Why are most Nigerian state governments accused of being broke and poorly run?

The short answer is that most are. Historically, Nigeria's state governments have invested very little in growing their state's income, relying on the Federal Government for their monthly handouts and leaving the burden of social development to the centre.

Some takeaways:

-

Anambra state, located in the south-eastern region of Nigeria, has the potential to be an economic powerhouse. But building economic hubs requires intentional funding—not volatile federal government income.

-

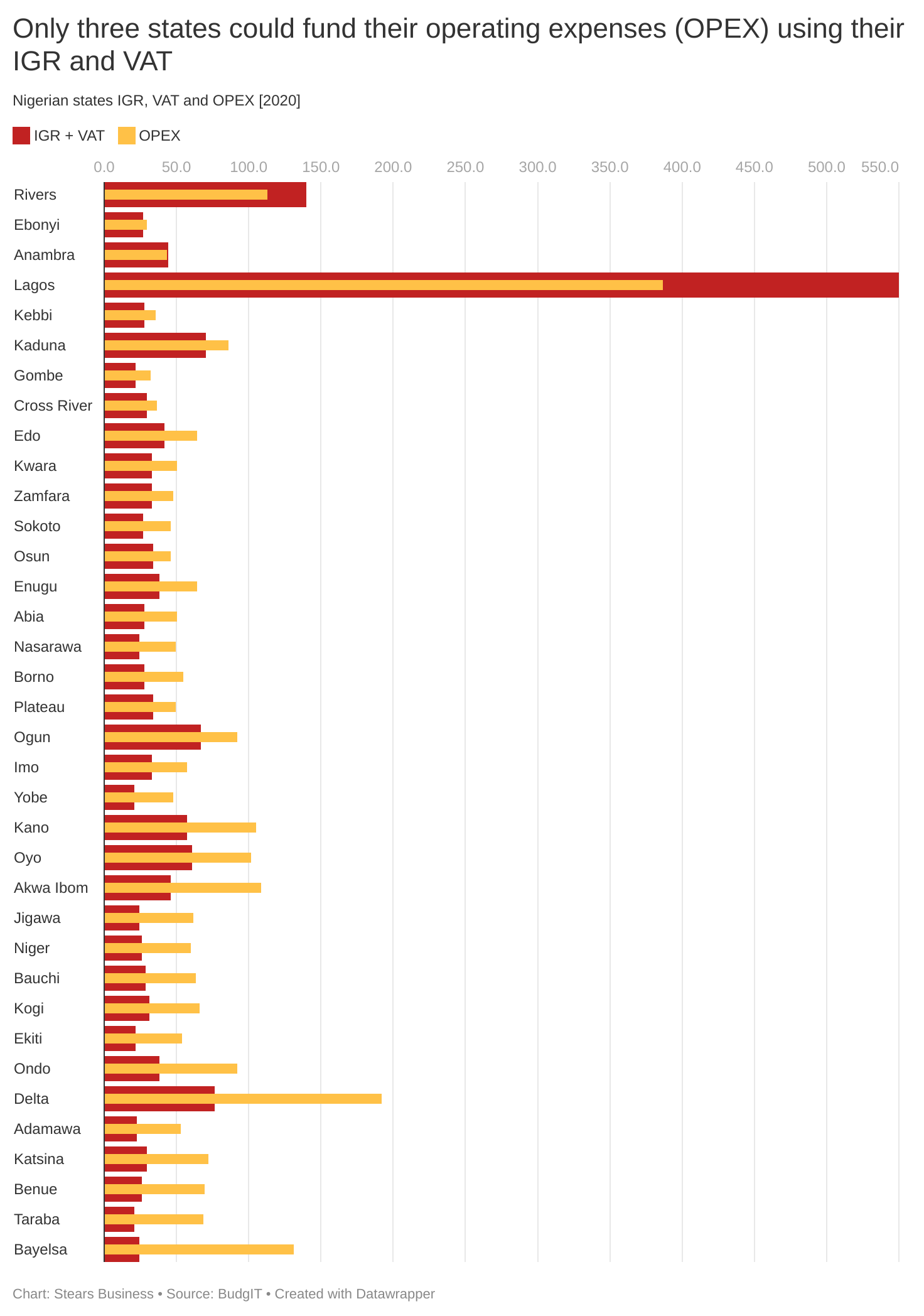

Anambra recognises this as it has grown its internally generated revenue by 83% between 2016 and 2020 and was one of only three states that could fund its operating expenses using IGR and VAT income.

- But growing income is not enough to fund development plans that will create half a million jobs. Revenue leakages must be plugged. And a commitment to funding infrastructure, being credit and capital worthy

However, revenue is vital to develop facilities that make economic activities thrive. For instance, a state that specialises in commerce and trading commodities requires well-maintained transport infrastructure like roads and ports. This helps manufacturers obtain raw materials and parts and deliver finished products to consumers.

In 2020, the Federation Account Allocation Committee (FAAC) was responsible for an average of over 70% of Nigerian states’ revenues, with Internally Generated Revenue (IGR) contributing less than 30%. National Bureau of Statistics (NBS) data also shows that FAAC has provided over 60% of the total revenue for all but six of the country’s 36 states since 2017.

Granted, laws determine which tiers of government can collect particular taxes and revenues, so states don’t have the avenue to generate as much income as they would like. For instance, the federal government collects petroleum profit taxes, company income tax, withholding tax on companies, and Value-Added Tax (VAT). On the other hand, states collect road taxes, capital gains tax, and personal income taxes like PAYE (Pay-As-You-EARN). With this, you can already see that states don't have access to a lot of revenue generated on their soil, leading to the FAAC dependence.

Still, the income states get from the federal government is hardly enough to cater for needs like salary payments, infrastructure development, and other economic stimulating activities, even after including the IGRs.

Some states still try to break the mould. The idea is that, if they can raise their IGR significantly, they can achieve their dreams of being economic powerhouses. For instance, Anambra State, the focus of this story is aspiring to be West Africa’s industrial hub.

Such aspirations do not come cheap.

To be an exceptional governor in Nigeria, you must find innovative ways to boost your IGR and make spending more efficient. For instance, Oyo state increased its PAYE revenue three folds in the last five years by introducing an automated collection system, which helps the state plug leakages. Likewise, Kaduna increased its 2020 IGR through PAYE, while also generating significant revenues from its ministries, departments and agencies (MDAs). MDAs like the state’s transport ministry is charged with collecting general fines & fees, registration and plate number licensing, etc. Income generated from MDAs contributed 45% to Kaduna's 2020 IGR.

By growing their IGR, these states try to reduce their economic dependence on the federal government’s FAAC. Anambra is set on a similar path.

From an economic perspective, Anambra is an interesting state because its new governor, Charles Soludo (sworn in yesterday), was the Central Bank of Nigeria (CBN) governor from 2004 to 2009, and is a well-regarded economics professor famous for his monetary policy expertise.

It is quite rare to find a professor of economics at the fiscal helm of affairs in Nigeria. In addition to this potentially exciting regime, we will get the chance to see how a monetary policy expert gets to play at the fiscal side of things, too—i.e. running a state government.

Outside that quirk, Anambra was also one of only three states in Nigeria that could meet their operating expenses with the revenue they generated internally coupled with value-added tax in 2020. The other two? Lagos and Rivers.

Efficient income aside, what does increased revenue mean for residents in Anambra? How has the state grown its revenue, and more importantly, can its revenue help it actualise the dream of becoming West Africa’s industrial hub?

Anambra’s revenue position

How has the state grown its revenue?

This question is important because powering industries is no easy feat. While technical knowledge and expertise are helpful in laying grand plans, the state needs money to actualise its dream. So, a look at its revenue can help us see how realistic this dream is. That said, Anambra’s Internally Generated Revenue (IGR) grew by 84% from 2016 to 2020.

If we trace IGR back to 2014 and compare it to projected income for 2021, the growth might even be as high as 300%. Although data from the NBS is updated to half-year 2021, which shows a ₦13 billion revenue, the state’s income growth trajectory is still on an upbeat track. The state’s internal revenue service (IRS) chairman claims Anambra’s IGR hit ₦30 billion last year (the NBS is yet to release this data).

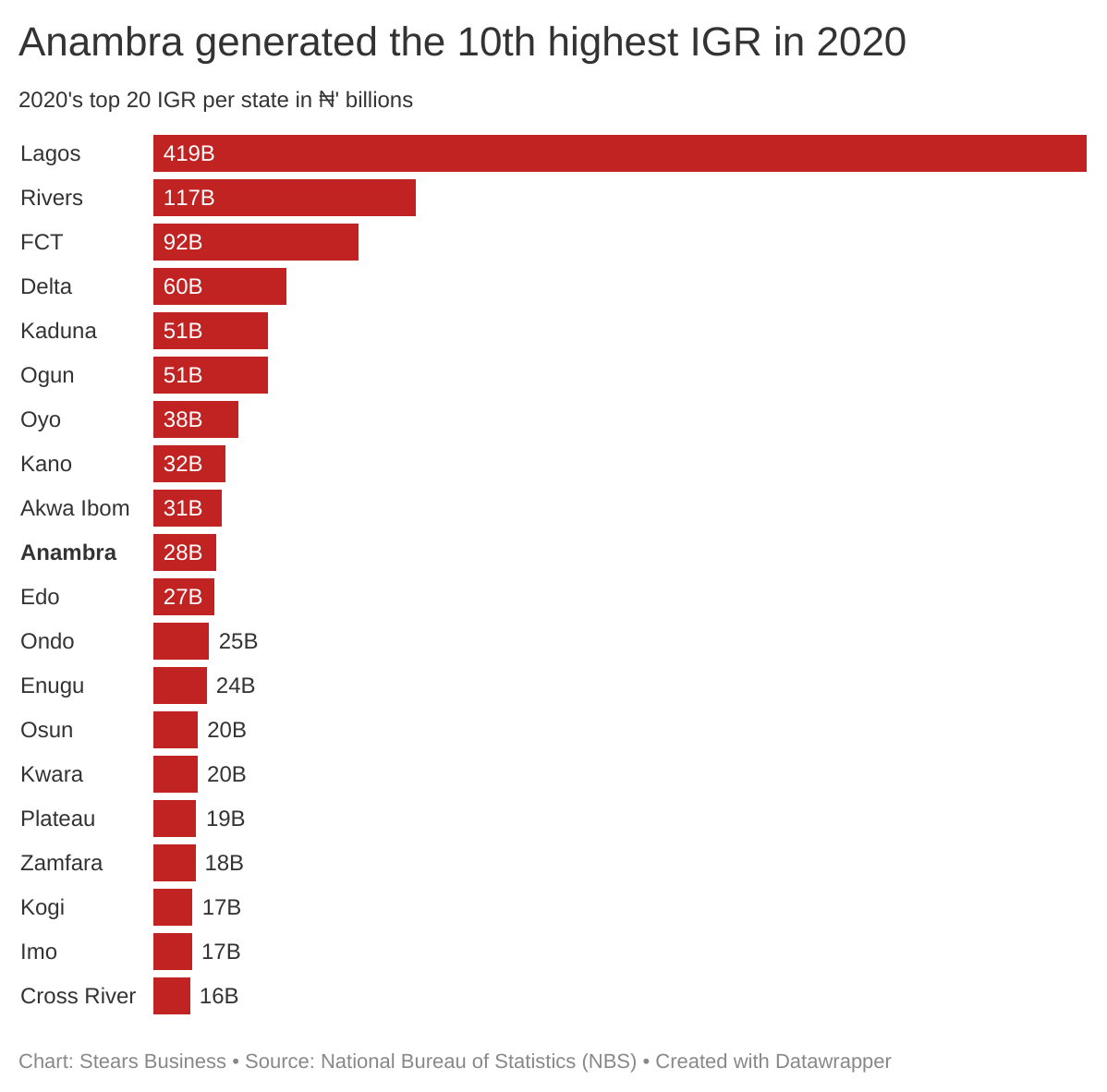

But even if the state’s projected revenue data turns out to be inflated, we can compare Anambra’s revenue to other states to determine how well Anambra is pulling its IGR weight. If adversity separates the pretenders from the contenders, a good year to look at is 2020 (pandemic year), when economic activities were disrupted in most states. Still, Anambra recorded the 10th highest IGR.

How?

Taxes and income from MDAs make up the bulk of states’ IGR. When we look at the composition of Anambra’s IGR, we see that, similar to Oyo and Kaduna, most of Anambra’s revenue came from PAYE and MDAs.

With dwindling oil revenue, FAAC proceeds have also dropped, compelling states to pursue alternative revenue channels or expand existing ones. For Anambra, the state introduced an automated, digitised tax payment system alongside Tax Identification Numbers (TIN) for its workers. It also launched the Grassroots Tax Awareness Campaign (GTAC) to address the low tax compliance level prevalent across the country. However, these initiatives are not foolproof.

For instance, a conversation with Segun Sogbesan, Head ICT and facilitator at the Onitsha Business School, exposed how workers have multiple TINs. According to him, Anambra state’s residents can register for a new TIN with a different mobile number. While this might mean tax evasion or avoidance, it also suggests several things. First, the state’s revenue can be better if they plug the existing porosity. Second, tax payment enforcement is still low. Sogbesan explained how the state still uses thugs when collecting levies from artisans or manual workers despite the automated systems. “Keke (tricycles) pay as much at ₦1,800 for ticket fare daily,” he said.

The incoming governor also attested to the broken tax collection system in his inaugural speech. He said the state will put a new system in place within four weeks, adding, "As from tomorrow, 18th March 2022, if anyone asks you to pay CASH as government revenue in the parks, markets and roads, such a person must be a thief.”

But even this solution ignores the underlining issue of people having multiple TINs, which suggests they believe nothing will happen to them when they evade taxes. Creating tax-paying initiatives aims to grow revenue and have enough funds to cater to the states’ growth plan.

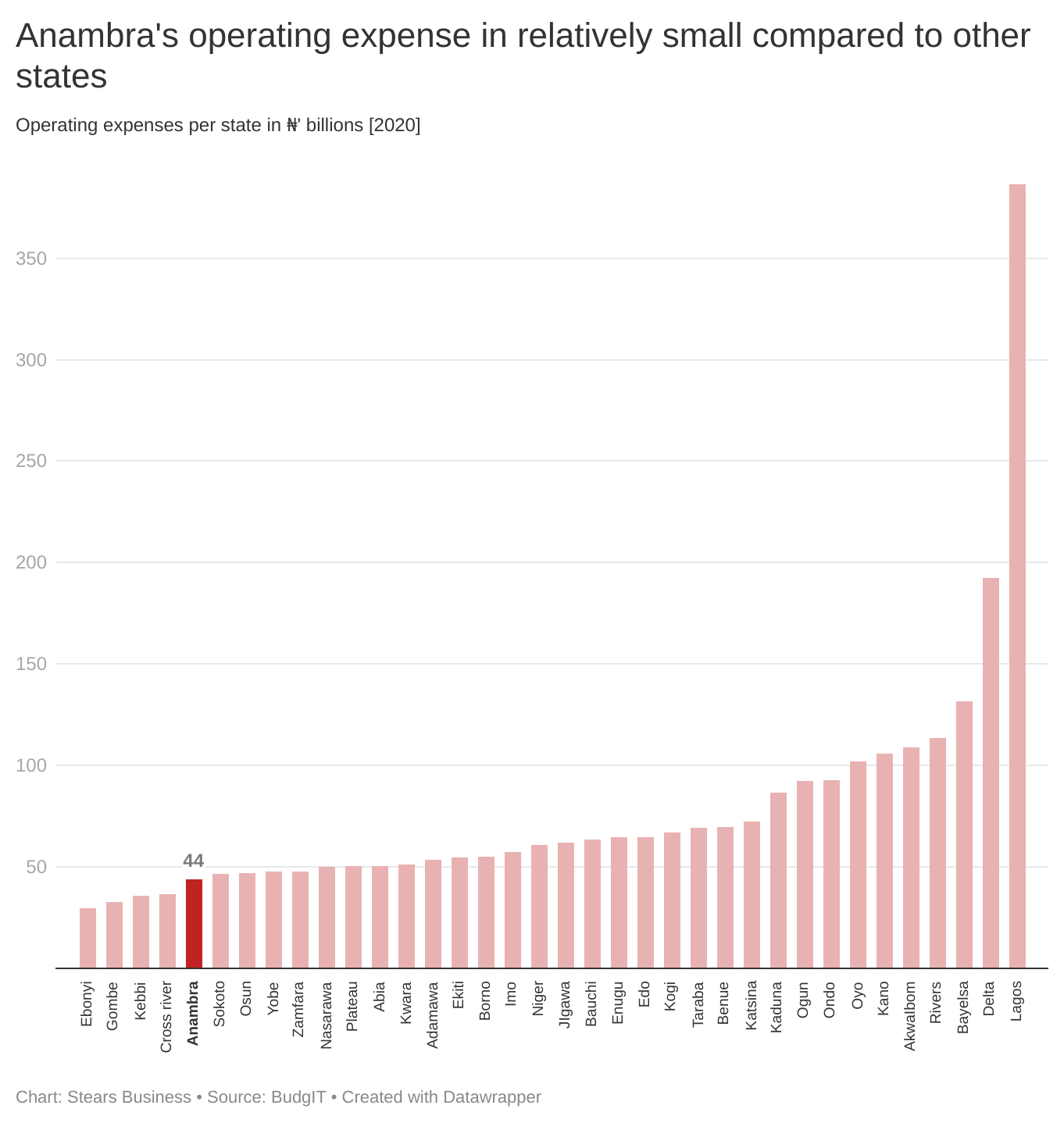

While such plans require revenue from taxes and other channels, an important aspect of financial management is how revenue is managed or spent. In this case, Anambra’s operating expenses (₦44 billion) was the fourth lowest in the country in 2020—so it’s relatively small.

It's worth noting that these operating expenses have reduced over time without evidence of a dwindling workforce, suggesting efficient management of scarce financial resources. According to BudgIT’s 2021 state of states’ report, Anambra cut the overhead component of its operating expenses from ₦24 billion in 2019 to ₦18 billion in 2020.

Despite the appreciated prudence and IGR growth, these funds aren’t enough to solve issues—one of which is job creation.

A deteriorating labour market

Speaking of the labour force, Anambra’s PAYE contribution to IGR (38% in 2020 and 59% in 2021 H1) shows the benefit of having a large working population. Interestingly, Anambra had the lowest unemployment and underemployment rates in the south-eastern region as recently as 2018—17.5% and 17.6%, respectively. Compare that to Abia, where the unemployment rate is almost double (32%).

But Anambra’s relatively enviable position has changed quickly.

According to the NBS 2020 data, nearly 45% of the labour force (those willing and able to work) in Anambra are now unemployed and 16.5% are underemployed—a total of nearly one million people. The increase in the unemployment rate was due to more people wanting to be part of the labour force in 2020. Remember, 2020 was when the lockdown was most severe, and most trading activities—a common job in Anambra—came to a halt. Notably, even though the national unemployment rate also rose during the period (from 23% to 33%), it did so much less rapidly than Anambra's.

In 2018, there were 3.2 million people of working-age in Anambra. By 2020, this had risen to 3.5 million. At the same time, the number of Anambra residents willing and able to work that did nothing nearly doubled from 276,000 in 2018 to almost 500,000 in 2020.

In addition to this is the agitation which has now escalated to a sit at home order that most south-eastern states have to obey. For context, the Indigenous People of Biafra (IPOB), a separatist group led by Nnamdi Kanu, placed a contrived sit-at-home order every Monday for people living in Enugu, Ebonyi, Abia, Imo and Anambra. People can’t embark on their lawful engagements due to the order to protest the detention of the IPOB leader who is facing a 15-count charge bordering on incitement and treasonable felony. On such days, the roads are deserted, while markets, businesses and all educational institutions are shut. Those who breached it were attacked and their properties destroyed by perceived IPOB members.

With trade as the major occupation in this region, people's livelihoods have been affected.

Governor Soludo has made his stance on this pretty clear. “Every day there is a “sit at home”, these poor masses lose an estimated ₦19.6 billion in Anambra alone. Due to the protracted breakdown of law and order, businesses are relocating outside Igboland, with growing unemployment, and traders who used to shop in Onitsha, Aba etc., are going elsewhere.” This order started in October 2021 so that's approximately 24 Mondays to date, almost ₦470 billion—equivalent to Lagos’ annual IGR! It's even harder to fathom the future economic consequences of children missing out on schooling and education.

The state is looking to address this by having a dialogue with the agitators so as to build an economy that attracts investment, thereby creating more jobs and boosting IGR. The newly sworn governor says he aims to create 520,000 jobs in four years and achieve a ₦50 billion IGR this year by creating the right business environment.

So, what exactly is the right environment?

Anambra is known for its manufacturing clusters, from automobile assemblers in Nnewi to its massive markets and trade centres. Nnewi houses key local manufacturing companies, including Innoson Vehicles Manufacturing, Tommy Tommy Industries, and Chikason Group. The legendary Onitsha market is also in Anambra, commonly known as Africa’s commercial powerhouse. It is one of the biggest open markets in West Africa and records nearly $3 billion worth of trade yearly. The state also has a river port that can be helpful for domestic and international trade.

Even with these prevailing advantages, investment flocks to regions with more conducive environments, where businesses are thriving and infrastructure is reliable.

What does the data say about these in Anambra?

First, ease of doing business in Anambra still requires some effort from the state government. Looking at the last subnational World Bank ease of doing business ranking, Anambra has lots of room for improvement. For instance, the state ranked 34 out of 36 states when it came to enforcing contracts.

However, the report explains how 29 states have instituted reforms across the four benchmark areas, with Anambra among the top five states tending towards the benchmark score.

The 2020 Presidential Enabling Business Environment Council (PEBEC) Ease of Doing Business Baseline Survey confirms this improvement. The study explored the experiences and perceptions of doing business in Nigeria and gathered feedback from surveys administered to 998 Small & Medium Enterprises (SMEs) across the country.

Under PEBEC’s infrastructure and security assessment, Anambra was ranked 23 out of 37 states on electricity, transportation and security respectively. Survey respondents also thought Anambra had become fairly good at enforcing contracts as it ranked third in the survey. Additionally, only Sokoto and Borno ranked higher than Anambra when it came to how easy it was to start a business.

Let's look at infrastructure. Earlier, I mentioned how car manufacturing and other assembly firms from textile to leather are resident in the state, as well as how having a seaport close by could be a trading and export advantage.

But, Nigeria’s challenge with ports is that not many of them are functioning. The federal government built a river port in Anambra to aid trade and the movement of goods from Onne port in Rivers State and Warri port in Delta. Yet, reports show that Anambra’s river port barely functions. Reported issues from shallow waters to not having a waterfront have stalled the process, suggesting areas the state will need to double down. The latest news on the Anambra river port is that the FG plans to concession it. Essentially, there is little to no money to get the port to function, and the government is hoping that the private sector will make it work.

Besides inefficient ports, there is also the issue of electricity, good roads, functioning telecommunications and internet facilities, among many others. For instance, the PEBEC report showed that businesses in Anambra are largely dissatisfied with the quality of transport infrastructure in the state, even though the state is relatively small. “You can almost drive through its length and breadth in one day,” Chineme Okafor an Anambra Indigene and a doctoral candidate of media and social science at Norway's University of Stavanger explained to Stears Business. Okafor said that electricity is also quite poor. “Once, I visited the factory of Chicason group in Nnewi and was told that they spend as much as ₦10 million weekly on diesel.” Imagine what the cost of diesel today for such manufacturers would look like.

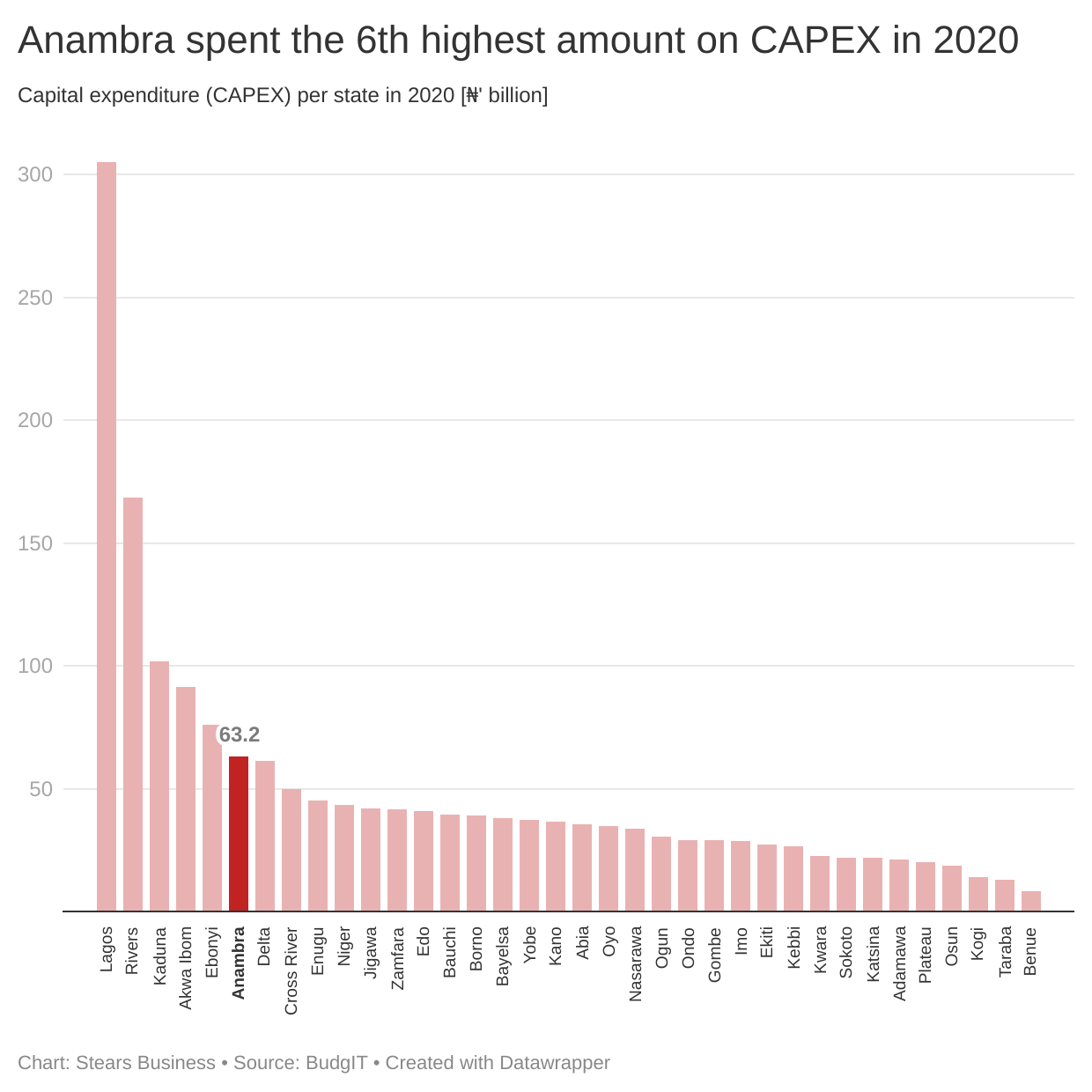

The point is, getting all of this infrastructure in place requires funds. Fortunately, Anambra’s state government appears to take capital expenditure seriously.

Although states like Lagos and Rivers dwarfed Anambra’s CAPEX spending, the state was the 6th highest capital expenditure (CAPEX) spender in 2020. It was also one of 17 states that increased its capital expenditure last year, increasing CAPEX by 28%. In contrast, 19 states reduced their CAPEX spend.

Yet, the reality is that infrastructure is expensive to fund, and few Nigerian states can do so with just FAAC and IGR. States that embark on aggressive infrastructure drives tend to rely on debt or similar funding. By that logic, to fulfil its dreams, Anambra has to look attractive to potential investors and creditors.

Anambra’s credit potential

As of 2020, Anambra had one of the smallest debt profiles in Nigeria, ranking 24th by size with total debt standing at ₦100 billion. But this doesn’t show us if the state is creditworthy. For all we know, the state’s low debt profile is because few people want to lend it money.

One way to know for sure is to see the state’s ability to cover their operating expenses and loan repayment with their total revenue. The thinking here is that if you can prove to creditors that you can pay them back, they have fewer reasons to deny you much-needed funds. BudgIT’s analysis of the state last year showed that Anambra could meet its operating expenses and make loan repayments (₦47 billion) with its total revenue (₦89 billion) and still have an excess of ₦42 billion.

This may suggest the state has fiscal room to borrow more. If it persists with its focus on capital expenditure, the state could also attract foreign direct investment.

There is ample opportunity to capitalise. But the state must realise it needs to prioritise making the business environment better. It needs to plug its revenue leakages and channel income towards capital expenditure for better economic welfare. These are essential for achieving the state’s grand plan of becoming the continent’s main industrial hub.

The truth is that the Nigerian economy needs more states like Anambra—more Lagos(es) with the capacity to grow, employ more people and support the federal government. But this won’t happen if efforts at the state level are mediocre.

The aggregation of the work done at the state level leads to the great economy we all hope for in our nation.