.4 million individuals worldwide. This is the first way players earn money, by exchanging their characters for cryptocurrency.

But the game does not stop there. Players who show their skill by winning over other players in matches are rewarded with the game's native token, $SLP or Smooth Love Portion. They can then sell their units of $SLP on exchanges for cryptocurrency or fiat money. This is called Play to Earn (or P2E) in Web3, where people play video games and earn crypto rewards that can be converted into cash.

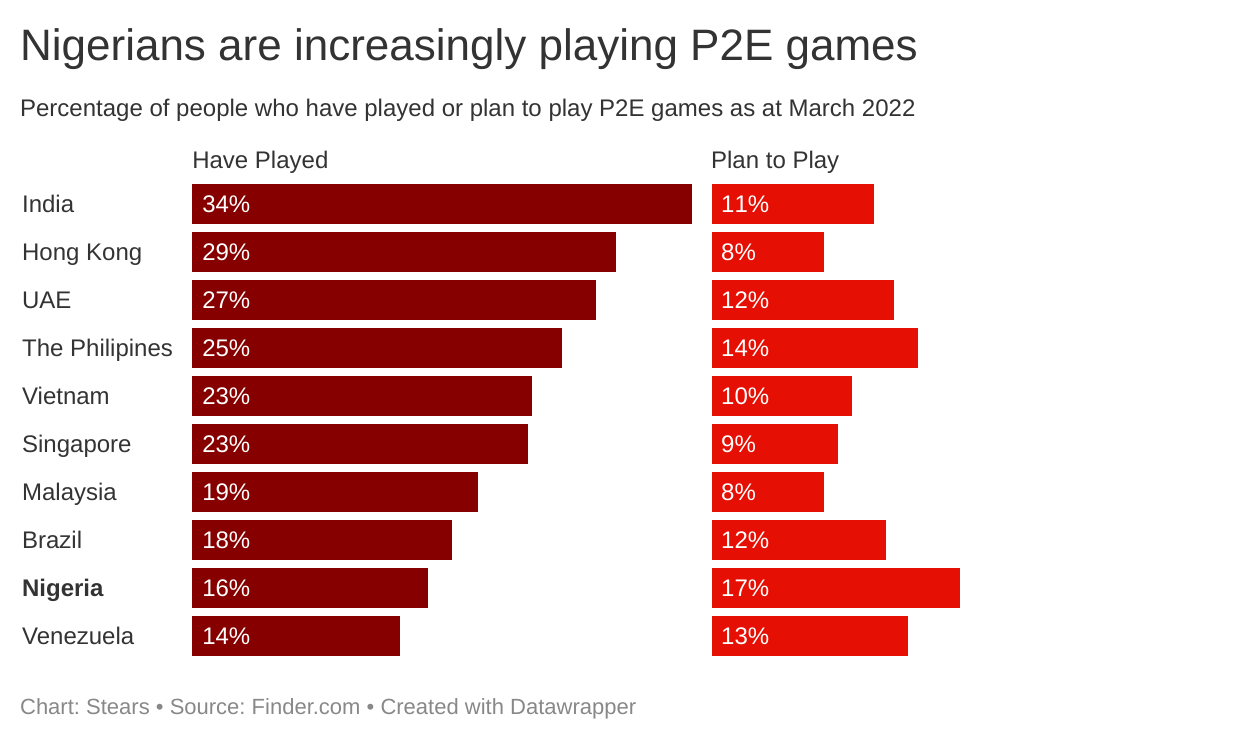

And blockchain games (or NFT games as they are alternatively called) have attracted over $2.5 billion in investments during the 1st quarter of 2022. At the same time, findings from a March 2022 survey, showed that 6% of people globally say they have played blockchain games, which is expected to increase to 15% by year-end.

And Nigeria is not left out, the country ranks 9th out of 26 countries surveyed. 16% of Nigerians say they have played blockchain P2E games, and 17% say they plan to play.

Playing for keeps

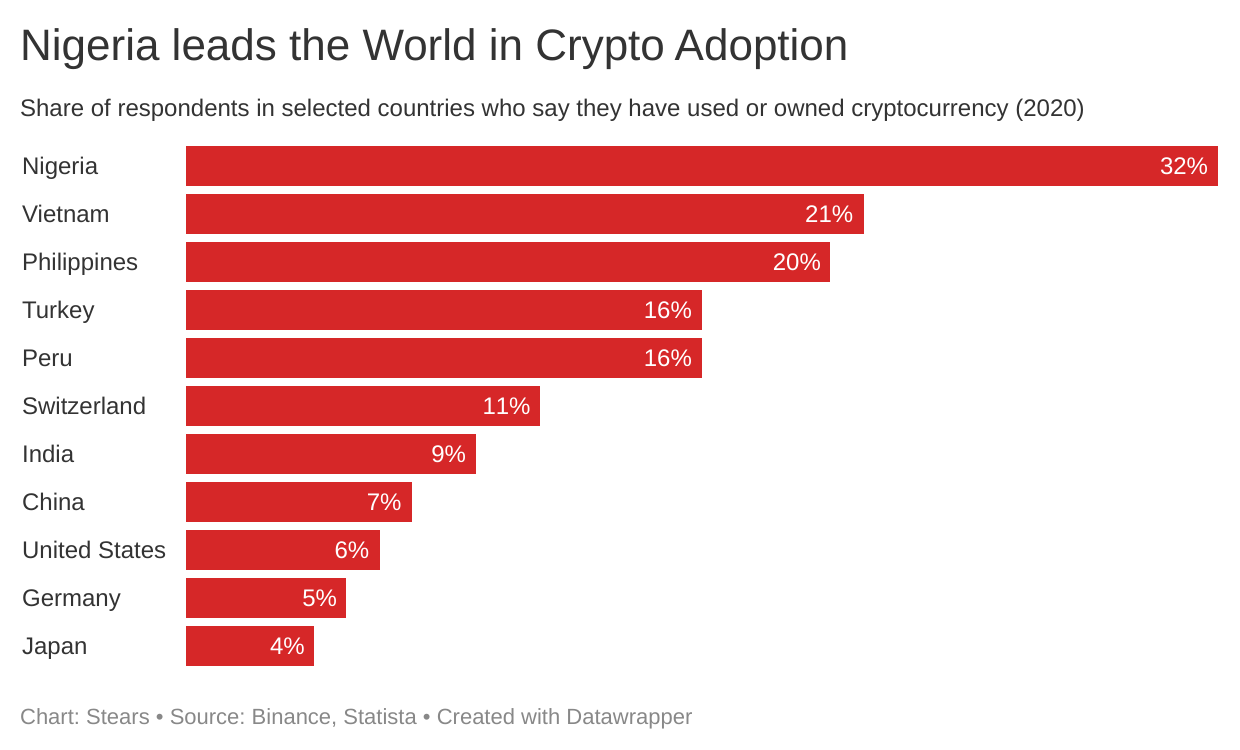

Nigeria's adoption of blockchain games is not too surprising in many ways. Nigerians have shown an affinity for crypto and all things blockchain and Nigeria leads the world in crypto adoption, with 1 in 3 persons using or owning crypto as of 2020.

This adoption of crypto is not unconnected to the fact that there are not enough jobs for young people in Nigeria who then seek alternative pathways to make money. Some even consider crypto a viable investment asset. The Philippines shows how gaming platforms like Axie Infinity can quickly rise in popularity because of the earning potential. I came across a story of a young man who transitioned from selling rice feed to farmers to earning $2,000 per month from playing for approximately 1 hour a day. Players from the Philippines account for around 40% of Axie Infinity's player base.

Stears spoke with Godwin France, an Axie Infinity Ambassador in Africa and someone who has been playing P2E games for close to a year now. Although a Ghanaian, he has spent considerable time building gamer communities in Nigeria and encouraging more people to try P2E games. He says that the potential to earn an income is a strong motivation for people, from Accra to Lagos and even Ibadan.

And the barriers are not too high for Nigerians; the widespread adoption of cryptocurrency means that people are already familiar with the intricacies like opening a wallet, purchasing crypto and sending it. In addition to this, P2E games only require downloading the game to your mobile phone and connecting to the internet.

But this is where it becomes more difficult. Most P2E games share a similarity with traditional games in that they are Pay to Play, which means that players need to fork out certain amounts to have access to these games. For example, as Godwin explains, at the height of the popularity of Axie Infinity somewhere in 2021, a floor Axie (the cheapest character) could go for as much as $200. And the game requires players to start out with at least three, meaning that a player at that time needed to "invest" roughly $600 or ₦243,000 just to play.

At this point you are probably wondering what the current crypto crash means for barriers to entry. Well, for starters, a floor Axie can be purchased for $4 meaning that with $12 a person can start playing. That's the good news. On the flip side though, gaming veterans advise against using floor Axies, as they can not hold up in matches against other players. Thus, players still have to go for pricier characters. Generally, though, it does mean that it is currently relatively cheaper to break into the game than it was some months ago in 2021.

When you consider that Nigeria's minimum wage is ₦30,000, almost 80% of Nigerians earn less than ₦200,000 in 2021, and only 3.1 million people can spend more than $10 per day, you start to see that it may not be easy to start playing P2E games like Axie Infinity.

This situation has paved the way for innovative business models addressing this challenge—one of these is P2E Guilds. A guild is a community or group of gamers that organise to play video games by sharing resources, information and tips to win within the games. In P2E gaming, guilds make it easy for interested individuals to access the in-game characters they need to begin playing games. Using the Axie Infinity example, a guild will typically pre-purchase Axies and then lend this out to vetted gamers to play. These players then share their winnings with the guild, thus creating a mutually-beneficial relationship. This is known as a Scholarship.

But guilds do not stop at lending expensive characters to prospective gamers. They also provide training, guidance and tips to enable the players to increase their skills and become better game players in general. Essentially, a guild acts like a "startup incubator" for gamers. In Nigeria, the guild model is quickly picking up and receiving attention from investors. Nestcoin, which owns the Metaverse Magna guild raised $6.45 million in seed funding earlier this year and Gamic guild was accepted into the Binance Labs incubator in May. Chike Okonkwo, co-founder and business development lead at Gamic said the idea is to put money in the hands of Africans that want to play games.

But how is this playing out? Chike noted that players he has interacted with say they earn anything from $50 up to $200. This also aligns with data from Godwin, who observed that players within his community in Ghana earned between $140 to $420 per month on average in 2021. Ultimately, as they both agree, the earnings potential are subject to the number of times a player wins in the game, which is a function of the player's skill and the time invested in playing the games.

But this is not all that affects a player's income. Because players earn in crypto, fluctuations in the market significantly affect the player's earning ability. Added to this is the impact of speculative activity. Gamers who are driven purely by profit motive will quickly dump their tokens on external exchanges, as more people do this, the price of the currency falls. Essentially, as the game gets popular, the price to enter increases, and the payout will likely fall due to the action of rent-seekers. The price of $SLP has fallen from an all-time high of $0.365 to its current price of $0.005, a 99% reduction.

The drop has undoubtedly impacted the incomes of players. At the all-time high of $SLP, it would take players roughly seven months to break even. At this current price, it may take as long as 2 years, says, Godwin.

However, this is not a bug but a feature of the system. Afterall, the games prop up the earning potential as a key selling point, which attracts people for this sole purpose. In many ways, you also see this play out with other crypto projects and Web3 in general. Most coins or tokens need increased demand to increase in price, but rapid sell-offs can depress the price and make them near worthless for individuals holding them for speculative gain. The massive economic potential of Web3, which has attracted profit-seekers, has made some people compare it to ponzi schemes.

The next level

Although blockchain P2E games seem to be subject to particular issues that affect the ability for earnings to be sustainable, this is not hindering the progress and interest of gamers who believe they can win with this.

Several gamers are setting their sights on other alternative or additional income streams such as competitive gaming or Esports and streaming on platforms like Twitch. Options such as these do not depend on crypto or in-game rewards but have seen big name brands commit considerable sums to sponsor players and teams. The global combined market of Esports and game streaming is expected to be worth $3.5 billion by 2025.

Guilds are also playing a role in this pivot. The idea is that the skilled talent pool created by guilds can be harnessed to win gaming competitions, thus reducing the reliance on in-game P2E rewards and diversifying income sources for both players and guilds. And this may be where P2E blockchain games become really important, as some form of on-ramp or training ground for individuals who can then go on to become professional gamers.

Guilds like Gamic have already started exploring this pathway. So while earnings from blockchain P2E games may not be sustainable long-term, the silver lining is that they can incentivise more people to become serious about playing games.